Navigating through merger and acquisition events can be a formidable task for legal, legal operations, and contract management professionals. The uncertainties surrounding contractual risks and processes before, during, and after M&A activities are common. For instance, questions may arise about the integration of supplier contracts, the alignment of service level agreements, and the handling of intellectual property rights.

Together, AI and CLM solutions enhance the efficiency and accuracy of due diligence efforts, empowering stakeholders to make well-informed decisions during M&A transactions. This synergy not only accelerates the evaluation of contractual landscapes but also contributes to a more transparent and structured approach to assessing the legal and financial implications of the proposed merger or acquisition.

Enhancing M&A Due Diligence with AI and CLM Software

This post will delve into how contract management software can become an indispensable tool for companies undergoing these complex M&A transactions.

1. Legacy Contract Migration and AI-Powered Extraction

Legacy contract migration during mergers and acquisitions (M&A) is a vital step in consolidating business operations and mitigating legal risks. The process involves transitioning existing contracts from the acquired company, which often exist in diverse formats and repositories, to a unified system.

Leveraging AI, clauses, terms and obligations from contracts of the acquired company can be intelligently extracted, streamlining the migration process. AI-powered contract management tools can efficiently analyze large volumes of contracts, identifying key provisions, terms, clauses, and obligations to extract relevant information for digitization. These digitized contracts are securely stored within a centralized repository, ensuring ease of access and searchability through an AI-driven smart search feature. Also, contracts of the acquired company can be seamlessly bulk uploaded and consolidated into a centralized repository, streamlining accessibility and facilitating comprehensive management through AI-enabled processes.

This not only accelerates the integration of contractual obligations but also enhances the ability to assess potential liabilities and compliance issues, contributing to a smoother and more informed M&A transition.

2. Centralized Repository for Due Diligence

Efficient due diligence is critical in the dynamic landscape of mergers and acquisitions, and contract management solutions play a pivotal role in streamlining this complex process. By consolidating (or migrating) all relevant contracts in a centralized repository, these solutions provide seamless access for stakeholders involved in due diligence. With advanced search and categorization features, users can rapidly identify and review essential contracts, minimizing the risk of oversight.

This is how the advanced search and categorization features act as a navigational guide, allowing the legal team to efficiently steer through the complexities of M&A due diligence:

| Swift Supplier Contract Retrieval: | The legal team uses advanced search to instantly pull up all supplier contracts tied to Company B. This includes crucial agreements with suppliers vital to Company B's manufacturing processes. |

| Focused Exploration of Intellectual Property Agreements: | With the same software, the legal team hone in on intellectual property agreements. This targeted search ensures a clear understanding of who owns what in terms of intellectual assets, reducing the risk of disputes after the acquisition. |

| Proactive Contract Organization by Expiration Dates: | Leveraging categorization, the team organizes contracts based on expiration dates. This strategic move allows them to quickly identify contracts set to expire soon, ensuring they are well-prepared for upcoming negotiations and potential risks in the supply chain. |

| Identifying Change of Control Clauses: | The software's categorization prowess extends to highlighting contracts with change of control clauses. This is vital in M&A, helping the team pinpoint contracts that might be impacted by the change in ownership. Armed with this knowledge, they can assess implications and foresee potential renegotiation needs. |

| Identifying Contract Risks and Non-compliance in Repository | AI in CLM software can identify contracts with high or unlimited liability, contracts that do not comply with GDPR, CCPA, SCADA, HIPAA, or other regulatory standards, contracts exhibiting high deviation or risk within clause libraries, enabling the formulation of risk mitigation strategies, and facilitating the review of high-risk contracts |

Furthermore, the inclusion of robust analytics tools enables a comprehensive analysis of contract terms, obligations, and potential risks. This not only accelerates the due diligence timeline but also furnishes decision-makers with the insights necessary to navigate the complexities of mergers and acquisitions.

Discover how Aavenir Contractflow, the exclusive solution with an AI-powered repository on the ServiceNow platform, elevates your contract management practices to the next level! Explore AI-powered Contract Repository in CLM.

3. AI-driven Insights Elevating Financial Due Diligence

Scrutinizing the financial viability of a target company in M&A transactions is a high-stakes game. While financial records form the foundation, the game-changer is AI-powered Contract Lifecycle Management (CLM) systems that enrich insights with transactional context and contract values.

