In today’s fast-paced business environment, staying ahead of the competition is crucial for success. One area that can significantly impact a company’s efficiency and bottom line is the management of accounts payable. Traditional manual processes are not only time-consuming but also prone to errors, leading to delayed payments, unhappy vendors, and potential financial losses. This is where accounts payable automation software comes into play, revolutionizing the way businesses handle their payables. In this article, we will explore the top features of accounts payable automation software that can help streamline your workflow, enhance productivity, and improve your overall financial operations.

Top Features of Accounts Payable Automation Software

1. Invoice Capture and Data Extraction

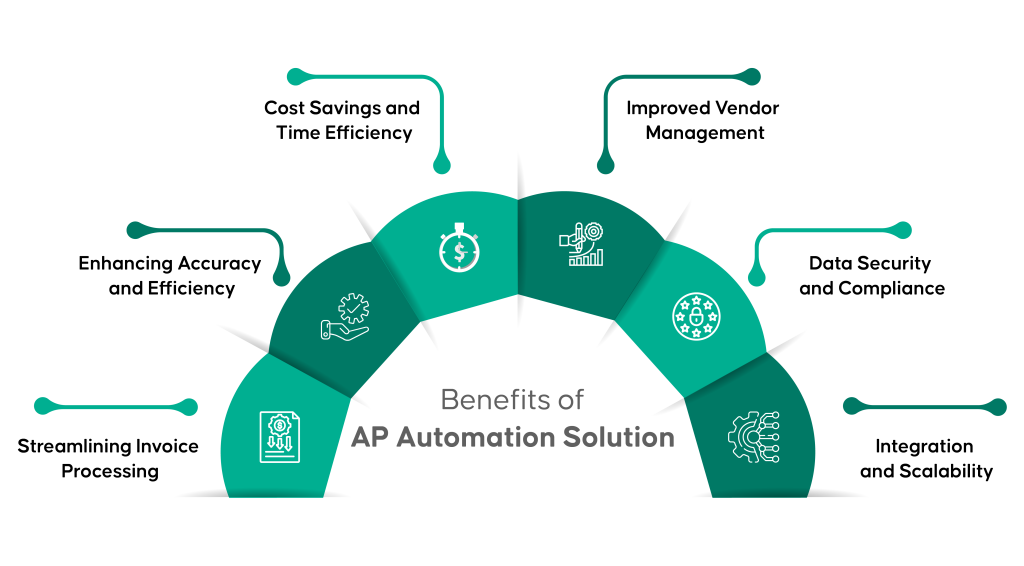

Invoice processing automation software allows for seamless capture of invoices, whether in paper, PDF, or email format. It leverages intelligent data extraction technology to extract key information such as vendor name, invoice number, due date, and line-item details. This feature eliminates manual data entry, reduces errors, and accelerates the invoice processing cycle.

2. Workflow Automation and Approval Routing

Managing the approval process for invoices can be a complex and time-consuming task, especially in organizations with multiple departments and decision-makers. Accounts payable automation software offers robust workflow automation capabilities that streamline the approval process. The software can route invoices to the appropriate stakeholders for review and approval based on predefined rules and workflows. This ensures that invoices are processed promptly, reduces bottlenecks, and provides better visibility into the status of payments. With automated approval routing, businesses can eliminate manual follow-ups, improve collaboration, and maintain compliance with internal policies and external regulations.

3. Vendor Management and Communication

AP automation software centralizes vendor information, allowing businesses to maintain accurate and up-to-date vendor records. It provides a platform for efficient communication with vendors, facilitating queries, dispute resolutions, and payment inquiries. This feature fosters strong vendor relationships and ensures smooth communication throughout the AP process.

4. Integration with ERP Systems

Integration with ERP (Enterprise Resource Planning) systems is another crucial feature. It enables seamless synchronization of data between the AP software and the ERP system, ensuring consistency and eliminating data silos. This integration streamlines the overall financial management process and provides real-time visibility into AP-related data.

5. Reporting and Analytics

Data is an asset for any business, and accounts payable automation software can help unlock its potential. Advanced software solutions offer robust analytics and reporting features that provide valuable insights into payables performance. Businesses can generate customized reports to analyze key metrics such as payment trends, vendor performance, and cash flow projections. These insights enable businesses to identify opportunities for cost savings, negotiate better terms with vendors, and optimize their overall financial operations. By leveraging analytics and reporting capabilities, businesses can make data-driven decisions that drive growth and profitability.

Conclusion

Accounts payable automation software offers a wide range of features that enhance efficiency, accuracy, and cost savings in the AP process. By carefully selecting the right software solution and following a structured implementation process, businesses can streamline their AP workflows, improve vendor relationships, and gain valuable insights for informed decision-making.

Selecting the right accounts payable automation software is crucial for a successful implementation. Businesses should start by identifying their specific needs and pain points in the AP process. Then, they should evaluate software features and functionality, considering factors such as OCR capabilities, workflow automation, analytics, and reporting. Integration options with existing systems and scalability for future growth are also important considerations. Try Aavenir Invoiceflow today, Book a Demo

FAQs

Q1. Can accounts payable automation software work with our existing accounting software?

Yes, accounts payable automation software can integrate seamlessly with existing accounting software, including popular ERP systems. Integration ensures that data flows smoothly between systems, avoiding duplication and reducing manual effort.

Q2. Is accounts payable automation only suitable for large businesses?

No, accounts payable automation software is suitable for businesses of all sizes. Whether you are a small startup or a large enterprise, automation can bring significant benefits, such as cost savings, improved efficiency, and better vendor management.

Q3. How long does it take to implement accounts payable automation software?

The implementation time for accounts payable automation software varies depending on factors such as the complexity of your existing processes and the customization required. On average, implementation can take a few weeks to a couple of months.

Q4. Will accounts payable automation software reduce the need for human involvement?

Accounts payable automation software automates repetitive manual tasks, but human involvement is still necessary for tasks that require judgment, exception handling, and strategic decision-making. The software enhances the role of AP professionals, enabling them to focus on value-added activities.