Today, the regulatory landscape is rapidly evolving and becoming more complex, making traditional manual contract review processes no longer sufficient.

Organizations need intelligent, automated solutions that can keep pace with the growing compliance demands while minimizing risk exposure.

AI-powered compliance screening is a game-changing approach that can transform the way legal and procurement teams manage contractual obligations.

What is Compliance Screening?

Compliance screening is the process of systematically reviewing contracts, vendor documents, and certifications to ensure alignment with internal policies, regulatory requirements, and risk management frameworks. It helps organizations identify gaps, mitigate legal risks, and maintain consistent compliance standards across all business relationships.

AI-powered compliance screening takes this further by combining speed, accuracy, and scalability. Unlike manual reviews, AI systems can analyze vast volumes of contracts in minutes, detect subtle compliance risks, and even suggest corrective actions. This proactive, data-driven approach makes it a game-changer, enabling legal and procurement teams to manage obligations with confidence while reducing cost and effort.

The Need for Intelligent Compliance Screening

Contract compliance has evolved from a routine administrative task to a strategic business imperative. With organizations managing thousands of contracts across multiple jurisdictions, regulatory frameworks, and business relationships, the complexity of ensuring comprehensive compliance has reached unprecedented levels.

Key Challenge: Legal professionals spend most of their time on contract review activities, with manual compliance checks being one of the most time-intensive and error-prone processes.

Why Traditional Contract Review Falls Short

Manual contract review processes are burdened with several critical limitations, exposing organizations to significant risks:

- Human Error Risk: Manual reviews rely heavily on individual judgment, making them prone to oversight, inconsistencies, and fatigue-related mistakes. Even minor errors can create compliance gaps, financial risks, or legal disputes.

- Scalability Issues: As organizations grow, contract volumes increase exponentially. Manual processes quickly become bottlenecks, limiting efficiency, straining legal teams, and preventing businesses from keeping pace with operational and market demands.

- Regulatory Complexity: Constantly evolving regulations across jurisdictions make manual tracking nearly impossible. This exposes organizations to compliance failures, penalties, and reputational risks, particularly in industries subject to high regulatory oversight.

- Inconsistent Application: Different reviewers often interpret compliance requirements differently, leading to uneven contract standards. This inconsistency increases risk exposure, complicates audits, and weakens organizational credibility in negotiations or regulatory reviews.

- Time Constraints: Manual review cycles are lengthy and resource-intensive, causing delays in closing deals and executing agreements. These inefficiencies reduce business agility, slow revenue recognition, and diminish competitive advantage.

Switching to a Modern Contract Review Process

Shifting from manual to modern contract review is no longer a matter of convenience; it’s a necessity for organizations seeking efficiency, compliance, and competitive advantage. Powered by AI and automation, modern solutions drastically reduce human error, accelerate review cycles, and ensure consistent application of compliance standards across every contract. They also simplify regulatory tracking by providing real-time updates, automated clause detection, and risk alerts.

By adopting modern review processes, organizations can scale effortlessly, close deals more quickly, minimize legal exposure, and free their legal teams from repetitive tasks to focus on high-value, strategic work.

The Modern Contract Review Process: Where Compliance Screening Fits

A comprehensive contract review process must integrate compliance screening at multiple touchpoints to ensure thorough risk assessment and regulatory adherence. Here’s how compliance screening should be embedded throughout the contract lifecycle:

- Pre-Contract Phase: Compliance screening begins during contract initiation, ensuring that proposed terms align with applicable regulatory frameworks and internal policies before negotiations commence.

- Contract Drafting: Real-time compliance validation occurs as contracts are drafted, with AI systems flagging potential compliance issues and suggesting compliant alternative language.

- Review and Negotiation: Comprehensive compliance analysis identifies risks, gaps, and required modifications, enabling informed negotiation strategies.

- Pre-Execution Validation: Final compliance verification ensures all regulatory requirements are met before contract execution.

- Ongoing Monitoring: Continuous compliance monitoring throughout the contract lifecycle ensures ongoing adherence to evolving regulations.

