In today’s rapidly changing business environment, organizations need smarter, more proactive approaches to sourcing to stay competitive. Strategic sourcing has emerged as a vital long-term procurement strategy that not only reduces costs but also mitigates risks and fosters stronger supplier relationships.

By aligning sourcing decisions with broader business goals, this approach drives efficiency and enhances market competitiveness.

This article delves into the processes, benefits, and practical applications of strategic sourcing, highlighting its transformative impact on modern supply chain management.

What is Strategic Sourcing?

Strategic sourcing is a proactive, systematic strategy in supply chain management that focuses on identifying, evaluating, and selecting suppliers to meet long-term procurement needs.

Unlike traditional sourcing, which focuses primarily on securing the lowest purchase price through bulk buying, strategic sourcing considers the total cost of ownership (TCO). It considers factors such as supplier performance, market trends, and long-term value, empowering teams to make informed decisions and navigate the bigger picture. The goal is to optimize costs, mitigate risks, and strengthen supplier relationships.

3 Strategic Sourcing Examples

To illustrate how strategic sourcing works, let’s consider these strategic sourcing examples across a few industries:

1. Healthcare Provider Sourcing Medical Supplies

A healthcare provider needs to source medical supplies for its hospitals. It strategically analyzes vendors based on cost, compliance with medical regulations, and reliability. After thorough vetting, it selects a supplier that meets its quality requirements while offering competitive pricing, ensuring safe and efficient healthcare delivery.

2. Construction Company Sourcing Materials

A construction company is sourcing building materials for a new project. They assess potential suppliers on pricing, availability, and the quality of materials. By strategically selecting the best vendors, the company ensures timely delivery, reduces material waste, and maximizes cost efficiency throughout construction.

3. Food & Beverage Company Sourcing Materials

A food manufacturer seeks suppliers for organic ingredients. They evaluate suppliers based on sourcing practices, pricing, and ability to meet food safety standards. After conducting supplier assessments and negotiations, they choose a vendor that aligns with their sustainability goals while offering high-quality, competitively priced ingredients.

What are the Different Types of Sourcing?

There are several types of sourcing methods, each with unique benefits and challenges, such as:

Outsourcing vs. Insourcing

Outsourcing involves contracting external providers for specific functions, offering cost savings and expertise. For example, a company might hire a third-party firm to leverage its market knowledge. However, it can lead to loss of control, security risks, and communication issues.

Conversely, insourcing uses internal resources, offering more control and alignment with company goals. For instance, a company might manage sourcing in-house to protect intellectual property. However, it can also be more costly, less scalable, and time-consuming.

Near Sourcing vs. Global Sourcing

Near sourcing (or nearshoring) involves sourcing from nearby suppliers to reduce lead times and costs. For example, a U.S. firm might source components from Mexico. Yet, it can limit access to specialized expertise and expose the business to regional economic risks.

Global sourcing taps into suppliers worldwide to access cost savings and expertise. For instance, a company might source raw materials from Africa and Asia but comes with challenges like higher logistics costs and geopolitical risks.

Vertical Integration

Vertical integration occurs when a company controls more stages of its supply chain by acquiring suppliers or distributors. For example, an automaker might purchase a battery manufacturer to improve efficiency, control quality, and maximize security. However, it requires significant capital investment and reduces operational flexibility.

Single vs. Multiple Sourcing

Single sourcing relies on one supplier to simplify management and streamline relationships. For example, a company might source all its raw materials from a single vendor for higher negotiation leverage but risks disruption if the supplier faces issues.

Multiple sourcing involves using several suppliers to reduce risks, save costs, and ensure supply continuity. For example, a company might use multiple suppliers for components to prevent disruptions, though it can complicate quality control and negotiation leverage.

Low-Cost Country Sourcing (LCCS)

LCCS involves sourcing goods or services from countries with lower labor and production costs to reduce expenses. For example, a clothing brand might source garments from Bangladesh to cut manufacturing costs. While it offers savings, LCCS can lead to quality control issues, longer lead times, and higher geopolitical risks.

Joint Ventures and Virtual Enterprise

Joint ventures involve two or more companies creating a new entity and sharing ownership and governance. For example, two electronics companies partnering to produce a new laptop share risks, but this can lead to unclear goals and decision-making conflicts.

Virtual enterprises are temporary networks of independent companies collaborating on specific tasks, such as tech firms joining forces for a short-term software development project. While this provides flexibility and market access, it can create coordination challenges.

