Electronic automotive giant, Tesla is making its own computer car chips. But is it possible for the entire automotive industry to manufacture the components they require rather than relying on their handful of suppliers? Of course, not.

The best they can do is source more vendors in their supply chains to meet the production demand and fulfill the requirements of the end customer. However, disruption in global supply chains all over the world is impacting almost all industries. And hence, Environmental, Social, and Governance or ESG compliance, which started as an optional choice for many global organizations, is NOW increasingly becoming a requirement, while sourcing and onboarding vendors.

Especially in the procurement, sourcing, and supplier relationship management-related actions, the ESG criteria serve as a guideline for environmentally friendly, socially acceptable, and ethically righteous supply chain activities.

Role of ESG Compliance in Sustainable Procurement and Compliant Sourcing

With ever-rising public scrutiny of sustainability, social justice, and related issues, ESG is taking a front seat to third-party risk management as cybersecurity and data privacy are. ESG audits and evaluations help determine if your suppliers share their values while preventing lousy publicity and reputational damage.

For organizations that are just on the way to prioritizing ESG in their supply chain, it can be challenging to know where to start. For example, it could damage your brand if your organization is either not doing due diligence as part of the vendor selection process or works with suppliers having poor ESG performance.

An Overview of ESG Compliance and Requirements

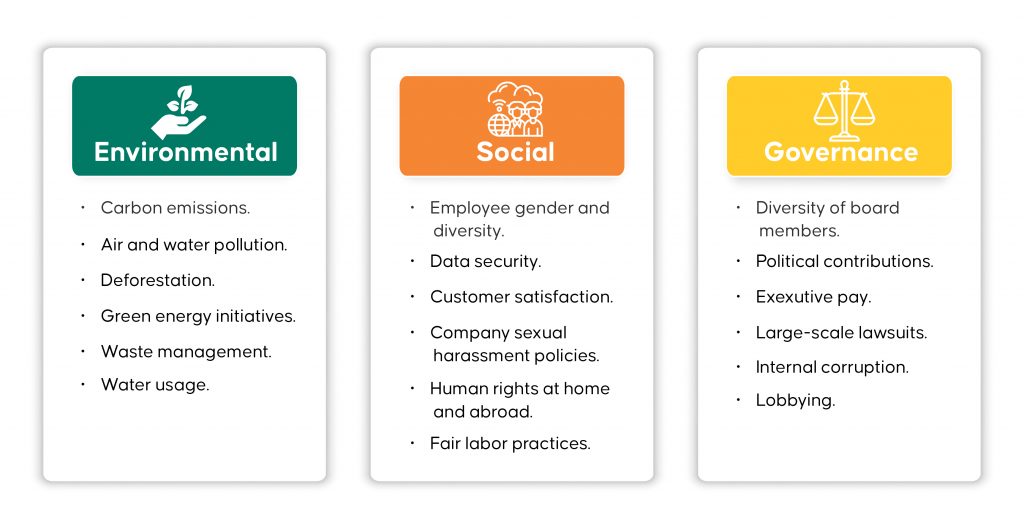

ESG stands for Environmental, Social, and Governance information.

- Environmental – Describes the company’s impact on the environment and resources.

- Social – Describes how the company approaches certain areas such as diversity, pay equality, and non-discrimination.

- Governance – Describes a company’s controls to address board diversity, internal controls, bribery and corruption, and other areas that boards and investors typically focus on.

ESG comprises critical factors that investors consider while assessing the sustainability of an investment. Environmental factors evaluate the preservation and protection of the environment. On the other hand, social factors look into how a business interacts with internal and external stakeholders. And, Governance concerns the review of how a company is administered.

It will help ensure all your suppliers meet your ESG requirements for related business operations and minimize business disruptions with continuous visibility into each vendor’s ESG track record and third-party ESG practices – before and after signing supplier contracts. Take a step forward to reduce complexity by centrally managing ESG assessments with all other supplier and vendor risk assessments

The Intersection of Suppliers, Procurement, Contract Management, and ESG Compliance

Businesses focused on ESG compliance are better positioned to meet the demands of a volatile, uncertain, complex, and ambiguous future. Nowadays, organizations look at their suppliers as strategic partners, not as somebody they buy from and have a single-lane relationship with. This strategic partnership requires transparency and shared values between a company and its vendors.

Here, ESG compliance plays a significant role in setting the stakeholders’ expectations right. For example, an organization whose sourcing and procurement activities are getting done by suppliers who comply with ESG requirements will ultimately be able to retain the customers and protect the brand reputation.

Regarding procurement and supply chain, ESG plays a significant role in stakeholder expectations. Organizations can achieve ESG compliance with appropriate procurement contract management. Your legal and procurement teams can comply with ESG criteria and help achieve sustainable procurement with the right contract management strategies. How? Let’s deep dive into it.

1. Optimize Existing Contracts

Examine whether you can utilize your existing contracts’ reporting requirements and audit rights to encourage vendors to provide ESG data. Organizations often have reporting rights and obligations in their contracts that are under-utilized during the contract lifecycle. This is where good contract management can assist. Modern-day CLM systems can help you optimize your existing contracts and stay on top of obligations.

Read More: 10 Essential Features of the Best Contract Lifecycle Management Software (CLM)

2. Optimize Existing Obligations

Increase the scope of your current obligations to include more than just adhering to the letter of the law or predefined commitments. For example, warranties that a supplier will not engage in conduct inconsistent with statutory requirements relating to modern slavery can be easily adapted to soft law standards.

Equally, a supplier must develop and maintain policies consistent with the customer’s policies that organizations can adapt to apply to that customer’s sustainable business practices.

3. Optimize Supplier Assessment Process

Involve your legal team with the preparation of procurement documentation, and ensure ESG requirements are brought to the fore in the supplier assessment process. This may include preparing RFPs and response frameworks that prioritize ESG criteria and ensuring bidder responses are evaluated on their ability to meet such ESG requirements. Similarly, legal teams can ensure ESG objectives remain front of mind during the procurement process through their involvement in preparing of board packs or contract approval processes.

Pro-Tip: Optimize your contracts as a part of your ESG compliance agenda. Use ESG screening questions to ensure your vendors’ ESG compliance.

Final Call to Ensure ESG Compliance

ESG is an investment, not a cost. Although some businesses might still treat the implementation, compliance, and reporting of ESG issues as a cost line in the short-run, many organizations have started considering it as a long-run investment.

Automating Governance, Risk and Compliance is the way to ensure ESG compliance. Automate, simplify, and maintain compliance across your international suppliers and vendors with Aavenir Onboardingflow.

Our entire Source-to-Pay suite provides total transparency and complete collaboration to give you the compliance confidence you need to succeed.