Banking and insurance operate within some of the most demanding regulatory environments in the world. Every product, partnership, vendor relationship, distribution channel, and operational process is governed by contracts that define obligations, timelines, controls, and customer protections. These contracts sit across thousands of pages and are influenced by multiple regulators, policy frameworks, and risk standards.

Contract compliance gaps occur when obligations written in contracts are missed, misunderstood, or not operationalized correctly. These gaps include undefined responsibilities, outdated clauses, missing regulatory language, unmonitored commitments, and obligations buried deep in vendor or partner agreements. In a sector where regulatory fines are rising and customer trust is fragile, these gaps expose institutions to material risk.

Despite robust compliance departments and large operational budgets, banks and insurers continue to struggle with contract compliance. The reason is not the lack of effort. It is the complexity of contracts themselves and the number of stakeholders who must interpret and execute them. Understanding why compliance breaks is the first step toward building a more resilient and dependable framework.

Are your financial operations exposed to hidden compliance risks?

Aavenir ComplianceNext centralizes obligations, automates monitoring, and eliminates blind spots across vendor, partner, regulatory, and customer-facing agreements.

Why Contract Compliance Breaks in Banking and Insurance

Contract compliance breaks when the obligations inside contracts are not connected to day-to-day operations. This happens for several reasons that are structural, not incidental.

Volume, Complexity, and Diversification of Contracts

Banks and insurers manage enormous contract portfolios. These include vendor agreements, outsourcing contracts, broker agreements, reinsurer contracts, policy administration contracts, loan agreements, technology contracts, and service-level agreements. Each contract carries regulatory or operational clauses that different teams must follow. The sheer variety makes consistent oversight difficult.

Rapid Regulatory Changes

The regulatory environment evolves quickly. Banking regulations, insurance supervisory requirements, consumer protection frameworks, and data privacy rules are frequently updated. Contracts often fall behind and no longer reflect current regulatory expectations, which results in outdated or incomplete obligations.

Lack of Centralized Visibility

Obligations sit in different systems, folders, emails, and departments. Compliance teams often do not have a unified view of all contract terms. When visibility is fragmented, monitoring becomes reactive, and gaps widen.

Manual Monitoring and Siloed Workflows

Many compliance efforts rely on spreadsheets, manual reminders, and human interpretation. Banking and insurance workflows often span legal, compliance, credit, underwriting, risk, operations, and vendor management teams, but the workflow is rarely integrated.

Dependency on Institutional Memory

Critical obligations are often known only to a few experienced employees. When roles change or teams reorganize, that knowledge is lost, and compliance begins to deteriorate.

Weak Linkage Between Contract Terms and Operations

Teams executing the work, such as credit operations, underwriting, claims, loan servicing, and vendor oversight, do not always receive clear guidance on what contract obligations require. As a result, execution drifts from contractual intent.

Common Contract Compliance Gaps in Banking and Insurance: North America

North America has a dense regulatory landscape, with multiple agencies governing different aspects of banking and insurance. The most frequent compliance gaps involve misinterpretation, missing obligations, and incomplete alignment between contract language and regulatory standards.

A. Regulatory Reporting Obligations

Banks and insurers often miss obligations tied to OCC, FED, FDIC, and NAIC reporting requirements.

- Deadlines referenced in contracts are not tracked accurately.

- Disclosures do not reflect contractually agreed responsibilities.

- Data required for regulatory submissions is inconsistent with contract terms.

B. Third-Party Risk Management Gaps

Under OCC 2013-29 and FFIEC standards, institutions must maintain strong oversight of vendor contracts.

- Missing due diligence documentation.

- SLA monitoring requirements not followed.

- Audit rights and oversight clauses not enforced.

C. Consumer Protection Compliance Issues

CFPB standards influence many servicing, lending, and policyholder agreements.

- Wrong fee disclosures or incomplete customer communication.

- Missed consent clauses and disclosure obligations.

- Misalignment between contract obligations and operational processes.

D. Data Privacy Gaps

Regulations like GLBA and state-level privacy laws require precise contractual protections.

- Missing data handling clauses.

- Inconsistent breach notification requirements.

- Incomplete privacy commitments in vendor contracts.

