What is Net 30?- Definition

Net days is a term used in payments to represent when the payment is due, in contrast to the date that the goods/services were delivered. So, when you see “net 30” on an invoice, it means that the client can pay up to 30 calendar days (not business days) after they have been billed. It’s essentially a form of trade credit that you’re extending to the customer.

Understanding Net 30

Net 30 is a term included in the payment terms on an invoice. It indicates when the vendor wants to be paid for the service or product provided. In this case, net 30 means the vendor wants to be paid within 30 full days of the invoice date. Net 30 is a credit term. The vendor sends the products or performs a service first and then requests payment by a certain date.

Net 30 is a short-term credit that the merchant extends to the buyer. Usually, Net 30 on an invoice is used when a job is complete, e.g. a product or service has been sold but the payment has not been made in full. The 30 day period includes the time products spend in transit to the end consumer.

Advantages of Net 30

Net 30 payment terms are relatively generous, meaning that they allow you to take on more clients than you would with stricter payment terms. They’re essentially an extra incentive to buy from you. It’s also worth remembering that offering trade credit to your clients is an expression of trust, and it’s likely to foster a good relationship that could lead to future business.

1.Expands your customer base

Offering net 30 terms can help to broaden your customer base tremendously, as many customers appreciate the 30-day payment option, particularly those that may be experiencing cash flow problems of their own.

2.Offers a strong incentive for your customers

If you frequently sell to larger businesses, you’ll understand that sometimes the act of getting payment up-front or at the time of service is next to impossible. However, by offering credit terms such as net 30, it’s much simpler for your customers to put your invoice through their normal processes and still pay you within the 30-day time frame specified on the invoice.

3.Lets you add an early payment discount

One of the most effective ways to get your customers to pay early is to offer an early payment discount. If you’re currently offering your customers net 30 terms, but would like them to pay a little quicker, you can add a discount for early payment.

4.Helps your business remain competitive

It’s tough to compete with other businesses in your industry if they’re extending net 30 terms to their customers and you’re still insisting on payment up-front. While not every business is in a position to offer credit terms to all of its customers, doing so can help your business remain competitive.

5.Builds customer loyalty

Offering credit terms to your customers can help establish both trust and loyalty, and perhaps even reward you with a customer for life.

Disadvantages of Net 30

There are disadvantages associated with net 30 invoice terms. For a start, many small businesses can’t afford to wait 30 days to receive payment. In addition, some businesses take advantage of net 30 terms by sending late payments. If this is the case for your business, issuing stricter payment terms could be a good idea.

1.Can create cash flow problems

If you have limited cash flow, you may want to reconsider offering net 30 terms to your customers. Small businesses with a limited cash flow margin may be hard-pressed to wait 30 days for payments from their customers. If you feel you must offer credit terms to remain competitive, consider net 10, which will bring in payment much faster.

2.Discounts create thinner profit margins

If you attach a discount to net 30 terms, your profit margin will become even thinner. Again, if you’re in a position to reduce your profit margin a bit in order to be paid more quickly, then go for it. But, if you’re already operating on a razor-thin margin, discounting invoices may not be a good idea for your business right now.

3.Can create additional work

Yes, it does take more work to invoice a customer, post a discount (if offered) and record a customer payment. You may also be tasked with following up with late-paying customers and even handling collections. If you have the staff and the time to do this, great, but if not, it may be better to continue using your current payment arrangements.

4.Terms are unclear

Net 30 terms can confuse customers, who ask the following questions:

- Do the 30 days start when the invoice is received?

- Is payment due 30 days from today or 30 days from the invoice date?

- Do the 30 days start when the product or service is received?

- If a discount isn’t offered, why are billing terms net 30?

These are all very good questions, and one of the easiest ways to get around them is to use a due date instead of a net 30.

5.Delinquent accounts become a reality

No matter how diligently you do your research, in reality, you’re going to have delinquent accounts. Late payers create a lot of extra work (see #3) and even with all of that extra work, they still may never pay. And as a business owner, you have to be prepared for that.

Is the Net 30 payment term right for your business?

Ultimately, the suitability of net 30 terms for your business comes down to cash flow. If your business has plenty of cash on hand, multiple clients, and you can survive a couple of late payments, then extending net 30 invoice terms can be a great way to build up a substantial client base. However, if you depend on one or two large clients and your business doesn’t have a particularly healthy cash flow, offering net 30 terms may not be the right option for you.

Explore Additional Resources to Know More

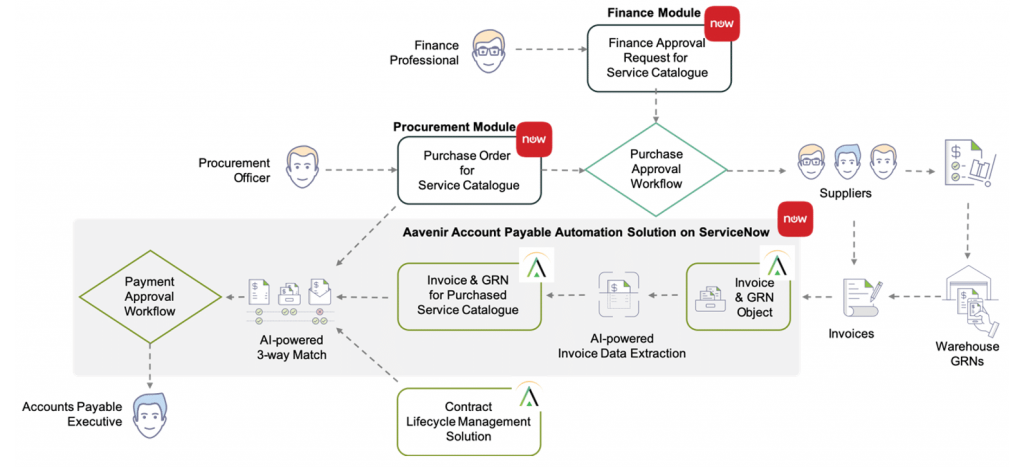

E-Book

Discover how automation will save you time, maximize security, and make your AP team more efficient.

Checklist

Ready to automate accounts payable operations with efficient invoice processing workflow?