Banks and insurers face rising obligations across regulatory mandates, customer agreements, product disclosures, vendor contracts, cybersecurity rules, solvency frameworks, and financial crime regulations. Manual tracking leads to blind spots, delayed evidence collection, and inconsistent execution of compliance.

AI-enabled obligation management provides structure, automation, and audit-readiness across regulatory, contractual, and operational workflows.

Still tracking regulatory obligations across spreadsheets, emails, and shared drives?

There is a better way. Explore how Aavenir Obligationflow – an AI-powered obligation management solution extracts, assigns, and monitors obligations.

Why Obligation Management Defines Compliance Resilience

With regulators tightening oversight, obligation management is now central to financial governance.

In banking and insurance, obligations shape every part of the operating model. They emerge from regulations, product policies, underwriting frameworks, customer agreements, risk guidelines, vendor contracts, and supervisory notices.

When obligations are not adequately captured, monitored, and evidenced, institutions face heightened regulatory exposure, compliance failures, delayed audits, operational errors, and costly penalties.

Obligation management is not just a compliance task. It influences enterprise risk, customer trust, supervisory relationships, and organizational resilience.

Universal Obligation Management Challenges in Banking & Insurance

Multiple teams have obligations, but no one has complete visibility into them.

Regulatory Obligations Are Fragmented and Constantly Changing

Regulators frequently issue updates, interpretive guidance, circulars, notices, and supervisory expectations. Without automated tracking, obligations quickly become outdated or go unaccounted for during audits or exams.

Complex Product and Policy Obligations Across Business Lines

Mortgage lending, consumer banking, P&C insurance, life and health insurance, credit cards, and investment products all carry unique disclosure, documentation, servicing, and risk obligations. Manual tracking cannot scale across product portfolios.

Third-Party and Vendor Obligations Add Multi-Layered Risk

Vendor contracts include SLAs, security obligations, risk protocols, service continuity requirements, audit rights, and compliance certifications. Without centralized visibility, institutions miss vendor-related risks or contractual violations.

High Evidence Burden for Internal and External Audits

Audit teams must collect documentation, approvals, proofs, and logs demonstrating compliance. When evidence is scattered across emails and shared folders, institutions struggle to demonstrate consistent adherence during regulatory reviews.

Siloed Processes Across Compliance, Risk, Legal, and Operations

Different teams interpret obligations differently, leading to inconsistent execution—the lack of central governance results in gaps, overlaps, and unclear accountability.

Limitations of Legacy Systems

Most obligation workflows still rely on spreadsheets or manual ticketing tools. These systems cannot support versioning, automated alerts, or regulatory mapping needed for modern compliance environments.

Obligation Management Challenges in Banking & Insurance in North America

Institutions in the US and Canada operate under one of the world’s most extensive and multi-agency regulatory environments.

Regulatory Complexity Across Multiple Federal and State Agencies

Banks and insurers must comply with obligations from the OCC, the FDIC, the CFPB, the Federal Reserve, the NAIC, FINRA, state insurance commissioners, and AML regulators. Each agency imposes simultaneous reporting and operational requirements that need centralized governance.

Stringent Consumer Protection and Fair Lending Obligations

Disclosure accuracy, fair servicing, claim settlement timelines, interest rate justification, and anti-discrimination safeguards carry strict enforcement risk. Missing these obligations leads to penalties and supervisory scrutiny.

Cybersecurity and Data Privacy Requirements

Regulations such as GLBA, NYDFS Part 500, NAIC model laws, and state privacy acts impose obligations around breach notifications, encryption, access control, vendor security, and incident reporting.

Complex Insurance-Specific Compliance Obligations

Insurers face obligations regarding underwriting guidelines, actuarial models, premium calculations, solvency monitoring, claims-handling SLAs, fraud reporting, and consumer disclosures.

SEC and FINRA Obligations for Investment Divisions

Institutions with wealth and brokerage services must manage obligations related to suitability, trade surveillance, fee disclosures, investor communication timelines, and recordkeeping.

Emerging ESG and Climate Risk Obligations

North American regulators increasingly require climate stress testing, sustainable finance disclosures, and environmental risk reporting.