E. Insurance Specific Gaps Under NAIC Guidelines

Insurers often face gaps in areas tied to rate filings, distribution oversight, and claims handling.

- Missed rate and form filings.

- Broker and MGA obligations not monitored.

- Claims processing standards defined in contracts are not followed consistently.

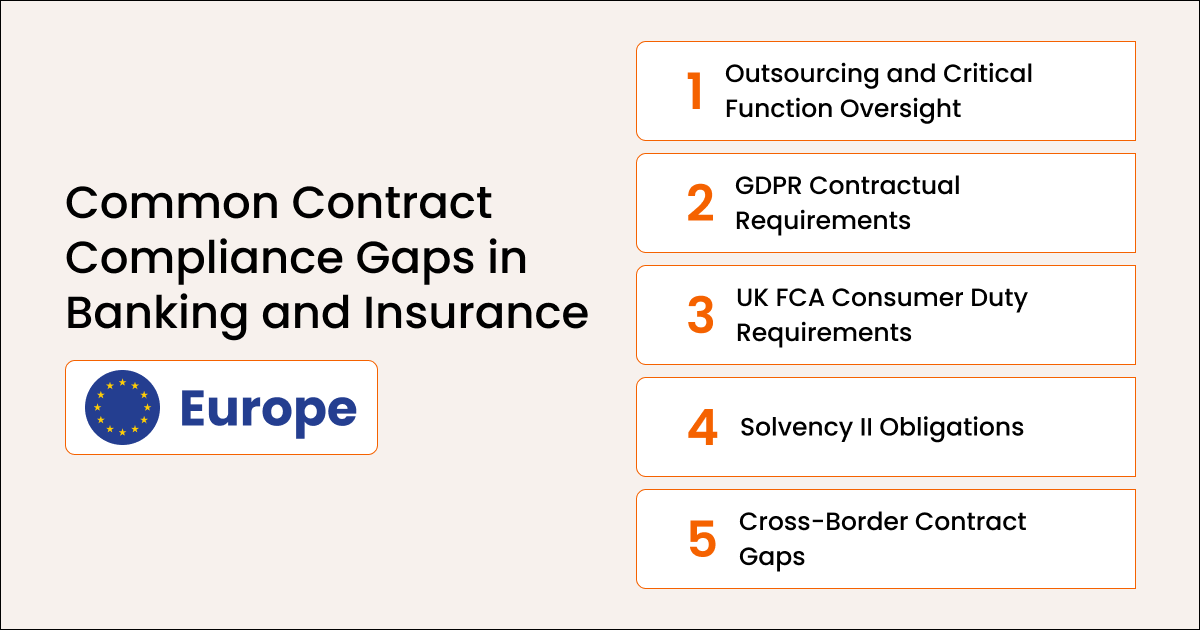

Common Contract Compliance Gaps in Banking and Insurance: Europe

Europe’s regulatory climate is even more structured, with specific expectations around outsourcing, consumer fairness, data protection, and solvency. Contract compliance gaps often arise when obligations are interpreted differently across teams or when updated regulations are not reflected in legacy agreements.

A. Outsourcing and Critical Function Oversight

EBA and EIOPA guidelines require detailed oversight of vendors and critical service providers.

- Missing audit rights or exit strategy clauses.

- KPIs and SLAs not monitored as defined in the contract.

- Insufficient oversight documentation.

B. GDPR Contractual Requirements

Data protection commitments must be clear and enforceable.

- Missing Article 28 data processing agreements.

- Incomplete cross-border transfer clauses.

- Untracked retention and deletion obligations.

C. UK FCA Consumer Duty Requirements

Distribution agreements and customer-facing contracts must reflect fairness, transparency, and outcome-based standards.

- Contracts not updated for Consumer Duty language.

- Missing obligations for risk assessments or customer outcome monitoring.

D. Solvency II Obligations

Solvency II introduces board responsibilities, reporting standards, and risk governance requirements.

- Missing ORSA data obligations.

- Incomplete risk governance descriptions.

- Poor alignment between contract language and board-level duties.

E. Cross-Border Contract Gaps

European banks and insurers operate across multiple jurisdictions.

- Misinterpretation of regulatory expectations between the EU, EEA, and the UK.

