The global pandemic of 2020 has reshaped the workplace model, with most organizations shifting gears to remote and hybrid models. Similarly, Accounts Payable teams are also struggling to measure efficiency and visibility in the current scenario.

While the needs have changed, the solutions sold as the “Accounts Payable Technology of Tomorrow” have remained the same. Technological advancements lead us to a world where almost everything can be easily monitored, tracked, and measured. There are specific applications available in the market today to remind and give us notifications on our calendars related to our travel schedules, food orders, and exercise routines to heartbeat rate.

Then why cannot we get automated alerts and reminders in our calendars for our Accounts Payable dues?

Analyzing Accounts Payable KPIs

Nowadays, progress is measured most often in seconds rather than minutes, which also holds for the accounts payable team within an organization. With accurate Accounts Payable KPIs measurements & metrics, organizations can address some of the standard accounts payable challenges, such as

- Reducing database errors due to manual data entry

- Monitoring invoice collection from various channels

- Matching invoice data with purchase orders, contract values, and goods-or-services-received notes

- Reducing the number of invoice exceptions and manual workflow bottlenecks

- Identifying AP fraudulent transactions

- Improving the efficiency of multiple accounts payable channels

Which Accounts Payable KPIs do Organizations Track?

To identify bottlenecks and maximize the efficiency of the accounts payable department, companies should define key performance indicators (KPIs) for the accounts payable department. KPIs can help the Accounts Payable team continuously measure your performance against key business objectives and set a target for continuous improvement.

In addition, Accounts Payable KPIs provide valuable data for crafting short and long-term procurement and payment strategies.

5 Key Metrics to empower your Accounts Payable Department from Aavenir

Here are 5 Account Payable KPIs that almost every AP department should focus on reviewing:

KPI # 1 Cost for Processing a Single Invoice

The tracking cost per invoice processed is the organization’s first glimpse into overall departmental efficiency. Different costs associated with processing an invoice are infrastructure and follow-up, staff salaries, managerial overhead, and IT support.

How to calculate this KPI:

Cost per Invoice Processed = Total accounts payable costs / Total number of invoices

KPI#2 Time for Processing a Single Invoice

Every organization records the time spent on processing invoices. This gives valuable insights into how the AP department performs on payment of invoices, productivity, maintaining vendor relationships, and the availability of early payment discounts. Time is money for every organization. Improving invoice data accuracy and streamlining the invoice payment-approval-receipt workflow are necessary to lower the average cost and time wasted.

How to calculate this KPI:

Time for Processing a Single Invoice= The total number of invoices paid (for a set period) / All costs incurred to pay the invoices(for that same period)

KPI#3 Number of Invoices Processed per day per AP staff

Considered a critical KPI, it demonstrates two objectives:

- Which vendor’s invoice causes the most significant issues for the AP staff, and

- Which staff requires additional training and guidance for proper analysis and review of invoices promptly

Measuring this KPI gives you a better idea where your AP processes demonstrate strength and which areas require improvement.

How to calculate this KPI:

Number of Invoices Processed per Day per AP Staff = Number of invoices processed / Number of AP staff who perform the accounts payable (AP) process

KPI#4 Percentage of Invoices related to a Purchase Order (PO)

One of the most important KPIs for Accounts Payable is invoice validation. The purchase order and the invoice have to match to facilitate a smooth transaction. It is a matter of concern if there is any discrepancy, regarding the time to check and the cost. The higher the percentage of invoices linked to purchase orders, the more accurate and less expensive your AP process is.

How to calculate this KPI:

Percentage of Invoices related to a Purchase Order (PO) = Number of accurately fulfilled invoices / Total Invoices * 100

KPI#5 Invoice Exception Rate

Exceptions are often caused by discrepancies in PO and invoice data, missing or incorrect POs, and bottlenecks in the approval workflow. For example, an invoice exception occurs when there’s a problem with an invoice—pending approval or routing errors. This can lead the payable process to a screeching halt, and without verification or centralized information access, it can also give rise to duplicate payments and other payment errors.

The formula to calculate this KPI is

Invoice Exception Rate = Rate of Invoice Exceptions / Total Number of Invoices Processed * 100

How to Track 5 Accounts Payable KPIs?

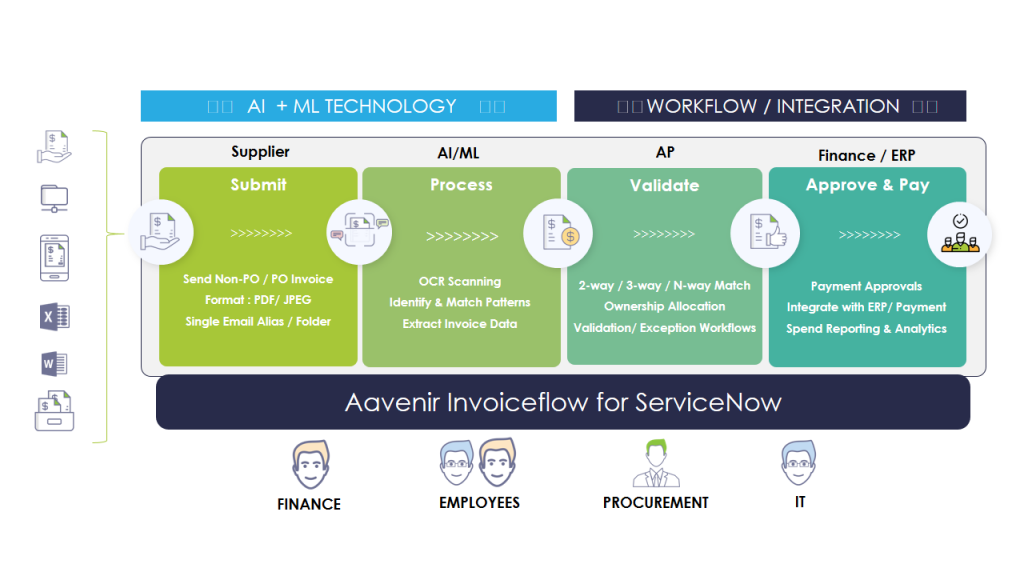

Just as much as it is vital to know which Accounts Payable KPIs to track, having the technology to gather, sort, and distribute the data you are collecting is also equally essential. Accounts Payable (AP) automation can be the first step toward the digital transformation of your accounts payable department. Try to bring everything onto a single platform and eliminate human intervention and paper-based inefficiency. With the help of the Accounts Payable automation tools like Aavenir InvoiceFlow (built on the ServiceNow platform), you can execute:

- Intelligent Invoice Data Extraction

- Invoice Data Onboarding

- AI-based 2-Way/ 3-Way Invoice Data Validation

- Invoice Approval Workflow

- Invoice Payment Request

The first two steps might involve pulling historical data. In case of no historical data, the organization needs to start with an educated guess or define the new KPI for a trial period to establish its merits. If necessary, you can set multiple targets for a single KPI to cater to readily identifiable circumstances.

By having access to all invoice data, your AP team will be able to monitor the performance of the KPIs mentioned above and then compare it against defined benchmarks to become more efficient and cut down on operating expenses.

Aavenir Invoiceflow dashboard automates reporting all-important KPIs, identifies bottlenecks, and defines alerts for the following actions (for pending invoice approvals/payments) to improve performance.

Why Aavenir Invoiceflow?

- Any department or vendor can send invoices in single invoice formats

- All data stored in secure, scalable, and compliant on the Now platform

- Capitalizes ServiceNow user hierarchy for Invoice Approval workflows

- No separate IT security clearance or IT audit required

- Integrates with all ServiceNow applications