A robust supply chain consisting of reliable sourcing partners accelerates the growth of successful enterprises. Each enterprise aims to make fast payments for vendor invoices received to build successful vendor relationships.

In a recent survey conducted for 170+ North American Accounts Payable teams, 23% of companies shared that non-PO invoice processing is one of their most significant pain areas. The remaining 77% are still figuring out a way to process PO-based invoices faster in their digital transformation.

The vendor invoice can be divided primarily into PO invoices (having a reference Purchase Order) and Non-PO Invoices (vendor-generated without any PO reference).

To reduce average receipt-to-invoice cycle time, Accounts Payable teams use different digital tools such as ERP, A/P automation tools, and lately, even ServiceNow to implement PO vs. Non-PO invoice approval workflow.

This blog discusses the difference between PO and Non-PO invoices and helps you understand the best practices to implement a successful invoice approval workflow process using the ServiceNow platform.

What is a PO Invoice?

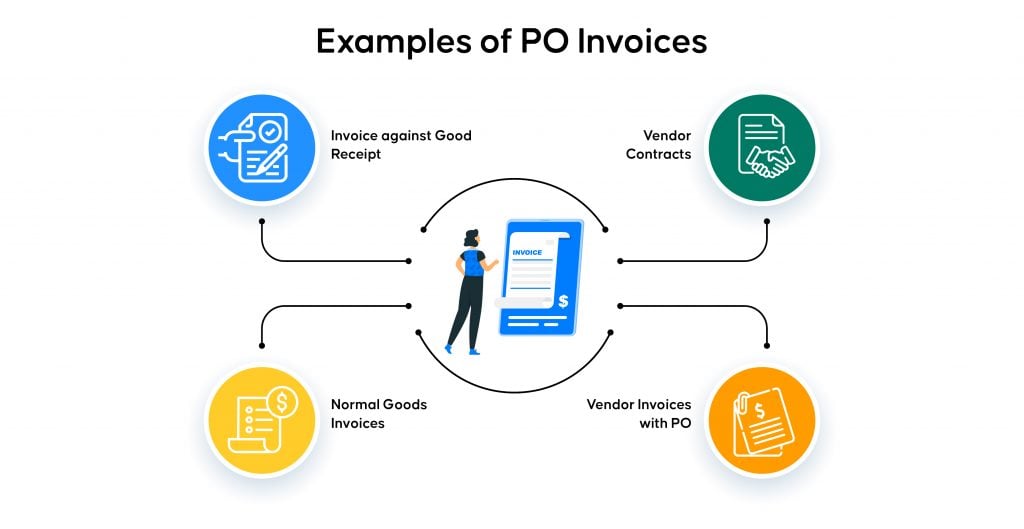

A PO (Purchase Order) invoice is the invoice raised by the vendor based on the purchase order created by the buyer. Generally, for processing an invoice, accounts payable will match the PO invoice raised by the vendors against the purchase order to ensure all details (quantity, price, PO number) are correct.

In some cases, enterprises will do a 3-way invoice matching process to confirm if the PO invoice details match the purchase order and the receipt number of the goods registered by the procurement system. For example, PO invoices typically include invoices for direct goods or services purchases.

Learn about the most popular PO Invoice examples:

What is a Non-PO Invoice?