Difference between Procurement and Strategic Sourcing

In simple terms, procurement is the overall process of obtaining goods and services, whereas strategic sourcing is a component of procurement with a long-term, value-focused approach. Here’s how they differ:

| Attributes | Procurement | Strategic Sourcing |

| Timeframe | Short-term | Long-term |

| Aim | Focuses on obtaining goods at the lowest cost | Aims to maximize value and reduce TCO |

| Approach | Reactive, focused on addressing immediate issues | Proactive, focused on fostering long-term growth |

| Scope | Limited to purchasing | Covers the entire supplier network |

| Supplier Relationship | Transactional | Collaborative |

Difference Between Strategic Sourcing and Tactical Sourcing

Strategic sourcing and tactical sourcing share the goal of securing value, but they differ in approach and timeframe. Here’s a comparison:

| Attributes | Strategic Sourcing | Tactical Sourcing |

| Timeframe | Long-term | Short-term |

| Aim | Focuses on long-term efficiency and supplier relationships | Focuses on immediate cost reduction |

| Approach | Proactive, focused on nurturing long-term growth | Reactive, focused on solving immediate problems |

| Supplier Relationship | Builds long-term relationships | Transactional, with no long-term commitment |

| Tools and Resources Needed | Advanced tools and skilled professionals | Fewer tools, minimal skill development |

| Suited for | Large organizations, or Multinational corporations (MNCs) | Small to medium businesses (SMBs) |

7 Factors that Impact Strategic Sourcing

Several internal and external drivers that influence strategic sourcing are as follows:

New Enterprise Policy

When a company adopts a new policy, it can shift its sourcing priorities. For example, if a company adopts a sustainability-focused policy, it may prioritize sourcing from suppliers with eco-friendly practices.

Disruptive Technologies

Emerging technologies can impact sourcing with the aim of improving efficiency. For instance, a company may use Artificial Intelligence (AI) for demand forecasting, influencing the way it sources products or suppliers.

Newer Programs

Novel initiatives can affect sourcing as organizations adapt to meet new goals. For example, a brand might launch a new product, requiring it to source materials from suppliers who can meet the specifications.

Quality Standards and Regulations

Regulatory changes can force companies to reevaluate suppliers to ensure compliance. For example, stricter environmental laws may push a company to source from eco-certified suppliers.

Existing and Potential Supplier Partnerships

Strong supplier relationships can lead to favorable terms and delivery schedules. For example, a business might leverage its long-standing partnership with a supplier to secure better pricing.

Supplier Availability and Capacity

These can impact sourcing decisions, especially during peak demand. For example, a tech firm may need to switch to a new supplier if its current one can’t meet production demands during holidays.

Time and Budget Constraints

Time and budget pressures can force companies to choose suppliers based on speed or cost efficiency. For instance, a company might choose a local supplier to reduce shipping times, even if the per-unit price is higher.

