Is it easy for you to find vendors that offer favorable and competitive procurement terms? No, practically, it can take time and effort to find vendors that fit your criteria. In a complex supply chain system, vendor management can become highly complicated when many vendors are involved, as each vendor will have its own payment structure, rates and fees, contract terms, and communication methods. Your sourcing department spends time looking for vendors, getting quotes, and reading internet reviews, but the final selection is typically based on financial parameters and procurement payment terms. One of the often-overlooked criteria in vendor contract management is vendor payment terms.

Research shows that, in a procure-to-pay cycle, one in twelve businesses don’t monitor their payment processes at all.

Most businesses prefer keeping their accounts receivable cycles as short as possible, but how about enhancing the flexibility potential of the bills you owe – your accounts payable? Payment terms with suppliers vary from industry to industry. Generally, you want as much time as you can get to pay your suppliers. As far as your cash flow is concerned, money in your pocket is preferable to money in the hands of your suppliers. However, a balance needs to be maintained. Pushing for extended payment terms or simply paying invoices late could be damaging to your relationship with your supplier.

An overview of procurement contract payment terms and their impact on cashflow

Procurement contract payment terms

You normally pay for a product or service in your personal life upon receipt or delivery of the good or service. However, in B2B transactions, the supplier ordinarily does not get paid right away. Typically, the buyer will receive the goods, parts, or materials first, and then the buyer will pay for it, sometimes much later.

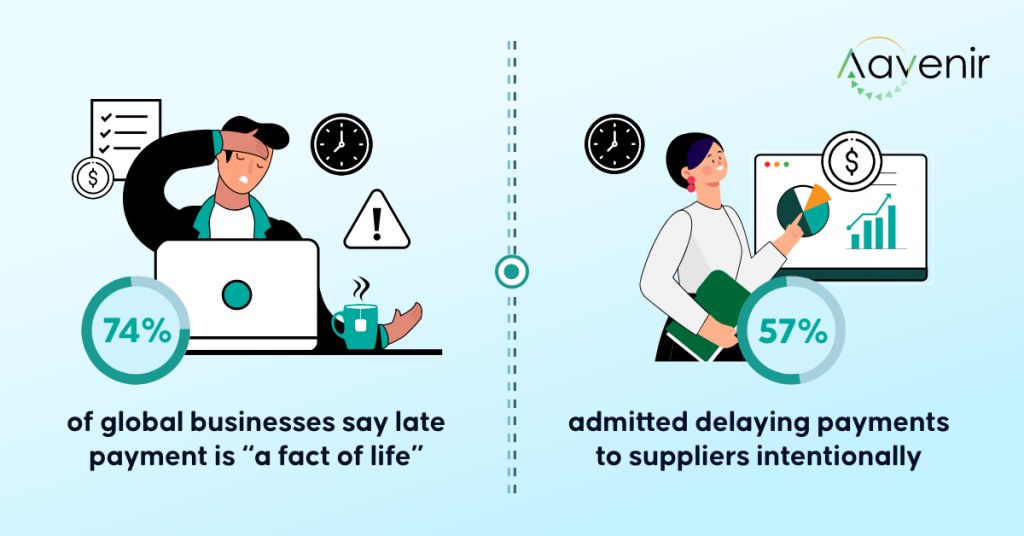

(Source: International Business Survey)

Buyers will always try to negotiate to push out payments for 30, 60, 90, 120 days after receiving goods or services. Suppliers are not thrilled with this, but they do extend flexible payment terms if they trust the buyer and know that they will eventually get paid. And why not, as offering extended payment terms can help a supplier win more business. Usually, large buying enterprises have this kind of leverage over smaller suppliers.

And that's when procurement payment terms come into play. Payment terms are important because knowing how much money will get debited from your account and when is essential for accurate cash flow management. Hence, payment terms are crucial when negotiating a contract. Payment terms help you strategically maximize working capital retention cycles and minimize inconvenience for your vendors. A good set of payment terms should benefit both parties.

