In today’s hyperconnected business environment, contracts are the foundation of every commercial relationship. Yet despite their critical importance, 90% of professionals find contracts either difficult or downright impossible to understand, while human contract review takes an average of 92 minutes per document. For Fortune 1000 companies managing between 20,000 to 40,000 active contracts, this inefficiency represents millions in lost productivity and hidden risks.

The stakes have never been higher. Poor contract reviews lead to compliance violations, missed renewal opportunities, unfavorable terms, and revenue leakage that can cost enterprises millions annually. Meanwhile, organizations with effective contract review processes gain competitive advantages through faster deal cycles, better risk management, and stronger vendor relationships.

This comprehensive guide will transform how your organization approaches contract review, turning a traditional bottleneck into a strategic business accelerator.

What Is Contract Review?

Contract review is the systematic examination and analysis of contractual agreements to ensure accuracy, mitigate risks, verify compliance, and align terms with organizational objectives. It’s far more than a legal formality—it’s a critical business process that protects interests, optimizes outcomes, and enables informed decision-making.

Key Objectives of Contract Review

Risk Mitigation: Identifying and addressing potential legal, financial, and operational risks before they become costly problems.

Compliance Assurance: Ensuring adherence to regulatory requirements, industry standards, and internal policies across all contractual relationships.

Strategic Alignment: Verifying that contract terms support business objectives, from pricing structures to performance metrics and delivery timelines.

Relationship Optimization: Creating frameworks for successful long-term partnerships through clear expectations and balanced obligations.

Types of Contracts Under Review

Modern enterprises review diverse contract categories, each requiring specialized attention:

- Buy-side Contracts: Vendor agreements, supplier contracts, and service level agreements

- Sell-side Contracts: Customer agreements, licensing deals, and partnership arrangements

- Legal Frameworks: Non-disclosure agreements (NDAs), master service agreements (MSAs), and statements of work (SOWs)

- Operational Contracts: Employment agreements, real estate leases, and insurance policies

Ready to transform your contract review process?

Discover how Aavenir’s AI-powered CLM platform can cut your review time by 70%

Critical Challenges in the Contract Review Process

Despite its importance, contract review remains one of the most problematic areas in enterprise operations. Organizations face mounting challenges that compound as business complexity increases.

Manual, Inconsistent Processes

Traditional contract review relies heavily on manual processes that vary by reviewer, department, and contract type. This inconsistency creates several problems:

- Variable Quality: Different reviewers apply different standards, leading to inconsistent risk assessment and term evaluation

- Knowledge Silos: Critical insights remain trapped with individual reviewers rather than being institutionalized

- Scalability Limitations: Manual processes cannot keep pace with growing contract volumes

Lack of Visibility and Collaboration

Contract review typically involves multiple stakeholders across different departments, yet most organizations lack effective collaboration mechanisms:

- Fragmented Communication: Email chains and disparate systems create information gaps and version control issues

- Limited Transparency: Stakeholders often lack visibility into review status, pending approvals, and historical decisions

- Delayed Feedback Loops: Sequential review processes create bottlenecks when multiple iterations are required

Legal Overload and Turnaround Delays

Legal teams face overwhelming workloads that impact business velocity:

- Resource Constraints: 89% of businesses grapple with managing a high volume of contracts with limited legal resources

- Bottleneck Creation: Legal reviews become critical path items that delay deal closure and business operations

- Competing Priorities: Legal teams struggle to balance contract review with other critical legal activities

Missed Clauses and Compliance Gaps

The complexity of modern contracts increases the likelihood of oversight:

- Critical Clause Omissions: Important terms like indemnification, liability caps, and termination rights may be overlooked

- Regulatory Non-compliance: Failure to identify and address regulatory requirements can result in violations and penalties

- Hidden Obligations: Complex contract language may obscure important commitments and responsibilities

Who Is Involved in Contract Review?

Effective contract review requires coordinated involvement from multiple stakeholders, each bringing specialized expertise and perspective to the process.

Legal Team Responsibilities

The legal department serves as the primary guardian of organizational risk and compliance:

- Risk Assessment: Evaluating legal exposure, liability implications, and potential dispute scenarios

- Compliance Verification: Ensuring adherence to applicable laws, regulations, and industry standards

- Term Negotiation: Providing guidance on acceptable contract language and negotiation strategies

- Documentation: Maintaining audit trails and legal rationale for key decisions

Procurement Team Focus Areas

Procurement professionals bring commercial acumen and supplier relationship expertise:

- Commercial Terms Analysis: Evaluating pricing structures, payment terms, and cost implications

- Supplier Performance: Assessing vendor capabilities, delivery commitments, and service level agreements

- Market Intelligence: Applying industry knowledge to benchmark terms and identify optimization opportunities

- Category Expertise: Providing specialized knowledge for specific spend categories and supplier types

Finance Team Contributions

Financial stakeholders ensure fiscal responsibility and budget alignment:

- Financial Impact Assessment: Analyzing cost implications, budget alignment, and cash flow considerations

- Payment Terms Review: Evaluating payment schedules, early payment discounts, and penalty structures

- Liability Analysis: Assessing financial exposure limits and insurance requirements

- Revenue Recognition: Ensuring contract terms support proper accounting treatment and reporting

