What is Purchase To Pay?- Definition

Procure to Pay, also called Purchase to Pay and abbreviated to P2P, is an integrated system that fully automates the purchasing process of goods and services. The main stages of this process are ordering goods, supplier requisitions, budget authorization, receipting of delivery, and invoice processing.

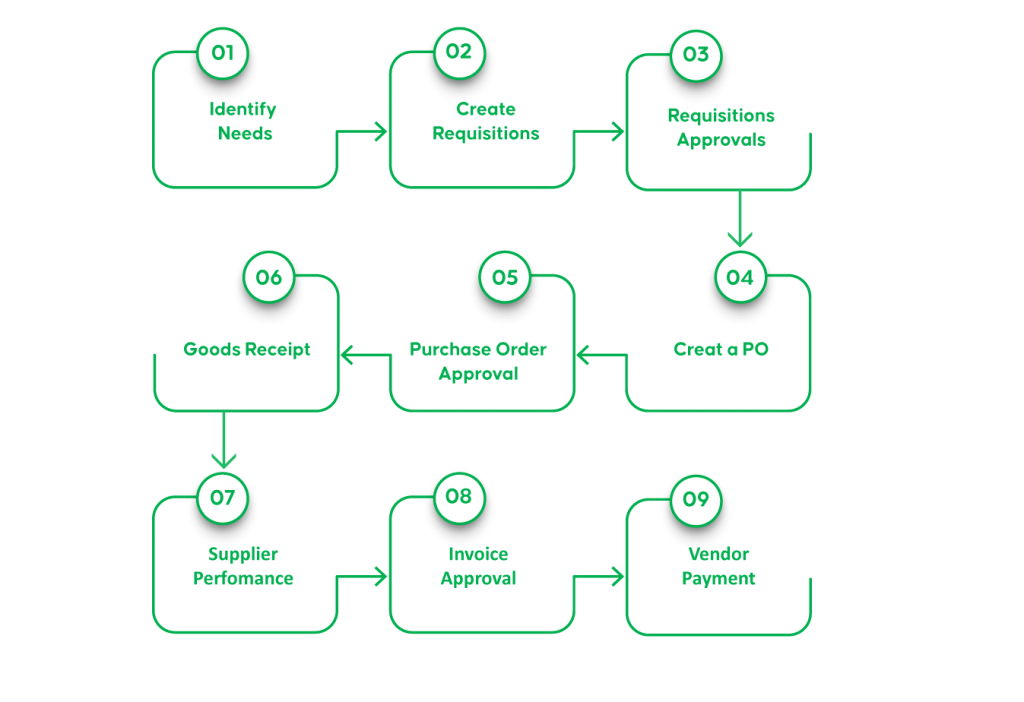

Major Steps of Procure to Pay Process

Procurement professionals choose to complete the most relevant stages of a procure-to-pay process based on organizational practice and the demand in question. Tools like Invoiceflow by Aavenir come into the picture at this stage. You can customize your workflow as per your business needs. But this is how a standard procure-to-pay process looks.

Step 1: Need identification

First of all, Identifying the need for specific goods and services and setting out what budget is available for the proposed purchase. Once a valid need is identified, the procurement team sketches out high-level specifications for goods/products, terms of reference (TOR) for services, and statements of work (SOW).

Step 2: Requisitions

Once the TOR, SOW, and specifications are finalized, a formal purchase requisition is created. A requester ensures all necessary administrative conditions and submits the filled-out purchase requisition form.

Step 3: Purchase Requisition Approval

Department heads or procurement officers then review submitted purchase requisitions. Approvers can reject or approve a purchase requisition after evaluating the need, verifying the available budget, and validating the purchase requisition form.

Step 4: Create a PO

Once the relevant management has approved the purchase requisition, a purchase order is issued to the supplier.

Step 5: Purchase order approval

Purchase orders are now sent for approvals to ensure the accuracy and legitimacy of specifications. Once approved, dispatch the purchase orders to vendors. After reviewing the PO, vendors can either accept, reject, or start a negotiation. When an officer approves a PO, a legally binding contract is initiated.

Step 6: Goods receipt

Once the promised goods/services are delivered, the relevant goods or services receipt is created as per the contract terms.

Step 7: Supplier performance Evaluation

Supplier performance is critical to lowering costs, increasing process efficiency, and improving business performance.

Step 8: Invoice approval

Once the receipt of the good is approved, a three-way match between the purchase order, the vendor invoice, and goods receipt is performed. If no discrepancies are found, the invoice is approved and forwarded to the accounts payable for payment. In case of inaccuracies, the invoice is rejected back to the vendor with a reason for rejection.

Step 9: Vendor payment

Once the approved invoice is received, the finance team will process payments as per the contract terms.

Conclusion

Procure-to-pay comes under the umbrella of source-to-pay solutions they help in simplifying the siloed processes and gain financial control & improved visibility over the processes. Aavenir is all about the future of how everything should be done in a modern organization. We are here to transform your Source-to-Contract, Procure-to-Pay, and Supplier Management experience by integrating innovative technologies, such as Machine Learning and Natural Language Processing.

Explore Additional Resources To Know More