Picture this: CLM software goes beyond tracking deal metrics to include contract execution times and a calendar view of renewal and termination dates. This comprehensive approach heightens the precision of financial evaluations, steering clear of costly oversights.

Let's put it in perspective. Consider a scenario where a target company's contracts are numerous and complex. With traditional methods, the analysis could be time-consuming and prone to oversight. Now, with AI in CLM, the system not only provides insights into current contract values but also predicts potential risks based on historical data. This predictive capability not only speeds up the decision-making process but also acts as a safeguard against costly oversights.

In Addition, generative AI in CLM not only identifies deviation in contract clauses of the company being acquired from your standard library of approved clauses but also provides associated risk insights which help parties involved take informed decisions.

In essence, the synergy of AI and CLM isn't just about adding insights; it's about revolutionizing how we gain and use those insights.

Validate Revenue

Another essential aspect of M&A due diligence is forecasting future revenue from existing accounts or sell-side deals. AI-powered contract intelligence platforms excel in identifying key clauses such as dollar amounts, term limits, assignment clauses, change of control provisions, and most favored nation provisions. This capability helps businesses obtain reliable insights into future cash flows, facilitating more informed and equitable purchase price negotiations.

4. Self-serve Portals for Collaboration

Contract management solutions frequently incorporate self-service portals that offer employees a guided experience when interacting with the legal or contracts team. A prevalent use case for these portals enables employees to effortlessly request a contract by supplying the necessary information.

These portals are invaluable during the transition and post-merger phases, enabling stakeholders from both entities to seamlessly request contracts through a unified portal. The unified interface facilitates swift access to standard contract templates of the merged entities, pre-approved by the legal team, streamlining the request process. By expediting access to these templates, the portals help in consolidating the contractual landscape after a merger. This consolidation reduces redundancies, standardizes terms, and aligns obligations, ultimately fostering a more seamless transition and integration between the merged entities.

This streamlined process not only facilitates efficient communication between stakeholders but also ensures that the legal team can manage and customize contracts in accordance with the intricate demands of mergers and acquisitions.

