What is a Two-Way Invoice Matching?

Two-way invoice matching is an automated process that verifies the purchase orders and their associated invoices for discrepancies before invoice approval and payment.

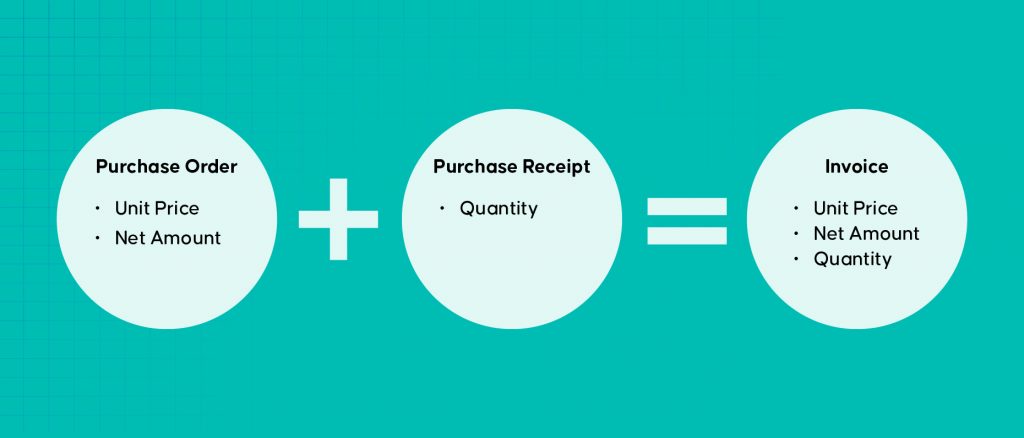

Two-way invoice matching, also known as purchase order (PO) matching, compares specific figures on both the purchase order and invoice. Besides, on non-verification, the invoice processing is halted until the discrepancies are addressed or rectified.

Companies use invoice matching to reduce time spent by the accounts payable (AP) team on manual invoice verification. Besides helping avoid the risk of human error, it verifies any discrepancy in invoice amounts and thwarts possibilities of vendor overpayments.

Two-way invoice matching verifies that purchase order and invoice information match within your tolerances as follows:

- The quantity billed is less than or equal to the amount ordered

- The invoice price is less than or equal to the purchase order price

How does Two-Way Invoice Match Work?

Two-way invoice matching is the simplest and most accessible form that provides adequate protection against incorrect vendor invoice payments.

The first step of two-way invoice matching includes receiving an invoice from a vendor. Next, the invoice is transferred into the vendor’s database and matched to a corresponding relevant PO.

Situation 1: If the tolerances set by the invoice matching solution add up, the invoice payment is scheduled.

Situation 2: If there is any discrepancy with the PO, the invoice is placed on hold. In such a situation, no payment is sent, and the accounts payable manager manually resolves the delay.

From thereon, either the invoice is approved manually or sent back through the automated invoice matching process for approval. After invoice approval, the vendor payment is scheduled, and transactions between the vendor and the company are completed and adequately recorded.

Inefficiencies in the Manual Invoice Matching Process

Imagine a sales transaction with a 20-page line-item PO. The accounts manager must match it to a 20-page PO invoice and check it with a 20-page packing slip.

There are many line items to match for a single vendor and a single product. And that is for only one invoice, vendor, and product line!

57% of organizations still use manual invoice matching processes to verify financial transactions.

Manual Invoice Matching Leads to Accounting Delays…

Manual invoice processing includes obtaining physical documents in journals or ledgers. With so much data to review, 2-way invoice matching can be tedious if done manually.

Typically, with a manual match, an accounts payable team member gathers all the relevant paper documents in a transaction to satisfy the matching procedures. They look at each document line to ensure they all match.

…But Accounts Payable Automation Can Help

Automated invoice matching is essential to ensure that mistakes, discrepancies, or outright dishonesty do not result in incorrect payments to vendors.

For example, an organization sends a purchase order for supplies from a vendor for $3,000. The vendor immediately reviews and accepts the purchase order and then delivers the requested supplies. Then, either by mistake or deliberately, they submit an invoice receipt for $5,000.

Invoice matching will help ensure that the incorrect invoice is not paid, thus saving a financial loss of $2,000 for the business. In addition, the automated invoice workflow ensures that payment is made only for invoices with the correct payable amount.

With invoice workflow and process automation, accounting teams gain access to the solution for automating a large amount of their manual process. They also gain visibility into where the invoice is at any stage in the workflow.

When the documents are stored digitally in electronic forms or by immediately scanning the received invoices, the invoices become more secure and are free of the troubles of the infamous “piles” of paperwork on desks throughout most organizations.

Explore Additional Resources to Learn More