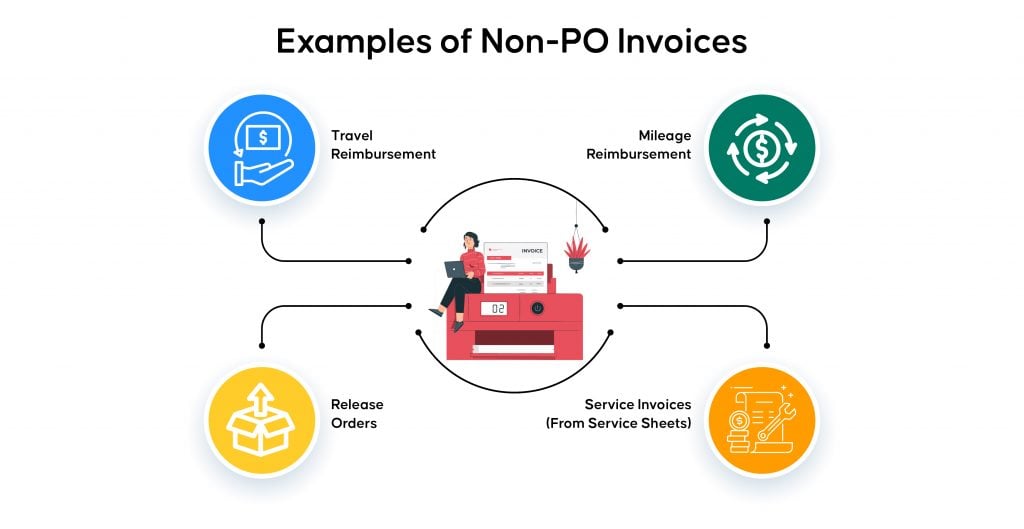

Non-PO invoices are those invoices raised by the vendor that does not have a purchase order (associated with them). Sometimes Non-PO invoices are also used to make vendor payments when an invoice is under a direct spend budget/ limit.

Non-PO invoices are often used for indirect purchases or spend below the tolerance limit. They might have a preparer and an approver as two major stakeholders for managing invoices. Here there are chances that an organization’s cost center or internal order might have been used.

Here are a few prominent Non-PO Invoice examples:

What is the difference between PO vs. Non-PO Invoices?

Differentiating between PO vs. non-PO invoices lies in exploring the underlying logic of the purchase that led to the generation of the invoice. The key differences are:

| Parameter | PO Invoice | Non-PO Invoice |

| Meaning | A purchase order is associated with the invoice raised. | A purchase order is not associated with the invoice raised. |

| Used for | Primarily used for Direct Purchase or Procurement. | Used mainly for Indirect Procurement or Purchase. |

| Approval | The purchase order reference is pre-approved. | The invoice approval process is not pre-approved and has been prepared by an Approver in some cases. |

| Processing Time | Faster Invoice Approval & Processing. | Slower Invoice Approval & Processing. |

| Clubbing | All goods can be clubbed into a Single Invoice. | Can have multiple invoices. |

| Transparency | Greater transparency of the invoice payment process. | Less transparency of the invoice payment process. |

| Advantage | Ideally used for normal procurement. | Ideally, used during discretionary spending (below tolerance limits) or emergency procurement of goods or services. |

Best Practices: PO vs. Non-PO Invoice Approval Workflow

Organizations need to consider these best practices while processing the PO & Non-PO Invoices:

- The Preparer and Approver must ensure that the transactions they submit are correct and compliant. They must read all warnings and errors against each transaction before submitting it.

- Ensure that payments are allowable, acceptable, and accurate. Also, ensure that the original vendor payment request is on file within the department. The Procurement Services nor eProcurement will not authenticate the reason for the invoice payment.

- Be careful and check that Procurement Services performs spot audits on Non-PO Invoices. The audits should reflect that transactions are compliant (i.e., items are not on the exceptions list).

- Determine the workflow between Preparers and Approvers for Non-PO Invoice payments within each department.

How to Automate PO & Non-PO Invoice Processing?

Currently, invoices received by the Accounts Payable teams in paper or email are processed either manually or with OCR (which requires manual effort in 62% of OCR invoices). Manual processing requires the most employees of any method. It is the processing approach used by companies with less than 10,000 invoices per month and processing greater than 10,000 invoices per month. OCR is more efficient (requiring fewer employees) than manual processing.

Depending on how fast and efficiently the accounts team processes invoices can help the organization save on late-payment penalties and avail of early-payment discounts.

Enterprises need a digital workflow solution like ServiceNow that enables all the departments to work collaboratively.

Your organization can leverage Aavenir Invoiceflow, which provides a unique touchless invoice processing solution covering intelligent invoice data extraction, AI-based 2-way/3-way invoice validation with flexible invoice processing workflows for automating invoice processing.

How Can Aavenir Invoiceflow Help?

- Pre-configured metadata identification of invoice number based on previous invoices from the same vendor or cost center

- Automatic distribution to the relevant approver based on the organization’s approval hierarchy

- Automatic approval by matching recurring invoices (such as a lease) to the payment plan in a contract

- 100% visibility into procurement and tracking of Invoices via workflows

Over to You

Aavenir Invoiceflow delivers faster invoice processing with fewer touchpoints, fewer errors, and more early payment discounts, thus improving the vendor invoice processing.