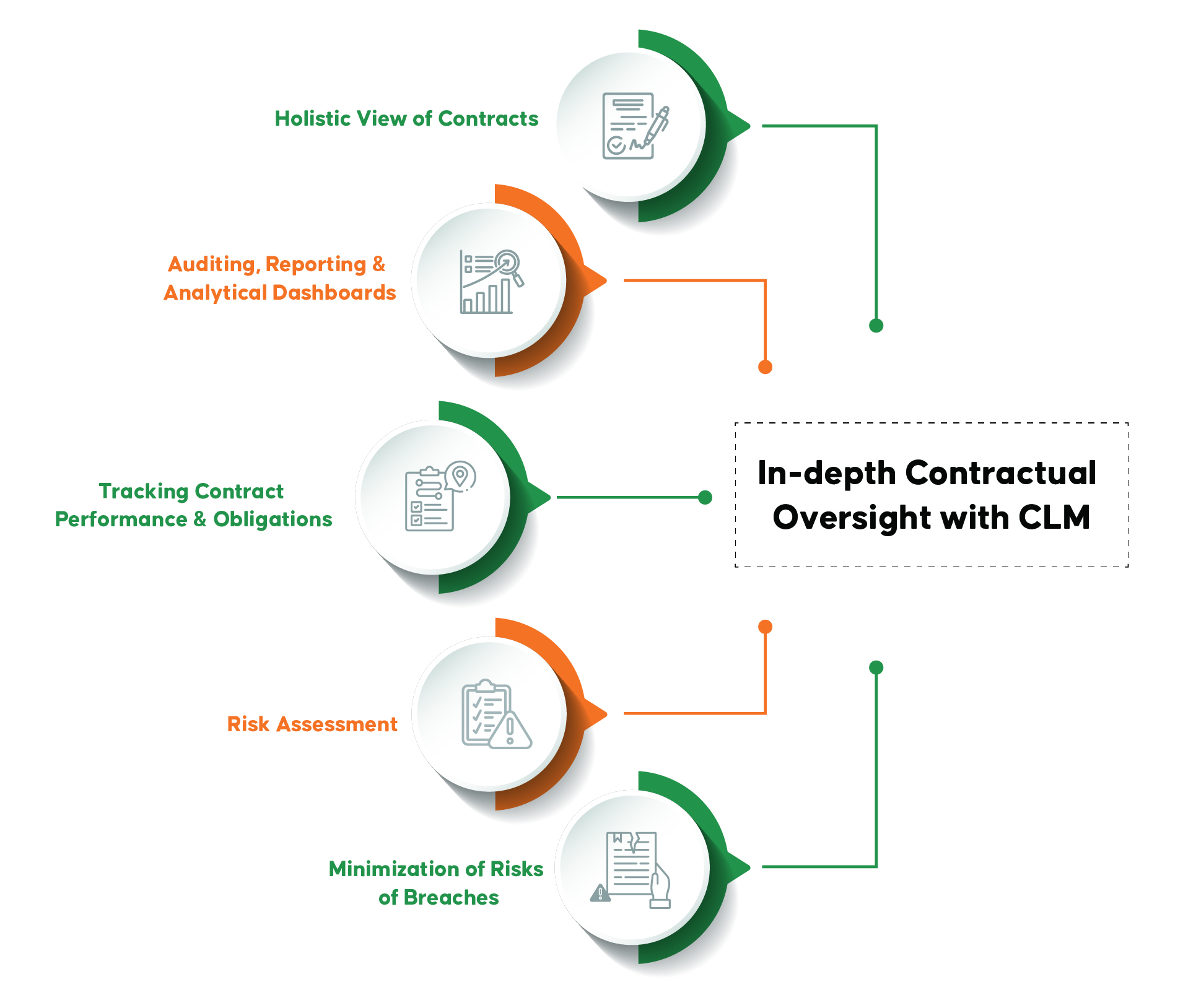

5. In-depth Contractual Oversight with CLM

In the dynamic landscape of M&A, companies often overlook contractual agreements with various stakeholders.

(a) Holistic View of Contracts

Contract Lifecycle Management (CLM) steps in to provide a holistic view of all contracts, including those not immediately customer-facing, such as real estate and government agreements. Centralizing contract-related data, CLM minimizes the risk of entering deals without complete information, offering efficiency and thoroughness in the due diligence process.

(b) Auditing, Reporting and Analytical Dashboards

Advanced CLM solutions let users generate comprehensive due diligence reports, conduct audit trails, and provide summaries of contract terms and conditions. These reports further assist them in decision-making and provide documentation for regulatory compliance.

(c) Tracking Contract Performance and Obligations

Users can track ongoing contractual obligations, commitments, and performance metrics. This compliance tracking helps evaluate the financial and operational impact of existing contracts on the M&A.

(d) Risk Assessment

Inherited contracts with suppliers and vendors may carry hidden risks, such as supply chain disruptions or non-compliance issues. CLM's categorization features can quickly identify contracts with key suppliers and vendors. AI-driven risk assessment tools can analyze these contracts for potential risks, allowing the acquiring company to proactively address issues and ensure a seamless integration of the supply chain.

(e) Minimization of Risks of Breaches

In M&A, handling sensitive information without ensuring proper data security and confidentiality measures poses a substantial risk, leading to potential breaches and legal consequences. CLM platforms equipped with AI can systematically analyze contracts for data security and confidentiality clauses. This ensures that the acquiring company is aware of its responsibilities regarding sensitive information, minimizing the risk of inadvertent breaches and legal repercussions.

Signing off

In conclusion, the adoption of Contract Lifecycle Management (CLM) and AI technologies in M&A due diligence is not just a strategic choice; it's a transformative one. From streamlining contract requests through self-serve portals to the meticulous organization of contracts based on expiration dates and identifying nuanced clauses, CLM proves to be the linchpin in efficient and risk-mitigated due diligence.

The synergy of AI elevates financial assessments, offering predictive insights that steer clear of costly oversights. Moreover, CLM's oversight extends beyond customer-facing contracts, ensuring a holistic view that is instrumental in minimizing risks and ensuring compliance. As businesses venture into the complex landscape of M&A, embracing CLM and AI becomes more than a choice—it becomes a necessity for those aiming not just for successful transactions but for sustainable, risk-aware growth.

This streamlining doesn't end with pre-acquisition; CLM and AI facilitate ongoing contract management using best practices, making future due diligence processes far less cumbersome. Embracing these technologies is a strategic move that enhances the efficiency and success of M&A activities in today's business landscape.

Excited to discover how Aavenir Contractflow's advanced contract intelligence can position your business for success amid the rising tide of M&A due diligence and related activities? Book a demo today to explore its powerful features and transformative impact on your contract management!