COVID-19 has had an unforeseen impact on businesses. Measures have already been taken to contain the spread of the virus—border closings, restricted air travel, quarantines, and shutdowns of non-essential businesses. But all these restrictions are driving companies to take immediate action. One key area of concern for organizations is what this situation means for their contractual obligations.

With such a large impact on both the buy and sell side, it is valuable for organizations to understand their entire contract inventory to help determine the risks and steps required to mitigate them. Due to the extent of impacted contracts, companies will need to review contractual relationships held with customers, suppliers, contractors, insurers, employees, and more.

The imperative for risk mitigation of Contract Obligations

Businesses face increasing pressure to mitigate the impact of COVID-19. As a result, a diligent review of existing contracts may be necessary to minimize loss, protect the business and ensure continuity. In reviewing such contracts, businesses will be required to:

1. Identify Impacted Contracts

Focusing on areas of high risk such as those held with key direct suppliers. Within these high-risk areas, organizations may need to evaluate their ability to alter suppliers to mitigate supply risk. This can help organizations move in an agile manner to establish secondary supplier relationships.

2. Understand and Actively Track Relevant Provisions

Provisions for each company will vary based on factors such as industry, relationship type, and contract type. Force majeure, which provides for instances where an unforeseen circumstance prevents an organization from fulfilling its contractual obligations, could be particularly relevant.

3. Determine The Applicability and Enforceability of Obligation Clauses

Clauses relating to the inability of an organization to meet its contractual obligations should be considered in the context of COVID-19. This could include a review in relation to governing law and identification of any notice requirements which will need to be carefully followed.

4. Renegotiate and Create a Plan of Action

Depending on the outcome of the review, organizations will need to take necessary action to mitigate risk and protect their business interests. Such action could include the renegotiation or termination of the contract, where the terms allow, which could potentially increase the workload of those in business functions such as legal and procurement.

How Aavenir Obligationflow can Improve Compliance with Contract Obligations?

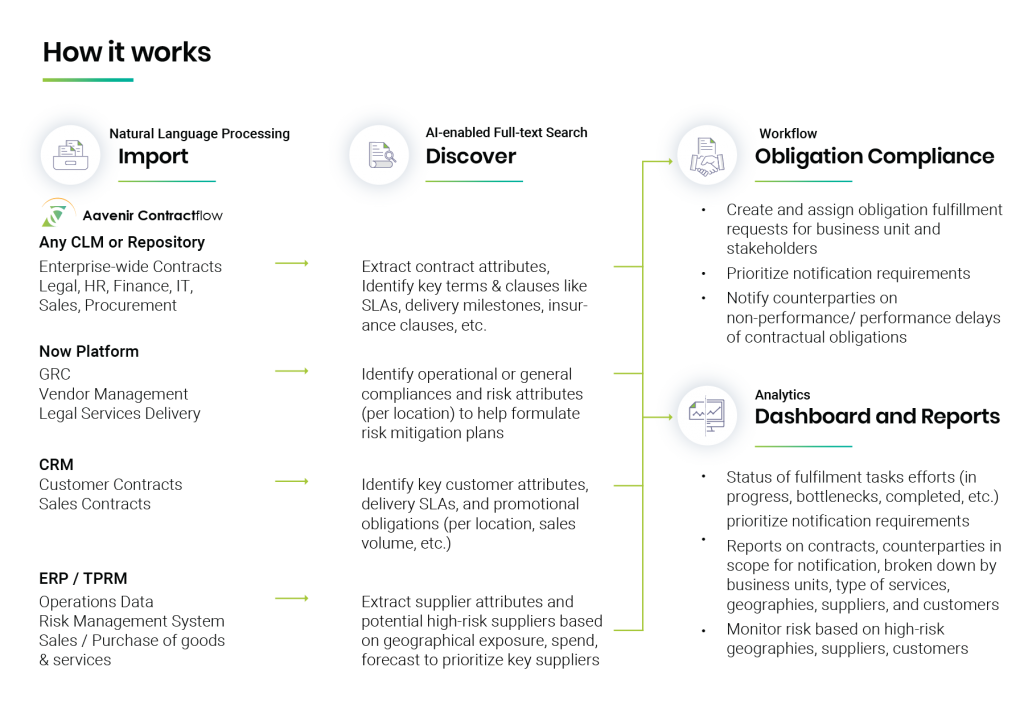

Aavenir Obligationflow can auto-discover key contractual obligations using AI-enabled full-text search capabilities, foster collaboration with the relevant stakeholder via digital workflow, and provide complete visibility of obligation compliances via a dashboard on ServiceNow.

Ready to see what your team would look like with Contract Obligation and Compliance Management Solution? Schedule a demo to see how Aavenir Obligationflow can auto-discover contract obligations and assign fulfillment tasks to meet compliance.