Aavenir ComplianceNext: AI-Powered Contract Compliance Redefined

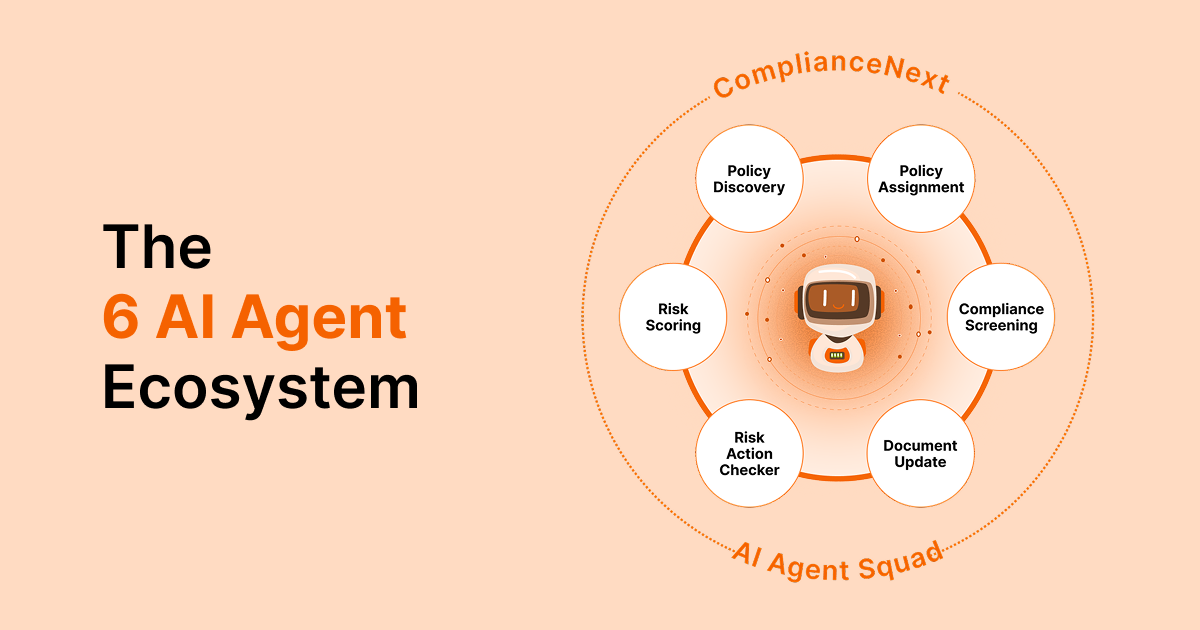

ComplianceNext, Aavenir’s compliance solution, introduces a paradigm shift in the way organizations manage contract compliance. By leveraging specialized AI Agents, the platform enables unmatched speed, accuracy, and thoroughness in compliance screening and monitoring.

The Six AI Agents Ecosystem

| AI Agents | Primary Function | Business Impact |

| Policy Discovery Agent | Discovers applicable regulatory frameworks and assembles policy checklists | Ensures comprehensive regulatory coverage |

| Compliance Screening Agent | Executes compliance checks against contracts and identifies gaps | Identifies non-compliance issues proactively |

| Risk Scoring Agent | Quantifies compliance risk exposure with AI-generated rationale | Provides quantified risk assessment for decision-making |

| Policy Assignment Agent | Dynamically assigns policy checklists to contracts and documents | Rationalizes policy application across diverse document types and relationships |

| Risk Action Checker Agent | Checks whether risk actions have been incorporated | Validates risk mitigation implementation |

| Document Update Agent | Automatically updates and redlines contracts to close gaps | Automates the contract remediation process |