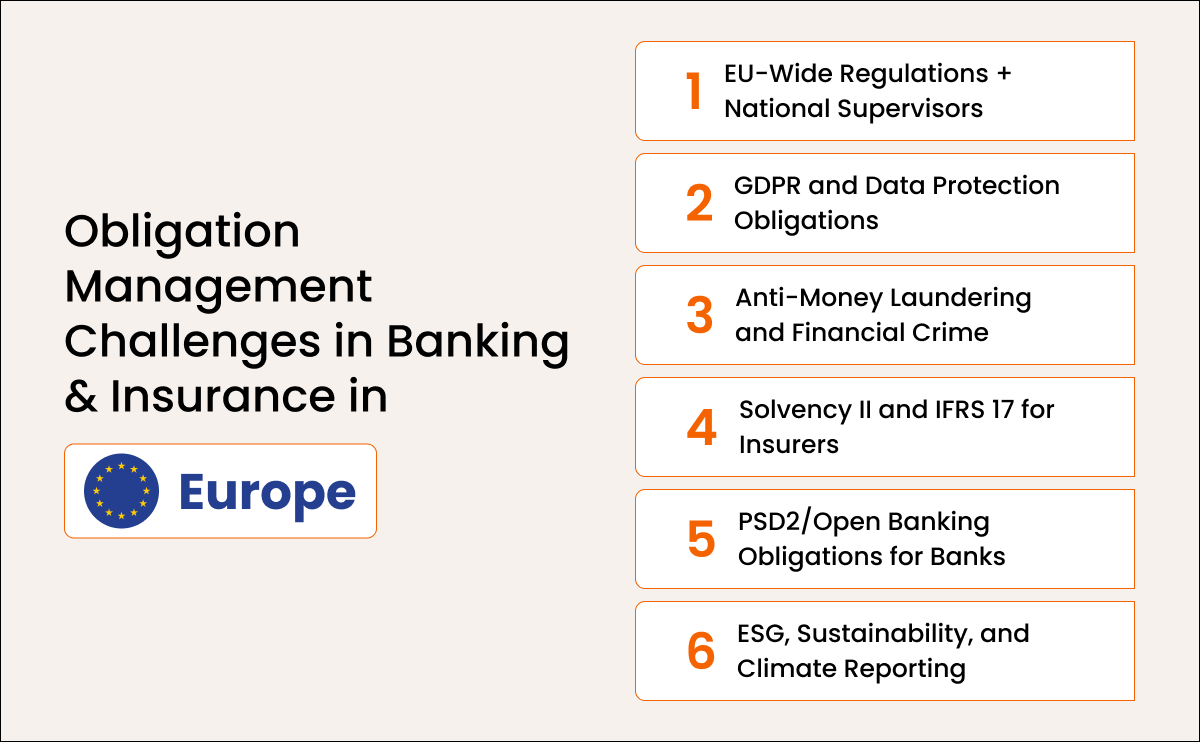

Obligation Management Challenges in Banking & Insurance in Europe

Europe exposes institutions to multi-regulator, cross-border, and sustainability-driven obligations unmatched in other regions.

EU-Wide Regulations Layered With National Oversight

Banks and insurers must comply with obligations from EBA, ESMA, ECB, EIOPA, and country regulators such as FCA, BaFin, ACPR, and SSM. Each adds reporting, governance, and operational demands.

GDPR’s Strict Data Governance Requirements

Institutions must track obligations related to consent, retention, processing, breach notification, customer communication, and cross-border data transfers. GDPR violations carry substantial fines.

Anti-Money Laundering and Financial Crime Obligations

AMLD 4, 5, and 6 require ongoing KYC, customer due diligence, suspicious activity reporting, sanctions monitoring, and transaction oversight.

Solvency II and IFRS 17 for Insurers

European insurers must meet capital adequacy, governance, disclosure, actuarial modeling, and financial reporting obligations tied to complex formulas and templates.

PSD2 and Open Banking Obligations for Banks

Obligations include API security, consent management, fraud controls, third-party verification, and customer data rights.

ESG, Sustainability, and Climate Reporting Requirements

SFDR, CSRD, and EU taxonomy rules require clear evidence of sustainability metrics, cross-border reporting, and portfolio-level data collection.

