Accounts Payable Workflow 101: Significance of an Efficient AP Workflow

The accounts payable workflow is a vital process encompassing the acquisition of goods and services, invoice processing, and payment execution. It is crucial to have a comprehensive understanding and effective management of this workflow for successful accounts payable (AP) operations. However, traditional manual workflows often present challenges that impede growth, compromise efficiency, and lead to errors.

Steps Involved in the Accounts Payable Workflow

Accounts Payable departments follow a series of steps to process each invoice, constituting the workflow. This workflow can be carried out either manually or through automation. In manual workflows, each step is performed by individuals, while automation eliminates repetitive tasks and integrates control points important for CFOs and controllers. By implementing Aavenir Invoiceflow, the entire AP process can be significantly accelerated, reducing it to a matter of minutes, as exemplified by Greg Rice, Director for Global Applications at T.D. Williamson (TDW).

The AP workflow includes following stages:

Invoice Capture

The method of capturing invoices depends on how they are received. Invoices received via mail or fax can be manually entered or scanned using a computer. Emailed invoices can be directed to a dedicated email inbox, triggering automated invoice capture.

Invoice Approval

Once invoice details are captured, the next step is to obtain approval for payment. In companies without an AP automation platform, this approval process is typically performed manually.

If Purchase Orders (POs) are used, the invoice is matched against the PO. AP staff or the automation platform manually conduct this matching process. If a match is found, the invoice proceeds to payment. If not, it initiates an exception handling workflow for further investigation and resolution before payment.

For companies not utilizing PO numbers, invoice approvals may involve physically delivering or sending the invoice for a signature. This process can be time-consuming, particularly if paperwork gets misplaced or emails are overlooked. However, an automated system ensures that invoices are appropriately routed for approval and sends reminders, ensuring the workflow remains on track.

Payment Authorization

After obtaining invoice approval, a separate step of payment authorization may be required. This step may involve authorizations for different types of invoices or individual items on an invoice.

The AP team typically prepares a payment run, which consists of payments awaiting authorization by the controller or CFO within a specific time period. In manual processes, this might involve preparing, aggregating, or printing invoices and associated documentation. AP employees then present these documents to the controller or CFO, who determines which payments should be made.

Automation significantly enhances efficiency at this stage by allowing easy queueing of payment batches and submission to the appropriate person for authorization. Approval and payment scheduling can even be based on current cash management policies.

Payment Execution

Once approved and authorized, payments are ready to be executed. Payment methods can include checks, ACH transfers, virtual cards, or other options. Currently, checks remain the preferred method for most businesses, with over 33% of organizations making the majority of their payments through this medium. However, manual processes like sending paper checks tend to be time-consuming, costly, and susceptible to delays and errors.

Even digital payment methods require manual effort in the absence of an AP automation platform. Manual payment execution through ACH or wire transfer involves logging into online banking, entering each transaction individually, and duplicating the entry in the accounting system. Credit card payments require contacting vendors or entering payments in an online portal, followed by separately sending remittance details via fax or email.

Supplier Management

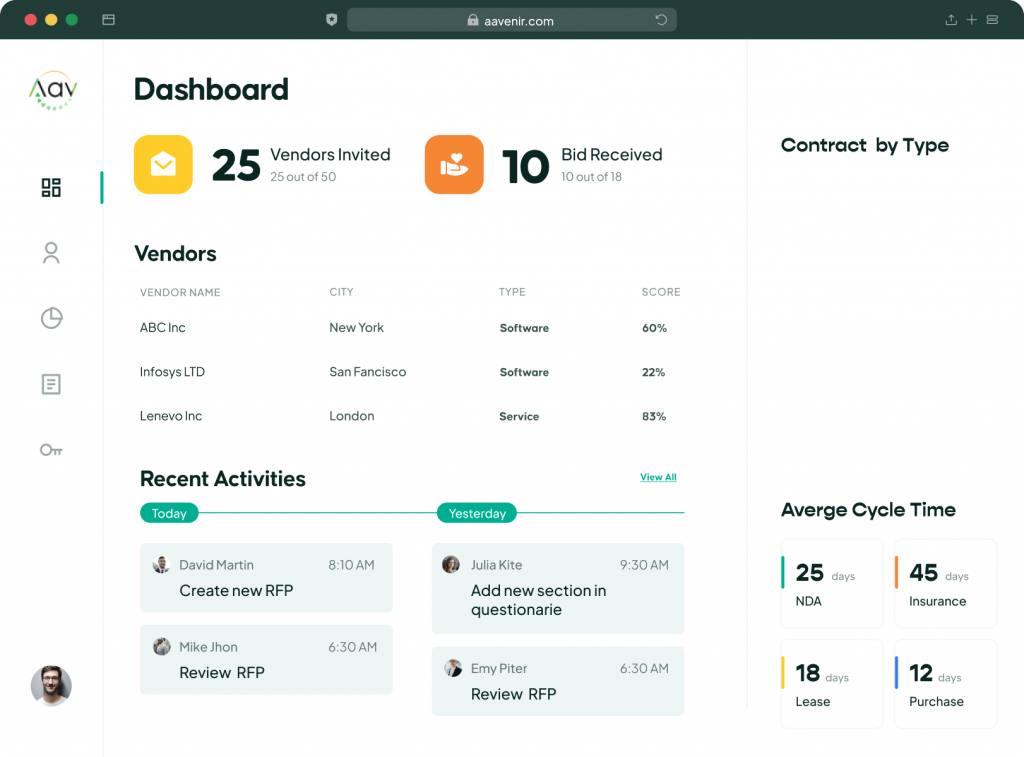

Efficient supplier management is integrated throughout the AP workflow. Streamlining AP workflows is crucial to achieving effective supplier management. Faster processing of payments leads to enhanced supplier satisfaction. Implementation of a digital system with a supplier portal enables suppliers to track the progress of their invoices, reducingthe need for frequent phone calls and inquiries.

