- Despite having mature AP processes and best-in-class procurement systems, one organization still fell victim to a multimillion dollar invoicing scam, undetected for several years due to lack of visibility across the value chain.

- Finance pros spent 80% of the time in manually gathering, consolidating, and verifying data with purchase orders, contract data and good/services received notes;

- AI-enabled workflow automation can reduce operational overhead, eliminate repetitive tasks, provides complete visibility, and reduce errors

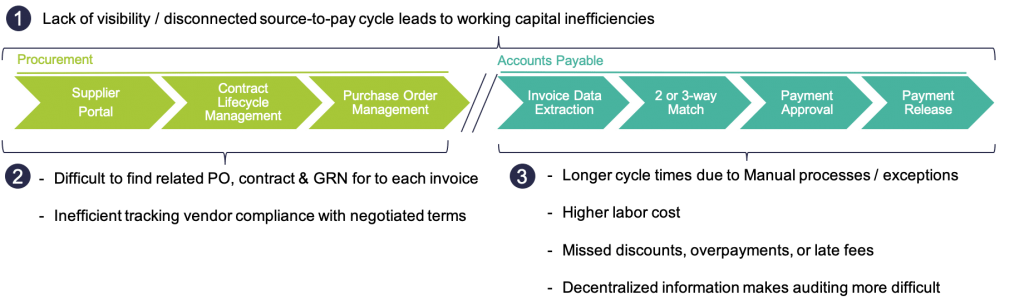

The source-to-pay cycle can be challenging to manage, given the high volume of transactional data often housed in multiple IT systems, applications, and complex email-driven processes. The financial consequences of invoice processing errors, duplicate payments, and vendor and employee fraud can run into huge amounts of losses each year.

Surprisingly, organizations with mature AP processes and best-in-class procurement/ERP systems were scammed of millions of dollars in fraud invoices for years. So, why did they fall into such an issue? Most organizations accept invoices and clear the financial documents to make those payments faster. Despite performing a 2-way/3-way match, lack of visibility into the complete source-to-pay cycle is leading to the continuous rising of invoicing inefficiencies. Three main areas where most of the organizations face challenges are:

To ensure the credibility of procurement’s claims to savings and value delivery, organizations should have complete visibility into the more transactional, but vital, value-sustaining activities of procure-to-invoice, invoice-to-pay, and supplier management.

Taking a Modern Approach to Accounts Payable Management

No single business function can work in isolation. Traditional Procurement and accounting solutions that don’t communicate with each other introduce multiple bottlenecks. New Workflow-based solutions provide a drag-and-drop interface to integrate multi-step processes and activities between people and systems for seamless flow of information across the organization. Thus, they increase visibility, reduce bottlenecks, and drive value. In recent years, Artificial intelligence (AI) also promises to fundamentally change the way that the AP team operates. Smart workflows incorporate AI to reduce manual intervention and automate repetitive tasks for business teams. Below are the 4 steps which can help organizations align procurement and account payable processes using AI and workflow-enabled solutions like Aavenir Invoiceflow.

#1 Centralizing accounts payable processing and reporting

Problem: Most organizations have clearly defined steps to receive invoices, process the invoices, and pay the suppliers. But, they either happen manually over emails or through discrete IT systems. Compounding the issue, many large organizations still rely on spreadsheets, which create communication silos that open the door for errors. Accounting team members are often buried in sourcing and verifying procurement data to ensure the accuracy of invoice processing.

Solution: Ideally, accounting teams want a system that can bring together disparate data (invoice entries, purchase orders, contract data, and assets) into a single platform to improve transparency and productivity. Having everything and everyone on the same page, managers can quickly identify the bottlenecks in their procurement process and build workflows using unique validation rules. A well-defined APA workflow offers flawless coordination between procurement, key stakeholders, and the accounts payable team in real-time. This helps expedite review cycles and make on-time payments with fewer resources, ultimately reducing enterprise costs.

Aavenir Invoiceflow centralizes all types of invoice processing requests with ready-to-drop-in Accounts Payable Automation (APA) workflow for all business functions on ServiceNow – the unified digital workflow platform for the enterprise. When a procurement team member or a vendor sends an invoice to the accounts team, each invoice payment request automatically gets scanned, uploaded, and attached with supporting procurement and contract documents on the centralized repository on ServiceNow. Magic. Isn’t it !?!