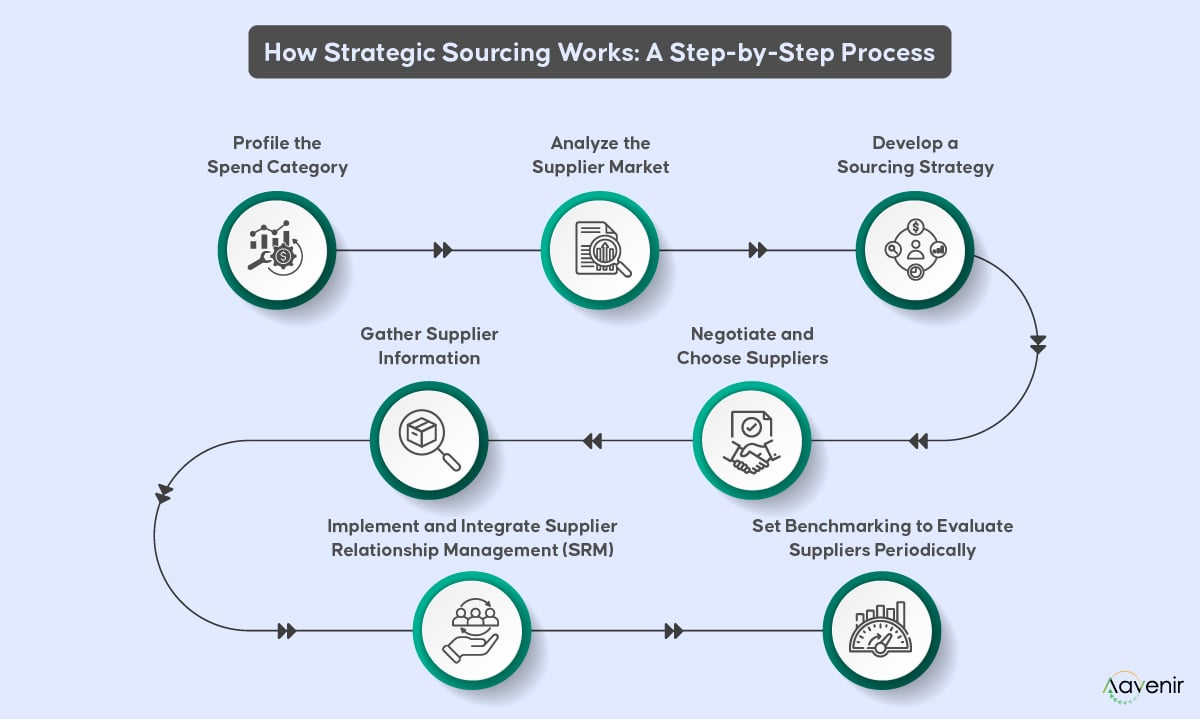

How Strategic Sourcing Works: A Step-by-Step Process

To optimize procurement processes and maximize value, an organization needs to follow these 7 building blocks of strategic sourcing:

Profile the Spend Category

Start by analyzing the costs according to purpose, quantity, and purchase frequency. Categorize spend and assess risk to prioritize sourcing activities. For example, a company might classify raw materials as critical for production, while office supplies are non-critical, allowing better focus on high-impact areas.

Analyze the Supplier Market

Identify the suppliers in terms of revenue, competitiveness, market share, industrial performance, and risks and opportunities. For example, a company might research suppliers in emerging markets to find more cost-effective options.

Develop a Sourcing Strategy

After the post-market analysis, align the strategy with business goals, set vendor selection criteria, and create an action plan. Form a cross-functional team to set objectives and timelines. For example, a tech firm could prioritize suppliers using Artificial Intelligence (AI) for demand forecasting.

Gather Supplier Information

As the fourth step, request RFIs, RFPs, or RFQs to outline needs and gather proposals. Use this data to refine selection criteria. For example, a company might send out an RFP detailing product specifications and delivery terms, ensuring all suppliers meet the same standards.

Negotiate and Choose Suppliers

After gathering data, evaluate suppliers based on cost, quality, and performance. Negotiate favorable terms and secure suppliers who best meet the company’s needs. For instance, a retail company might consider a vendor with faster delivery times while reviewing scorecards.

Implement and Integrate Supplier Relationship Management (SRM)

Following negotiation, foster strategic partnerships by maintaining constant communication with stakeholders to ensure alignment. For example, a company might collaborate closely with its suppliers for joint product development.

Set Benchmarking to Evaluate Suppliers Periodically

Finally, supplier performance should be regularly evaluated using key performance indicators (KPIs) like delivery schedules and quality. For instance, a software company might rate its cloud service providers on customer support to maintain performance.

9 Benefits of Strategic Sourcing in Supply Chain Management

Strategic sourcing provides key advantages for companies of all sizes, including:

- Higher Cost Savings: Strategic sourcing cuts costs by consolidating suppliers and negotiating better deals. Cognitive Market Research found that 70% of procurement savings come from strategic sourcing. For example, saving $50,000 on materials directly boosts the bottom line.

- Improved Service Quality: ETQ’s survey found that 35% of brands suffered damage from supplier issues. Strategic sourcing enhances service quality by selecting suppliers to balance cost and quality. For example, investing in higher-quality raw materials with more upfront costs can reduce product defects and warranty claims.

- Time Savings: A report revealed that a typical strategic sourcing project can take 3-6 months. Consolidating suppliers and fostering long-term relationships reduces procurement cycle times. For example, a company using automated ordering systems can quickly replenish stock, shortening lead times.

- Better Supplier Relationships: A study cited that over 90% of supply chain disruptions originate from suppliers, emphasizing the need for strategic sourcing. Fostering strong supplier relationships improves reliability and innovation. For example, close collaboration ensures consistent delivery and product quality, boosting customer satisfaction.

