Private investment firms manage obligations across LPAs, side letters, MFN clauses, co-investment agreements, covenant-heavy loan documents, ESG commitments, and regulatory filings. Most of these obligations sit buried inside static PDFs and spreadsheets, leaving teams blind to deadlines and execution risks.

AI solves this by automatically extracting obligations, assigning them to the right teams, tracking execution, collecting evidence, and providing predictive alerts before obligations slip.

Aavenir brings this capability to life with an AI-powered obligation management platform designed specifically for private equity, venture capital, private credit, secondaries, and fund administrators.

Want to See How Top Private Investment Firms Operationalize Obligations?

Explore how AI transforms LPAs, side letters, covenants, and reporting commitments into structured workflows that never slip through the cracks. Download the Aavenir Obligationflow Datasheet to learn more!

Why Obligation Management Is a Strategic Priority for Private Investment Firms

Obligation accuracy determines LP trust, regulatory standing, deal performance, and fund reputation.

Private investment firms operate in an environment where obligations create the backbone of all relationships: with LPs, regulators, deal partners, lenders, and portfolio companies. These obligations come from LPAs, side letters, MFN lists, subscription agreements, co-invest agreements, loan covenants, ESG frameworks, and regulatory rules.

Yet, these obligations remain scattered across email chains, data rooms, CRM notes, shared drives, and spreadsheets. When teams lack end-to-end visibility, even critical obligations can be overlooked. This introduces regulatory exposure, damages LP relationships, delays deal milestones, and impacts fund performance.

To operate with precision, firms need a centralized, intelligent way to detect, assign, and monitor obligations across the investment lifecycle.

Where Private Investment Firms Struggle: The Core Obligation Gaps

Every team manages obligations, but without a unified system, everyone operates in silos that create risk.

Legal and Fund Governance Teams

Legal teams manage complex documents like LPAs, side letters, and MFN summaries that contain hundreds of obligations with downstream impacts across the firm. When obligations are not extracted and assigned, operational teams often miss requirements unknowingly. This creates compliance gaps and legal exposure that surface during LP reviews or regulatory exams.

Deal Teams in Private Equity, Venture Capital, and Private Credit

Deal teams handle closing conditions, covenants, notice requirements, integration steps, and performance milestones. Once a deal closes, these obligations often remain in closing binders or emails rather than being operationalized. This leads to missed deliverables, covenant breaches, lender penalties, or failed integration timelines.

Portfolio Operations and Value Creation Teams

Portfolio ops teams must monitor ESG metrics, financial audits, operational KPIs, reporting deadlines, and compliance attestations across multiple companies. Without a centralized view of obligations, they rely on manual follow-ups that slow progress and create blind spots.

LP Relations and Investor Reporting

LP-specific preferences, reporting frequencies, transparency requirements, and custom side letter terms need precision execution. When unmet, LP dissatisfaction grows, damaging long-term relationships and potentially impacting future fundraising cycles.

Compliance and Risk Functions

Compliance teams track obligations under SEC, FCA, AIFMD, AML, KYC, and sanctions screening rules. Manual processes create documentation gaps that make firms vulnerable during regulatory inquiries, exams, or investigations.

Finance and Fund Accounting

These teams must meet obligations tied to capital calls, fee disclosures, NAV reporting, audits, valuations, and tax filings. When obligations are not tracked, errors or delays can disrupt fund operations and impact LP trust.

Obligation Management Challenges in Private Investment Markets in North America

North American firms face rising regulatory scrutiny, complex reporting requirements, and demanding covenant structures.

SEC and State-Level Regulatory Obligations

The SEC’s new private fund rules increase obligations across quarterly statements, fee and expense transparency, audit preparation, and investor disclosures. Failing to comply with any regulatory obligation exposes firms to serious enforcement risks.

Covenant-Heavy Private Credit and Financing Deals

In private credit and structured financing, covenants detail financial tests, notice periods, reporting obligations, cure timelines, and trigger events. Without automated monitoring, teams risk breaching covenants that directly impact portfolio valuation and lender relationships.

Side Letter and MFN Complexity

North American LPs negotiate custom requirements that must be honored precisely. Even with spreadsheets or email-based tracking, high-performing firms routinely miss LP-specific obligations.