- Contract templates are not harmonized across countries.

Why These Gaps Matter: The Cost of Non-Compliance

Contract compliance gaps have far-reaching consequences. They affect regulatory posture, financial performance, customer experience, and institutional reputation.

Regulatory Sanctions

Supervisory authorities treat contract failures as indicators of weak governance.

• Institutions may face corrective programs, fines, or public reprimands.

- Regulators often increase supervision frequency after a failure.

- Enforcement actions harm credibility with customers and investors.

Financial Leakage

Incorrect fees, unmonitored vendor charges, penalty interest, and non-compliance with rate commitments all create financial loss.

- Small issues accumulate silently over time.

- Institutions may need to issue customer refunds or vendor clawbacks.

LP or Customer Dissatisfaction

Trust is central to financial services. Missed obligations create friction.

- Customers or partners demand additional oversight.

- Institutions face escalations, complaints, or reputational damage.

Audit Disruption

Gaps create delays in regulatory or internal audits.

- Missing evidence or conflicting documents lead to findings.

- Audit cycles become longer and more resource-intensive.

Operational Risk

Portfolio disruption, claims mishandling, lending issues, or vendor failures are common outcomes of contract gaps.

- Operational teams struggle to meet obligations they were unaware of.

- Small misses escalate into risk events or loss incidents.

How to Detect Compliance Failures Before They Escalate

Financial institutions need a proactive detection framework that identifies gaps early and ensures contractual obligations do not slip through operational cracks. Effective detection combines structured processes, regulatory awareness, and intelligent technology to catch issues before they become risk events.

Contract Inventory and Classification

A complete inventory is the foundation of compliance. Institutions must classify all contracts by type, risk level, function, jurisdiction, and counterparty. This helps determine which documents carry the highest regulatory exposure and need closer monitoring.

Obligation Extraction and Mapping

Every contract contains obligations that must be fulfilled by specific teams. Extracting these obligations and mapping them to responsible owners creates clarity and removes ambiguity. This step ensures obligations are visible, traceable, and ready for monitoring.

Template Comparison

Regulated institutions rely on standardized templates for data protection, outsourcing, lending, distribution, and vendor agreements. By comparing executed contracts to approved templates, firms can identify missing clauses, outdated language, and deviations that introduce risk.

Regulatory Alignment Review

Contracts must reflect the latest supervisory expectations from regulators such as OCC, FDIC, NAIC, FCA, EBA, and EIOPA. Reviewing agreements against current regulatory frameworks helps institutions spot mismatches, outdated commitments, and missing compliance provisions.

Vendor and Partner Agreement Assessment

Third-party agreements are subject to significant regulatory oversight requirements. Assessing vendor, broker, MGA, and outsourcing contracts ensures audit rights, data protections, performance SLAs, and exit strategies are in place and enforceable. Weaknesses in these areas often lead to regulator findings.

Use of AI to Accelerate Detection

AI enhances detection by automatically extracting obligations, tagging clauses, and comparing documents for deviations. It identifies inconsistencies, conflicts, and missing requirements in seconds, enabling compliance teams to focus on remediation rather than manual review.

Compliance Gaps Keep Appearing Because Obligations Are Buried in PDFs

Explore how Aavenir Obligationflow extracts, structures, and automates the monitoring of obligations so your teams never miss deadlines or regulatory requirements.

Monitoring Contract Compliance and the Role of AI

Monitoring contract compliance in banking and insurance is not a one-time activity. It requires continuous oversight across regulatory obligations, operational commitments, vendor performance, and customer protections. AI strengthens this process by ensuring that monitoring is accurate, real-time, and scalable, even across thousands of contracts.

Ongoing Monitoring of Obligations

Institutions must track deadlines, covenants, reporting cycles, and customer-facing commitments throughout the contract lifecycle. AI helps by automatically flagging upcoming deadlines, identifying obligations at risk of delay, and surfacing patterns that indicate potential non-compliance. This creates a proactive environment where risks are addressed before they escalate.

Real-Time Detection of Changes and Amendments

Contracts evolve through amendments, renewals, addenda, and regulatory updates. AI can instantly analyze updated documents and highlight new or modified obligations. This ensures institutions always work from the latest terms and prevents outdated requirements from slipping back into operations.