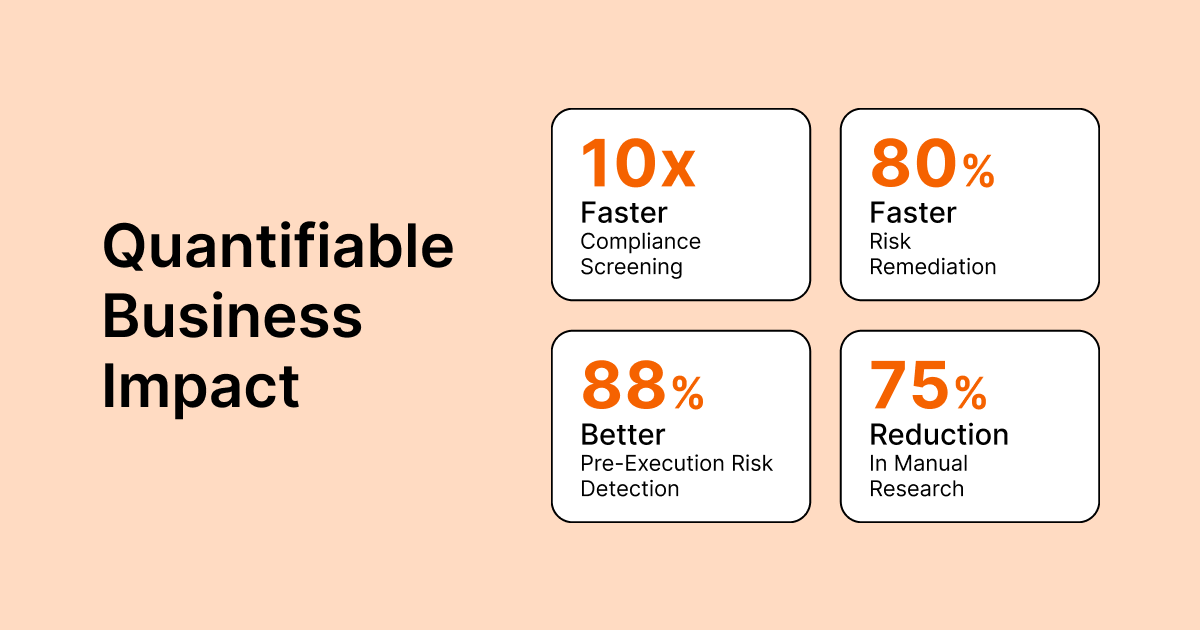

Quantifiable Business Impact

Strategic Benefits of AI-powered Compliance Solution for Modern Organizations

1. Enhanced Risk Prevention

Aavenir’s AI-powered approach shifts compliance from a reactive checkpoint to a proactive safeguard. By flagging potential compliance issues before contract execution, organizations can prevent costly penalties, disputes, and reputational harm.

2. Operational Efficiency

With automation handling repetitive compliance checks, legal and compliance teams are freed from manual workloads. This efficiency allows them to focus on higher-value tasks such as negotiation support, strategic planning, and advisory roles.

3. Scalable Compliance Management

As organizations expand and contract volumes grow, Aavenir’s AI Agents scale effortlessly. The platform ensures consistent compliance standards across thousands of contracts, regardless of complexity or jurisdiction.

4. Cost Optimization

Aavenir ComplianceNext directly impacts the bottom line:

- 50% reduction in external compliance review costs

- 40% lower internal audit costs

- Millions saved through the avoidance of regulatory fines and penalties

5. Improved Visibility & Transparency

The platform centralizes compliance monitoring and reporting, giving leadership a real-time view of obligations, risks, and compliance status across the entire contract portfolio. This transparency strengthens accountability and supports better decision-making.

6. Strengthened Collaboration

By standardizing compliance processes, the platform ensures alignment between legal, procurement, finance, and business teams. This cross-functional visibility reduces miscommunication and enables smoother contract execution across departments.

7. Faster Decision-Making

Automated insights and AI-driven alerts accelerate decision-making. Leaders and contract owners receive timely information on risks or non-compliance, empowering them to act quickly and keep business transactions moving without delay.

8. Consistency & Accuracy

Unlike manual reviews, which may vary by reviewer, AI-driven compliance ensures every contract is checked against the same standards. This consistency minimizes human bias and maintains accuracy across the board.