ESG and Impact Reporting

North American investors increasingly require detailed ESG and DEI reporting. Portfolio companies often struggle to deliver consistent data, increasing the burden on portfolio ops teams.

Tax and State-Level Filing Complexity

Different states impose unique filing and tax reporting obligations. Without automation, the risk of missed deadlines is high.

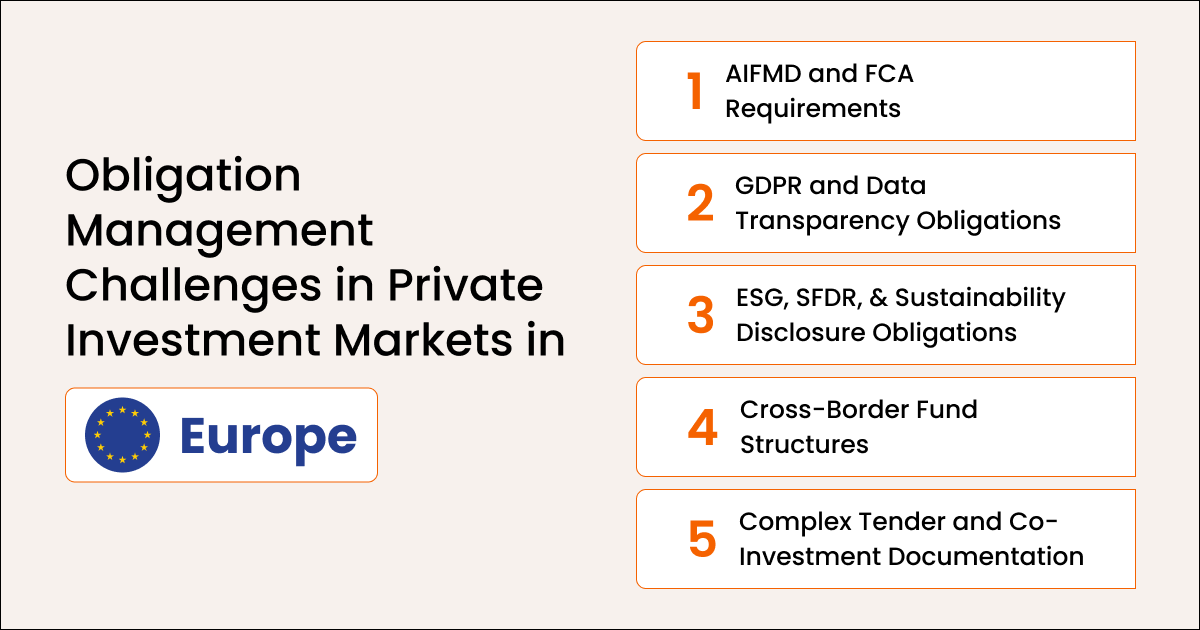

Obligation Management Challenges in Private Investment Markets in Europe

European investment firms face cross-border complexity, multi-regulator obligations, and strict ESG requirements.

AIFMD and FCA Reporting Requirements

European firms must meet extensive reporting and disclosure obligations related to liquidity, leverage, investor transparency, and annual filings. These must align across multiple agencies and jurisdictions simultaneously.

GDPR and Data Privacy

Investor data, reporting communications, and internal systems must comply with strict GDPR rules. Every data interaction creates new obligations around collection, storage, and breach reporting.

ESG and SFDR Requirements

European regulators mandate sustainability disclosures for Article 6, 8, and 9 funds. These obligations extend across portfolio companies and require consistent data collection and verification.

Cross-Border Domicile Requirements

Firms operating across Luxembourg, Ireland, the Channel Islands, and the UK must meet different regional rules. Tracking obligations manually across these regions creates gaps.

Tender-Based or Sovereign Investor Obligations

Large European pension funds and sovereign wealth funds negotiate extensive reporting, operational, and governance obligations that require precise execution.

What Happens When Obligation Management Breaks Down

Missed obligations weaken LP trust, trigger compliance exposure, disrupt deals, and undermine fund performance.