Portfolio-Level Monitoring

Banks and insurers oversee large portfolios of loans, claims, policies, and outsourcing arrangements. AI maps portfolio data against contract obligations to spot early signs of non-compliance, such as late reporting, missed covenants, or underperforming vendors. This early warning capability helps prevent operational disruptions and governance failures.

Monitoring Fee and Expense Accuracy

Fee accuracy is a critical regulatory focus, especially for institutions that manage complex service-level agreements or premium-related calculations. AI-powered contract management software can automatically validate fees against contract terms, detect anomalies, and ensure that billing aligns with negotiated obligations. This reduces financial leakage and strengthens audit readiness.

Monitoring Investor or Customer-Specific Commitments

Many customers or institutional partners receive custom rights or commitments through side letters, service contracts, or distribution agreements. AI can track each unique obligation, ensure it is fulfilled on time, and detect conflicts or inconsistencies across customer groups. This creates consistency and fairness across the client base.

Responsive Monitoring Aligned With Regulatory Updates

Regulations from bodies such as OCC, NAIC, FCA, EBA, and EIOPA evolve constantly. AI can monitor regulatory changes, compare them to existing contractual obligations, and identify

areas requiring updates. This ensures compliance monitoring is dynamic and keeps pace with supervisory expectations.

How Aavenir ComplianceNext Helps Banking and Insurance Fix the Problem

Banks and insurers often lack visibility across their contractual ecosystem. Aavenir ComplianceNext brings structure, automation, and intelligence into contract compliance.

A. Automated Obligation Extraction

Extract obligations from lending agreements, outsourcing contracts, policy admin contracts, and vendor contracts.

B. Regulatory Mapping

Align obligations with OCC, FDIC, FFIEC, NAIC, FCA, EBA, EIOPA, and GDPR requirements.

C. Workflow Automation

Turn obligations into actionable tasks with alerts and evidence capture.

D. Continuous Monitoring

AI monitors amendments, vendor issues, policy updates, and regulatory changes.

E. Audit Readiness

ComplianceNext provides clear evidence of compliance for regulators and internal audit teams.

Conclusion

Contract compliance in banking and insurance is both essential and challenging. The complexity of contracts, the speed of regulatory change, and the breadth of stakeholders involved create conditions where compliance gaps are inevitable without a systematic approach. Institutions that invest in detection, structured workflows, and continuous monitoring build stronger governance and reduce risk.

Aavenir ComplianceNext helps banks and insurers eliminate blind spots, strengthen oversight, and maintain audit-ready compliance across thousands of obligations.

Want contract compliance to run smoothly, predictably, and without surprises?

Connect with Aavenir and to experience smarter, automated, and audit-ready compliance.

Frequently Asked Questions (FAQs)

1. What causes contract compliance failures in banking and insurance?

Contract compliance failures occur when contractual obligations are not translated into operational workflows, are buried in large or outdated agreements, lack clear ownership, or are scattered across systems. Fragmented visibility and manual processes also contribute to these gaps.

2. Why is centralized visibility important for contract compliance?

Without a centralized system, teams cannot see all contract terms, deadlines, or obligations in one place. This fragmentation makes monitoring reactive and increases the risk of missing critical regulatory or operational commitments.

3. How do regulatory changes affect contract compliance for banks and insurers?

Regulations evolve quickly, and contracts often lag behind current expectations. When obligations are outdated or inconsistent with current rules, compliance gaps emerge. Regular alignment reviews against updated regulatory frameworks help prevent these gaps.

4. What are common contract compliance gaps for financial institutions in North America?

In North America, gaps often appear in regulatory reporting, third-party risk oversight, consumer protection disclosures, data privacy clauses, and insurance-specific filings. Missed deadlines, inconsistent disclosures, and poor alignment between contract language and operations are common triggers.

5. How can technology help detect and fix contract compliance issues before they escalate?

Technology such as contract intelligence and automation can build a complete contract inventory, extract obligations, compare executed contracts to templates, align terms with current regulations, and identify missing or conflicting requirements. This proactive approach enables compliance teams to fix issues early.