Negotiating procurement payment terms

Many companies have a net-45 term. Net-45 means that buyers would make the payment 45 days after the invoice date. When a supplier receives a purchase order, some terms and conditions apply to all invoices issued. The only department within a company that can negotiate net-45 payment terms is the purchasing department. The net payment terms on which an organization will pay will be vital in determining the financial consequences and the financial risk associated with the supply and purchase contract. In some industries, suppliers face lengthening average payment terms – not to mention the challenge of collecting those payments in a timely fashion.

Forcing net payment terms (of more than 45 days) may inconvenience your vendors as business owners, as they will have expensed the entire project without receiving income. So, your contracts should have an ideal payment term that helps you manage your cash flow and does not hamper your vendors’ liquidity. However, monitoring contracts by payment terms will give you a clear picture of what amount is expected to get debit and its impact on the cash flow. Based on the cash flow projection, you may consider negotiating payment terms that are in your favor.

Adhering to negotiated payment terms

Let’s take a look at a scenario of late and extended payments and their impact on cash flow.

A small business supplies to a large paper, packaging, and recycling company. Although the small business supplier requested 30-day payment terms, the larger business applied its own terms of 60 days (on approval of the invoice). However, the company rarely pays invoices within the agreed timelines. On average, the payment is sent within 65-75 days.

Impact to vendor

- Irregular payments after multiple follow-ups create uncertainty for the small business and impacts their cash flow.

- Due to the delayed payments, the small business faces difficulties in meeting tax obligations on time, and paying its own suppliers and employees on time.

- Late payments also contribute to the forced reduction in staff working hours.

- The small business fears that the large business may trigger the termination for convenience clause included in the contract. This makes it difficult for the small business to chase late payments for fear of losing the contract.

Impact to the large business

- Since payments aren’t released on time, the AP team has no clarity on when the next payment is due.

- The large business leaks revenue as it is unable to leverage early and prompt payment discounts, volume discounts, and trade credits mentioned in the contract terms.

- The large business may have to pay multiple invoices together which hampers its cash flow.

New Hackett Group research has found that nearly one-quarter of all supplier invoices are paid late.

Adherence to negotiated payment terms helps both the supplier and buyer manage cash flow, business risk, and preserve relationships.

Source-to-pay solutions to the rescue

Source-to-pay solutions can help protect cash flow by monitoring contracts by payment terms.

Within complex supply chains, a single company is typically both a buyer and a supplier, part of a wider network of strategic B2B relationships. Whether you handle buy-side contracts or sell-side contracts, payment terms will have an impact on your cash flow. When an organization makes a late payment to a vendor, the relationship can deteriorate, and penalties might apply because of contractual obligations and government statutes. One way to prevent this from happening is practicing effective communication, processes and setting up automated payments. If you need to make changes to a contract, it is crucial to contact a vendor immediately to enhance the payment process.

An intelligent Source-to-pay solution monitors and analyzes your contracts (by payment terms) and will alert you when a clause or condition becomes a negotiation point. You can then focus on actually getting what you want instead of wasting time and energy trying to remember what you've agreed to.

How does an intelligent Source-to-pay Solution help monitor contracts by payment terms?

- Ensures appropriate onboarding of suppliers with relevant information, delivers notifications on contract terms events including payment terms, and enables processes that minimize the risk of not being paid on time

- Alerts you to apply standard net payment terms using AI, in the event that the contract is silent on payment terms.

- Monitors contract terms and payment dates and helps you strategically negotiate your payment terms with vendors to ensure longer working capital retention without damaging your trade credit

- Provides Intelligent contract review capabilities that prevent inaccurate, fraudulent vendor billing practices which could result in duplicate payments and overpayments

- Delivers regular notifications on payment terms and the availability of volume discounts, trade credits, or other ongoing or periodic rebates.

- Develops supplier performance scorecards for strategic vendors and leverages these scorecards during contract negotiation

Test drive S2P suite on ServiceNow and streamline critical Source-to-Contract and Procure-to-Pay functions by incorporating ML & NLP technologies.