LP Trust Erodes and Fundraising Becomes Harder

When firms fail to honor side letters or reporting commitments, LPs perceive the firm as unreliable. This damages long-term relationships and slows and complicates future fundraising cycles. Large institutional LPs often reduce commitments or walk away when trust breaks.

Regulatory Risk Increases Immediately

Missed obligations tied to SEC, FCA, AIFMD, AML, or KYC requirements expose firms to heightened scrutiny, exams, or enforcement actions. Regulators interpret gaps as governance failures, which can lead to penalties and long-lasting reputational damage in the market.

Covenant Breaches Impact Portfolio Performance

In private credit or structured financing, overlooked covenants can trigger default clauses, lender intervention, or emergency renegotiations. Even minor reporting misses can damage credibility and lead to valuation adjustments or operational restrictions.

Deal Execution Slows Down and Integration Weakens

Post-close obligations such as reporting, approvals, operational milestones, and compliance steps often slip when tracked manually. This causes friction between deal teams and operators and delays integration progress or value-creation activities.

ESG Reporting Breaks and Reduces LP Confidence

Institutional investors increasingly rely on verified ESG metrics. Missing ESG obligations, failing to collect data, or reporting inconsistently signals governance weakness. This can result in exclusion from mandates or reduced commitments from ESG-sensitive LPs.

Financial Processes Face Delays and Errors

Missed deadlines for audits, valuations, tax filings, capital calls, and fee disclosures disrupt fund operations. These delays erode internal efficiency and may raise concerns among LPs who prioritize transparency and consistency.

Reputation Suffers Across the Private Markets Ecosystem

Word travels fast among LPs, consultants, and co-invest partners. Firms known for lapses in obligations face reputational challenges that affect fundraising, deal flow, and partnership opportunities. In a trust-driven industry, credibility is everything.

Tired of Last-Minute Compliance Scrambles Before SEC or FCA Reviews?

Aavenir ComplianceNext gives private investment firms real-time regulatory tracking, automated evidence collection, and audit-ready documentation.

How AI Helps Private Investment Firms Fix Obligation Gaps

AI turns hidden obligations into structured workflows with ownership, timelines, and audit trails.

AI-Powered Obligation Extraction

AI identifies obligations across LPAs, MFN lists, side letters, co-invest agreements, loan covenants, regulatory documents, and ESG frameworks. This eliminates manual document review and ensures nothing is missed.

Automated Assignment and Ownership

Obligations route to the correct teams with clear due dates, context, reminders, and escalation paths. Every obligation is visible and trackable.

Predictive Risk Alerts

AI surfaces obligations that are slipping, missing evidence, or trending toward non-compliance. Firms can act before issues escalate.

Centralized Evidence and Documentation

All supporting documents, approvals, communications, and compliance workflows are stored in one system. This reduces audit preparation effort dramatically.

Cross-Jurisdiction Harmonization

AI normalizes obligations across the SEC, FCA, and AIFMD rules, giving global firms a single, consistent compliance framework.