What Happens When Obligation Management Breaks Down

Missed obligations lead directly to regulatory action, audit findings, customer complaints, and reputational harm.

Regulatory Exposure and Enforcement Actions Increase

Missing or inconsistently executed obligations attract attention from agencies and supervisors. Institutions may face penalties, mandatory corrective actions, and heightened monitoring.

Audit Preparation Becomes Chaotic and Time-Consuming

Without centralized obligation tracking, evidence collection becomes reactive. Teams scramble to locate documentation, increasing the risk of audit findings and follow-up remediation.

Customer Trust and Policyholder Confidence Decline

Delayed claims, incorrect disclosures, or non-compliant processes erode customer trust and trigger complaints with regulatory bodies.

Operational Failures Spread Across Business Units

Obligations tied to underwriting, servicing, lending, risk monitoring, or transaction controls create downstream issues across the organization when missed.

Vendor and Third-Party Compliance Weakens

Without tracking vendor obligations, institutions face cybersecurity lapses, SLA failures, or regulatory findings tied to third-party management.

Reputational Risk Escalates Rapidly

Regulators, rating agencies, and market participants view obligation misses as governance failures that can affect brand perception and competitive positioning.

Does Every Audit Cycle Still Feel Like a Fire Drill?

Aavenir ComplianceNext centralizes evidence, automates audit workflows, and eliminates the last-minute scramble that slows down banking and insurance teams.

How AI Helps Banks and Insurers Fix Obligation Gaps

AI reduces regulatory risk by automating detection, assignment, escalation, and evidence collection.

AI-Based Regulatory and Contract Obligation Extraction

AI scans regulatory notices, supervisory guidelines, product policies, vendor contracts, and internal risk manuals to extract obligations with high accuracy. This eliminates the burden of manual interpretation and ensures nothing is overlooked during audits or regulatory review cycles. AI also keeps institutions up to date as rules evolve.

Automated Assignment and Accountability

Once obligations are extracted, AI intelligently routes them to the right owner, department, or business line with precise due dates, context, and required evidence. This creates a predictable compliance workflow where accountability is transparent, and tasks do not fall through organizational gaps.

Real-Time Monitoring and Predictive Alerts

AI continuously tracks obligation status, upcoming deadlines, missing evidence, and potential compliance risks. Predictive alerts flag deviations early, allowing teams to fix issues before they escalate into supervisory findings or operational failures.

Audit-Ready Evidence Repository

All documentation, approvals, communication history, and compliance artifacts are automatically collected and stored in a centralized, audit-ready repository. This reduces pre-audit effort, ensures version control, and creates a reliable historical trail for regulators and internal auditors.

Cross-Border Regulatory Mapping

For institutions operating across the US, Canada, the UK, and the EU, AI harmonizes obligations across multiple frameworks. It translates overlapping rules into a unified compliance view, making it easier to demonstrate consistency during cross-jurisdictional supervision or enterprise risk assessments.