- Reduced Supply Chain Risk: According to Procurement Tactics, 80% of companies experienced supply chain disruption in 2024. Strategic sourcing helps reduce risks by diversifying suppliers. For example, sourcing from multiple suppliers ensures continuity if one faces issues.

- Enhanced Operational Efficiency and Market Agility: According to a Gartner report, 90% of supply chain leaders prioritize market agility. Strategic sourcing enhances operational efficiency and agility. For example, a retailer with flexible supplier contracts can quickly adjust inventory during peak seasons.

- Greater Alignment of Sourcing and Business Needs: With ESG compliance becoming the norm, strategic sourcing helps companies select suppliers who align with business goals. KPMG’s survey shows that 90% of organizations will boost ESG investment in the next 3 years. For example, collaborating with suppliers on sustainability reduces costs and meets the demand for eco-friendly products.

- Improved Compliance: As per a recent Gartner report, 35% of legal and compliance leaders prioritize keeping compliance programs aligned with fast-changing regulations. Strategic sourcing improves compliance by standardizing processes. For example, automated reporting helps identify gaps to reduce regulatory risks.

- Innovation and Continuous Improvement: Strategic sourcing encourages innovation by leveraging supplier expertise to enhance products and processes. For instance, a manufacturer collaborating with a supplier to develop new materials can reduce production costs and improve product quality over time.

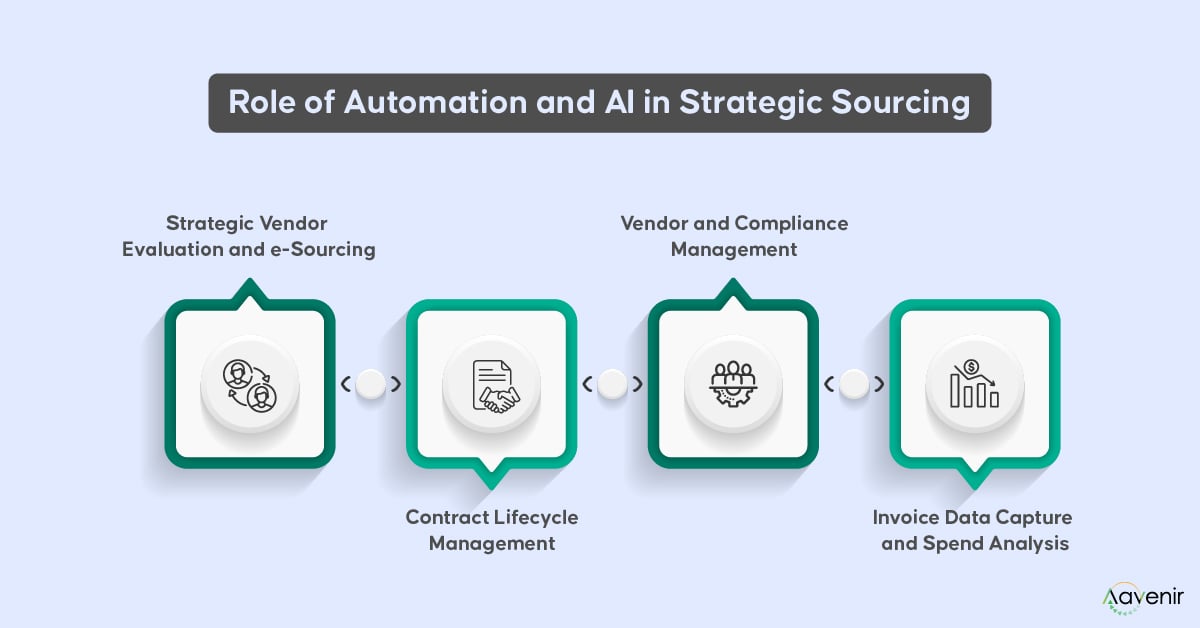

Role of Automation and AI in Strategic Sourcing

Despite the growing use of technology in procurement, many teams still rely on manual processes to select suppliers due to a reliance on outdated systems and a lack of confidence in tools.

According to SupplyChain Management Review, 44% of organizations are yet to automate their sourcing activities. As a result, procurement professionals spend around 2 hours and 45 minutes daily on manual tasks, as reported by Kronos Group. This highlights the urgent need to adopt automated strategic sourcing tools.

Below are the ways these technologies can improve the sourcing process.