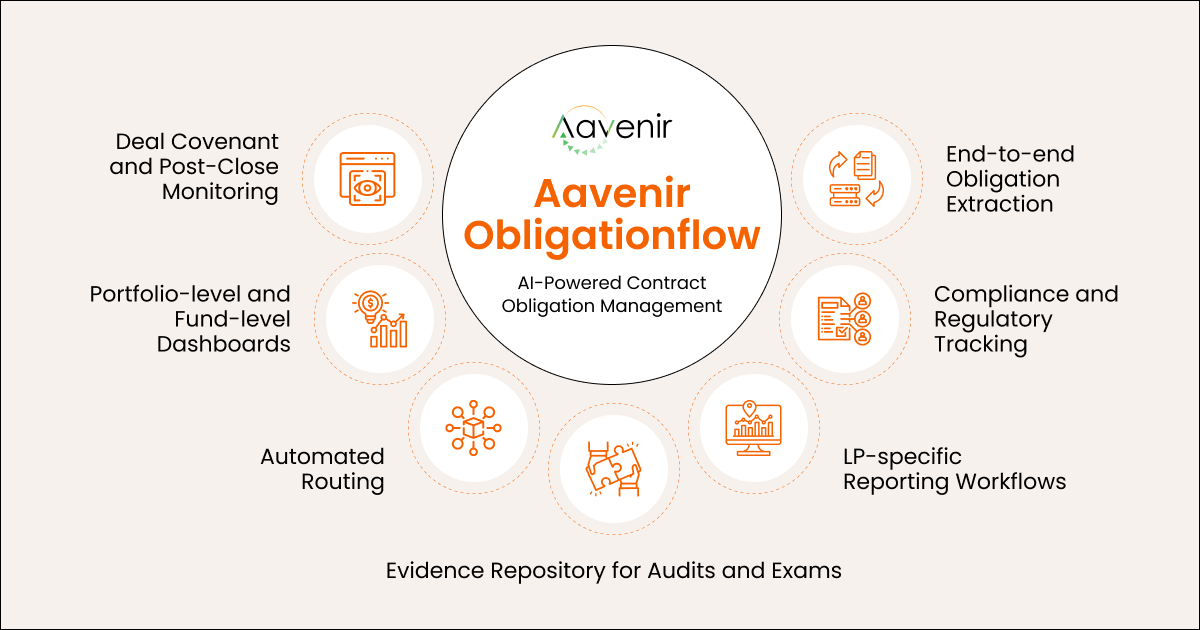

How Aavenir Strengthens Obligation Management for Private Investment Firms

Aavenir provides an AI-powered obligation management system for private equity, VC, private credit, secondaries, and fund administrators.

Aavenir enables private investment firms to detect obligations, assign ownership, track execution, and maintain audit-ready compliance across funds, deals, investors, and portfolio companies.

Key Capabilities

- AI extraction from LPAs, side letters, MFN lists, loan agreements, ESG frameworks, and regulatory documents

- Centralized repository of all obligations

- Covenant and post-close monitoring for deal teams

- LP-specific reporting and preference management

- Automated workflows with reminders and escalations

- Regulatory and compliance tracking across regions

- Evidence collection for audits and investor due diligence

- Dashboards for fund-level, deal-level, and LP-level oversight

Conclusion: Obligation Excellence Defines Private Investment Market Performance

Firms that operationalize obligations earn stronger LP trust, avoid regulatory exposure, and achieve better deal outcomes.

Private investment firms face rising complexity across LP expectations, regulatory scrutiny, ESG mandates, and covenant-heavy deal structures. Manual obligation tracking no longer works.

AI-powered obligation management helps firms build a proactive, accountable, and reliable operating framework that supports stronger returns and long-term LP trust.

Want to See How Top Private Investment Firms Eliminate Obligation Blind Spots?

We can walk you through real examples, fund-level workflows, deal covenants, LP requirements, and compliance obligations.

Frequently Asked Questions (FAQs)

1. What types of obligations do private investment firms need to track?

Private investment firms must track obligations across LPAs, MFN lists, side letters, co-invest agreements, subscription documents, loan covenants, regulatory filings, ESG frameworks, audit requirements, and portfolio reporting timelines. Each one carries specific deadlines and evidence expectations that must be managed precisely.

2. Why is obligation management more complex in private markets than in other industries?

Private markets operate on highly customized documents and investor agreements. No two LPAs, side letters, or covenants are the same. Obligations vary by investor type, jurisdiction, fund structure, and deal terms. This creates a volume of bespoke obligations that spreadsheets and email reminders cannot reliably track.

3. What are the risks of using spreadsheets for obligation management?

Spreadsheets create blind spots, lack real-time updates, offer no audit trail, and depend entirely on manual upkeep. As a result, teams frequently miss investor commitments, covenant deadlines, regulatory filing obligations, or ESG reporting requirements. Each miss increases regulatory exposure and erodes LP trust.

4. How does AI help private investment firms manage obligations?

AI extracts obligations from LPAs, side letters, loan documents, ESG frameworks, and regulatory texts. It assigns them to the right teams, tracks progress, centralizes evidence, and flags risks before deadlines are missed. This shifts firms from reactive tracking to proactive obligation governance.

5. Why choose Aavenir for obligation management?

Aavenir provides an AI-powered platform designed specifically for private equity, venture capital, private credit, and alternative investment firms. It automates obligation extraction, ensures accountability across teams, maintains audit-ready evidence, and provides complete visibility across funds, deals, investors, and regulators.