Integration with Existing Workflows

One of Aavenir ComplianceNext’s key strengths lies in its seamless integration capabilities. The platform works within existing business processes:

- Contract Lifecycle Management: Embedded compliance verification in CLM solutions

- Vendor Onboarding: Automated compliance screening during supplier due diligence

- Enterprise Risk Management: Integrated compliance results and risk scores in risk management platforms

- ServiceNow Platform: Native integration with enterprise workflow solutions

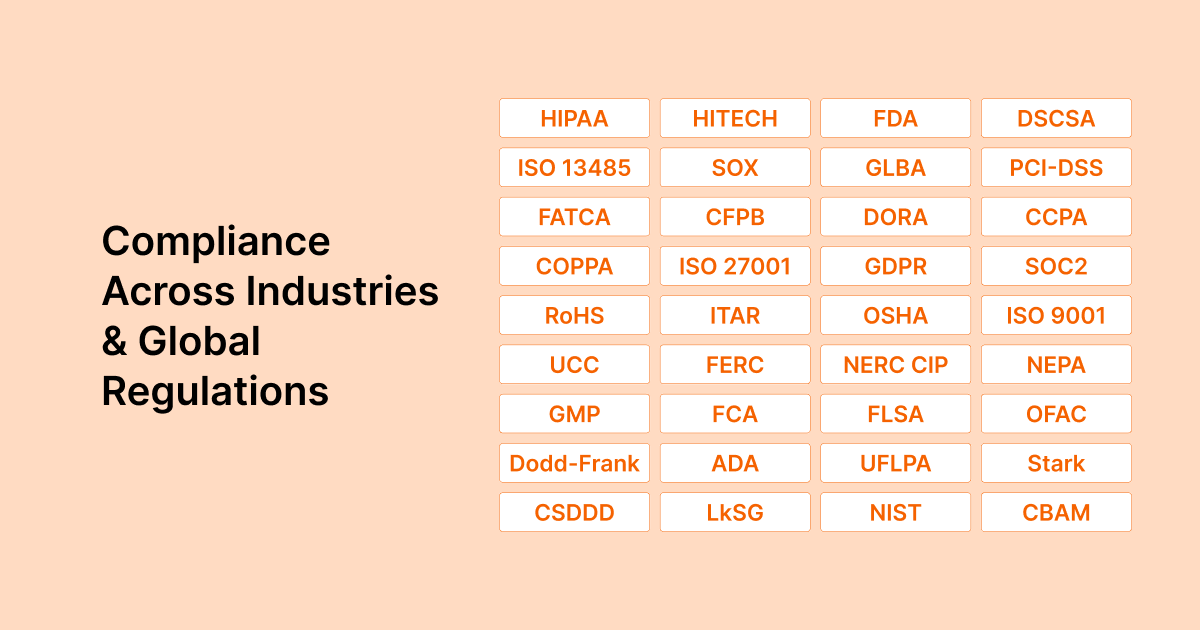

Comprehensive Regulatory Coverage

Aavenir ComplianceNext provides coverage across 100+ global regulations, including:

The Future of Contract Compliance

As regulatory complexity continues to increase and business relationships become more intricate, the need for intelligent, automated compliance solutions will only grow. Organizations that embrace AI-powered compliance screening today position themselves for:

- Competitive Advantage: Faster deal execution and reduced compliance delays

- Risk Resilience: Proactive identification and mitigation of compliance risks

- Operational Excellence: Optimized processes and improved resource allocation

- Regulatory Readiness: Ability to quickly adapt to new compliance requirements

Conclusion

Contract compliance is no longer just a back-office function; it’s a critical business enabler. Traditional review methods, limited by human error and inefficiency, cannot keep pace with today’s complex regulatory and contractual landscape. By adopting AI-powered solutions like Aavenir ComplianceNext, organizations gain the ability to proactively manage risks, streamline operations, and ensure consistent compliance across their entire contract portfolio. Book a demo to learn more about Aavenir ComplianceNext!

In an environment where every delay or oversight can translate into financial loss or reputational damage, the shift to intelligent compliance isn’t optional; it’s essential. Organizations that act now will not only safeguard themselves against risks but also unlock opportunities for faster growth, stronger partnerships, and long-term resilience.