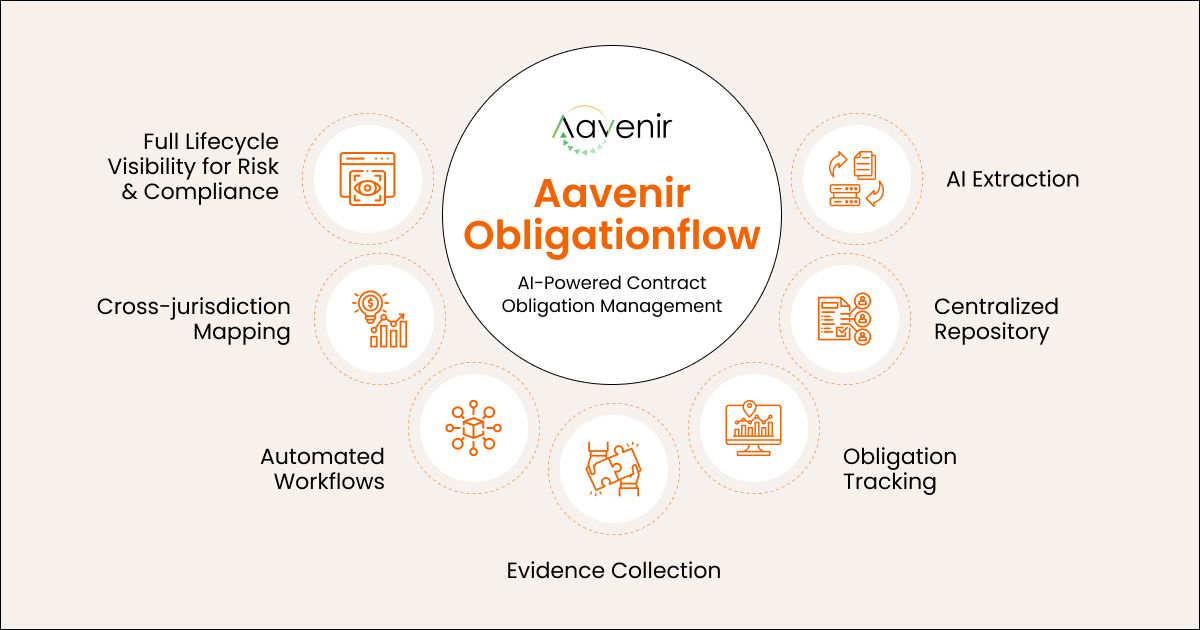

How Aavenir Helps Financial Institutions Manage Regulatory and Contract Obligations

Aavenir delivers a single source of truth for obligations across banking, insurance, and financial services ecosystems.

Core Capabilities of Aavenir Obligationflow for Financial Institutions

- AI extraction from regulations, policies, contracts, risk manuals, and vendor agreements

- Centralized obligation repository

- Automated workflows with reminders and escalations

- Evidence collection for audits and exams

- Cross-jurisdiction mapping across the NA and European frameworks

- Vendor and third-party obligation tracking

- Complete lifecycle visibility for compliance, risk, legal, underwriting, lending, and claims teams

Aavenir provides the compliance foundation financial institutions need to remain continuously audit-ready and proactively aligned with regulatory expectations.

Conclusion: Compliance Confidence Begins With Obligation Clarity

Banks and insurers face unprecedented volumes of regulatory and contractual obligations. Manual processes create gaps that lead to fines, customer dissatisfaction, and operational risk.

AI-powered obligation management helps institutions achieve visibility, strengthen governance, and operate with confidence across jurisdictions.

Make Your Next Audit or Regulatory Review 10X Faster

Learn about real examples across banking, insurance, lending, underwriting, and compliance operations.

Frequently Asked Questions (FAQs)

1. Why is obligation management so tricky in the banking and insurance industry?

Banks and insurers operate under multiple regulatory bodies, complex product obligations, and cross-functional processes that generate hundreds of requirements. These obligations come from regulators, contracts, policies, risk manuals, vendor agreements, and customer commitments. Manual tracking creates inconsistencies and blind spots, increasing regulatory risk.

2. What are the most significant risks of managing obligations in spreadsheets and shared drives?

Spreadsheets offer none of the following: version control, automated reminders, accountability, evidence management, or audit trails. This leads to missed deadlines, inconsistent compliance execution, and evidence gaps during audits or regulatory examinations. Institutions often struggle to prove adherence because documentation is scattered across email and shared folders.

3. How does AI help banks and insurers reduce compliance and regulatory risk?

AI automates obligation extraction from regulations and contracts, assigns them to the right teams, monitors progress, and sends predictive alerts before issues escalate. It also consolidates evidence into a single source of truth, significantly improving audit readiness and regulatory reporting accuracy.

4. Can AI map obligations across multiple regulators such as OCC, SEC, FCA, EIOPA, and local authorities?

Yes. AI can harmonize obligations across multiple regulatory frameworks and jurisdictions, aligning overlapping requirements into a unified view. This is especially valuable for large banks and insurers operating across North America, the UK, and the EU, where cross-border rule alignment is critical.

5. How does Aavenir support compliance, risk, and audit functions in financial institutions?

Aavenir provides an AI-powered platform that centralizes obligations, automates evidence workflows, tracks regulatory tasks, and delivers real-time compliance dashboards. By reducing manual work and strengthening oversight, Aavenir helps institutions stay audit-ready, minimize regulatory exposure, and operate with higher governance confidence.