Strategic Vendor Evaluation and e-Sourcing

Automation tracks RFx progress, flags delays, and suggests improvements. For example, it can identify delays in bid submissions and recommend adjustments. Automation simplifies sourcing by collecting and evaluating supplier data with RFQs, RFIs, and RFPs.

RFP Management Solutions help teams collaboratively create and review RFPs, improving supplier evaluation. For example, a procurement team uses Aavenir RFPflow to gather inputs from IT and finance teams, ensuring a comprehensive evaluation of software vendors.

Contract Lifecycle Management

AI and automation in Contract Lifecycle Management Software’s accelerate contract creation, approvals, and renewals by reducing manual effort. AI scans contracts for key terms and risks, flagging issues like policy violations for quick review. For example, AI can analyze contracts to recommend key terms for strategic sourcing, such as payment terms, maintenance support duration, compliance requirements, etc.

Vendor and Compliance Management

Automation speeds up vendor onboarding by automating document submissions via portals. AI enhances this by assessing timely compliance by flagging delays in bid submissions and recommending adjustments. For instance, AI can verify certifications during onboarding, ensuring compliance without manual checks.

Invoice Data Capture and Spend Analysis

AI extracts invoice data matches it with purchase orders, contracts, and receipts, and flags discrepancies. Digital workflows streamline approvals, enabling timely processing and avoiding overpayments or penalties. AI also analyzes spending patterns and forecasts needs. For example, it can identify cost-effective alternatives to optimize procurement spend.

Aavenir is at the forefront of empowering businesses with strategic sourcing tools and technologies, enabling them to stay ahead of the curve. Let’s explore how!

How Aavenir Enables Strategic Sourcing for Leading Enterprises

Strategic sourcing is more than a procurement tactic—it’s a vital business strategy for navigating today’s dynamic markets. By leveraging technologies like AI and automation, businesses can enhance supplier relationships, optimize costs, and improve efficiency. Aavenir’s RFP management software make this journey seamless, empowering companies to stay competitive and resilient.

Aavenir RFPflow empowers strategic sourcing by utilizing AI-powered solutions to streamline procurement, enhance supplier management, and drive cost reduction. By automating key sourcing processes, such as supplier evaluations and market analysis, the RFP management solution enables data-driven decisions and improved risk management.

The solution helps businesses align sourcing strategies with long-term goals, ensuring greater efficiency and supplier performance. Aavenir also fosters stronger supplier relationships, optimizes contract lifecycle management, and provides real-time insights, ultimately helping organizations stay agile in a dynamic market.

Start your strategic sourcing transformation today and unlock long-term value!

Real-world Success Story with Aavenir

Here is an example of how Aavenir transformed the sourcing processes for a leading global premium pet food manufacturer was able to resolve key sourcing challenges and achieve significant results with Aavenir’s RFPFlow solution.

FAQs

1. What are the 4 pillars of strategic sourcing?

The four pillars of strategic sourcing are spend analysis, sourcing, contract management, and supplier relationship management (SRM).

2. What is the meaning of strategic sourcing?

Strategic sourcing is a procurement process focused on selecting suppliers to maximize long-term value and cost efficiency. It involves evaluating suppliers, considering the total cost of ownership, and building strong relationships to align procurement decisions with business goals and improve supply chain performance.

3. Why is continuous learning pivotal in strategic sourcing?

Continuous learning in strategic sourcing is crucial for staying updated with industry changes. It helps companies understand production processes, forecast market trends, make data-driven decisions, reduce costs, improve the supply chain, and create opportunities to enhance reputation, sales, and market share.

4. Why do supply chain managers embrace strategic sourcing?

Supply chain managers adopt strategic sourcing to improve efficiency, reduce costs, and stay competitive. By using the right tools and a strategic approach to supplier management, they streamline operations, minimize risks, and maximize value, boosting both day-to-day performance and long-term success.

5. What is the goal of strategic sourcing?

The primary goal of strategic sourcing is to optimize procurement by analyzing purchasing needs, supplier markets, and vendor performance to identify the best suppliers, focusing on total cost rather than just the lowest price.

6. When to use strategic sourcing?

Strategic sourcing is key when procurement is inefficient, costs need reducing, or supplier relationships require improvement. It’s also vital for standardizing specifications, engaging suppliers for new initiatives, addressing supply chain disruptions, supporting business growth, and improving supply base visibility.