Aavenir Invoiceflow, an AP automation solution, automates various activities that contribute to improved supplier satisfaction, such as supplier onboarding, payment preference management, responding to payment inquiries, and supplier enablement.

Management of the Accounts Payable Workflow

The management of the accounts payable workflow can be either manual or automated. Manual processes require a larger workforce to handle payments, as approvals, data entry, and invoice verification can be time-consuming. In companies utilizing AP software, the automation platform takes charge of the payment process, simplifying invoice approvals and payment execution.

The Importance of Managing the Accounts Payable Workflow

Encountering roadblocks, bottlenecks, or errors at any stage of the accounts payable process can result in delayed payments, duplicate payments, increased costs, wasted time, and more. A streamlined workflow directly impacts the financial well-being of an organization, the efficiency of its supply chain, and the strength of its supplier relationships.

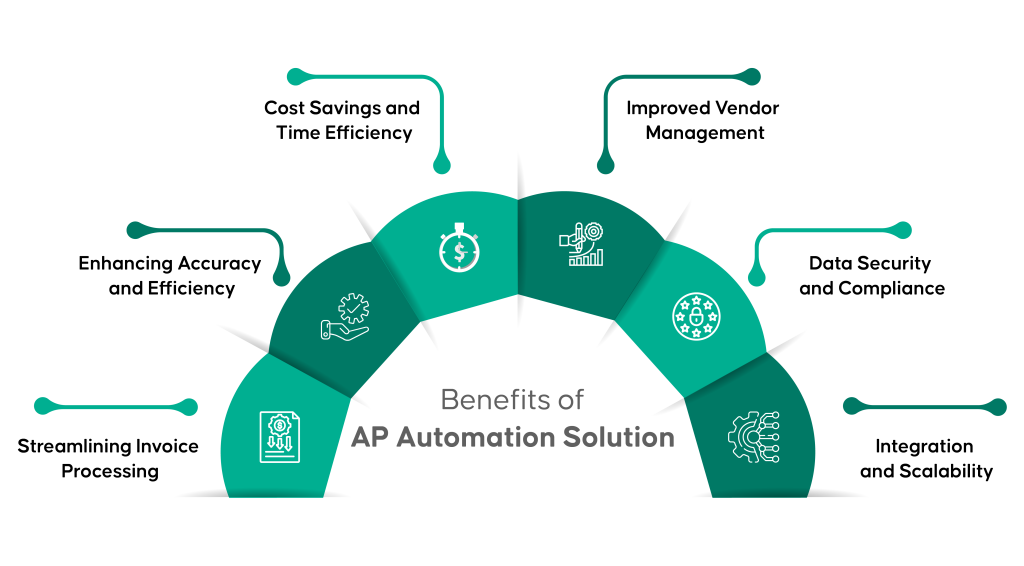

That's why an increasing number of organizations are embracing automation and digitization to optimize their accounts payable workflow. Automation facilitates the management of growing invoice volumes, enables the utilization of early payment discounts, reduces risks, and helps prevent fraud.

Challenges in the Accounts Payable Workflow

When the AP workflow remains non-automated, several challenges may arise:

Missing Invoices

Invoices sent through mail or email instead of being directly entered into the system can easily go astray. The handling of manual invoices increases the likelihood of invoices getting lost, particularly in organizations with multiple locations. Late payments lead to additional fees and strain supplier relationships.

Manual Data Entry and Human Error

Manual data entry is susceptible to human error. The manual input of data significantly increases the chances of typos and mistakes. T.D. Williamson's accounting team, for instance, previously managed approximately 50,000-60,000 invoices per year across seven different email inboxes manually. This process resulted in duplicate payments and longer approval cycles. By implementing Aavenir Invoiceflow, they were able to automate invoice coding and approval workflows.

Scaling Issues

Organizations experience varying invoice volumes, with some having consistent monthly volumes and others facing fluctuations. Handling invoices can become challenging during periods of high volume. Scalable processes are necessary to avoid complications. According to our 2021 State of AP Report, 61% of respondents who invested in AP automation solutions were able to process more invoices without increasing their team size.

Physical Document Storage

Physical document storage is prone to damage and loss. Additionally, retrieving and accessing documents stored in physical form can be cumbersome.

Duplicate Invoices

Inefficient or slow invoice processes can result in the receipt of duplicate invoices, leading to confusion and cash flow issues that must be resolved.

The Importance of Streamlining the Accounts Payable Workflow

Efficiency and streamlining in the accounts payable workflow translate to faster payment processing, reduced errors, and improved satisfaction for all parties involved. Automation simplifies the management of increased invoice volumes without requiring additional staff or causing delays in payments.

By streamlining the accounts payable workflow through automation, businesses can future-proof themselves and gain a competitive edge. Suppliers appreciate prompt and effortless payments, which can lead to early payment discounts or virtual payment cashback rewards. Furthermore, automation enhances security and simplifies the auditing process.

To conclude, a comprehensive understanding and effective management of the accounts payable workflow are vital for successful AP operations. By embracing automation and digitization to streamline the workflow, organizations can overcome challenges, minimize errors, improve supplier relationships, and achieve greater efficiency. This optimization not only enhances the AP process but also positions businesses for growth and competitiveness in the modern business landscape.