Time saved in data consolidation: 125 hours per month

(15 min per invoice X 500 invoices per month)

#2 Moving towards a touchless invoice processing using Artificial Intelligence (AI).

Problem: For many organizations, it is not easy to digitize all invoices. A cookie-cutter manual invoice data entry is prone to human errors and also results in very high AP processing costs. As per a Deloitte survey, typically, it costs $8 to process a single supplier payment, and 62% of this costs due to manual efforts.

Solution: Organizations need automated invoice data extraction as a first step to workflow-based invoice receiving methods from employees and vendors. Also, based on data extracted, each invoice received needs a flexible workflow to ensure on-time and accurate payments.

Using advanced AI technologies, Aavenir Invoiceflow offers zero-touch cognitive invoice data extraction from an invoice image or document attached in the email. It automatically enters all invoice data and creates an invoice payment request on ServiceNow. Each request then gets routed through a condition-based, automated invoice processing workflow to free up the Accounts Payable team from operational tasks and let them deliver strategic value to organizations. Only exceptions get routed for human intervention.

Time saved in invoice data entry: ~36 hours per month (~41 hrs – ~5 hrs)

(~5 min per invoice X 500 invoices per month) – Manual(~0.5 min per invoice X 500 invoices per month) – using AI-based Invoice data extraction

#3 Automated 2-way /3-way match with supplier, contract and inventory information

Problem: Many times manual invoice matching fails because they are unaware of the incorrect purchase orders, item categories, payment terms, or supplier data. To eliminate such failures, accounting teams frequently must search for the correct stakeholder to match the data, identify the root cause if there is data mismatch, and request corrective action if required. This entire process becomes very time-consuming when you have your procurement team, legal team and account team working remotely in different time zones, and data is not centralized.

Solution: Accounting teams need a 360-degree view of purchase orders (POs), contract information, and inventory (assets/Services) data to electronically validate and accept invoices, verify payment terms against the contract, track goods received, and approve invoices payments. For the invoice matching phase, procurement teams should use centralized data and start using analytics to match a code for material, item catalogs, and flag purchase orders with line items. They also need an automated system for faster comparison of supplier data with supplier master data, identifying pricing mismatches, verifying payment terms with contracts, material categories, etc. An automated 2-way or 3-way match can help organizations increase payables to free up cash and strengthen their working capital or achieve savings through available discounts or rebates.

Using AI-enabled smart workflow, Aavenir Invoiceflow offers complete visibility across the source-to-pay cycle. It can lead to a 15% to 20% reduction in accounting errors with automated 2-way/3-way match, track delivery receipts (GRNs), and workflow routing to PO creator or related stakeholders to resolve disputes rather than manual email follow-ups. Such automated routing of issues can expedite Accounts Payable processing and reduce invoice frauds/mismatches.

Time saved in invoice processing: ~209 hours per month (~250 hrs – ~41 hrs)

(~30 min per invoice X 500 invoices per month) –traditional system integration (< 3 hrs in some case)

(~5 min per invoice X 500 invoices per month) – AI-enabled automated 2-way 3-way match

#4 Adopting more robust governance practices

Problem: Most large enterprises have put the pieces of the puzzle together over time. The system architecture and processes that they have, have all been kind of stitched together. There is no single underlying technology platform to manage all systems and data flow all the way through the organization.

Solution: Organizations need to consolidate all applications using a single data model on a single cloud platform for data consistency, faster data analytics, and reduce the cost of ownership.

If you use Aavenir Invoiceflow on ServiceNow, the same team, who supports employee, vendor, and customer-related enterprise applications, can also support Aavenir Invoiceflow. So, there is an economy of scale. There is no need for additional skillsets for system administration, system audit, or applying security policies. This is one of the benefits we’re seeing with Aavenir Invoiceflow on ServiceNow.

100% Reduced total cost of ownership

What Next?

Most organizations fail to maintain an accurate and single view of data, thus inducing long invoice payment cycles. Long cycles lead to bulk processing of Invoices in a shorter time and fail to recognize invoicing errors or frauds. According to a report by PWC, payment-related fraud occurs more often than any other type of procurement fraud. Smarter workflow solutions like Aavenir Invoiceflow can help ServiceNow customers to bring in human intelligence to accounts payable that accelerate the payment cycle and reduce frauds in invoices.