Business Stakeholder Involvement

End users and business leaders provide operational context and requirements validation:

- Requirements Verification: Confirming that contract terms meet actual business needs and operational requirements

- Performance Expectations: Defining success criteria and measurement frameworks

- Implementation Planning: Ensuring contract terms support practical implementation and ongoing management

- Stakeholder Communication: Facilitating clear communication between business needs and legal/commercial terms

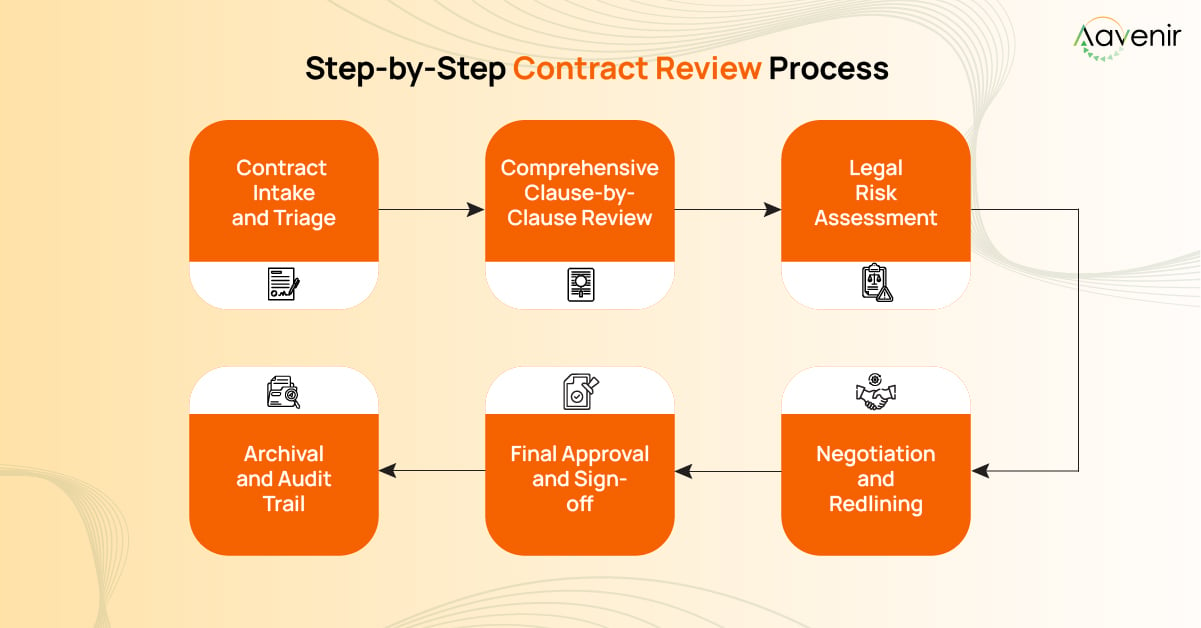

Step-by-Step Contract Review Process

A systematic approach to contract review ensures consistency, thoroughness, and efficiency while reducing the likelihood of costly oversights.

Step 1: Contract Intake and Triage

The review process begins with proper categorization and prioritization:

- Contract Classification: Categorizing agreements by type, value, complexity, and risk level

- Priority Assignment: Establishing review urgency based on business impact and timeline requirements

- Resource Allocation: Assigning appropriate reviewers based on contract category and required expertise

- Initial Assessment: Conducting preliminary risk screening to determine review depth and approach

Step 2: Comprehensive Clause-by-Clause Review

Systematic examination ensures no critical elements are overlooked:

- Standard Terms Verification: Comparing against organizational templates and preferred language

- Risk Clause Identification: Flagging terms related to liability, indemnification, termination, and dispute resolution

- Commercial Terms Analysis: Evaluating pricing, payment terms, delivery requirements, and performance metrics

- Compliance Check: Verifying adherence to regulatory requirements and internal policies

Step 3: Legal Risk Assessment

Thorough risk evaluation informs decision-making and negotiation strategy:

- Liability Exposure Analysis: Quantifying potential financial and legal exposure under various scenarios

- Regulatory Compliance Review: Ensuring all applicable laws and regulations are addressed

- Dispute Resolution Planning: Evaluating resolution mechanisms and jurisdictional considerations

- Insurance and Indemnification: Verifying adequate protection and risk transfer mechanisms

Step 4: Negotiation and Redlining

Strategic modification of contract terms to optimize outcomes:

- Issue Prioritization: Ranking concerns by business impact and negotiation likelihood

- Alternative Language Development: Proposing specific language changes and fallback positions

- Commercial Trade-offs: Balancing risk mitigation with business objectives and relationship considerations

- Approval Protocols: Following established escalation procedures for significant changes

Step 5: Final Approval and Sign-off

Formal authorization ensures appropriate governance and accountability:

- Stakeholder Concurrence: Obtaining necessary approvals from all relevant parties

- Authority Verification: Confirming signatory authority and corporate approval requirements

- Documentation Completion: Finalizing all supporting documents and audit trail materials

- Execution Coordination: Managing signature processes and effective date requirements

Step 6: Archival and Audit Trail

Proper documentation supports ongoing management and future reference:

- Contract Repository: Storing executed agreements in accessible, searchable systems

- Review Documentation: Maintaining records of key decisions, rationale, and approval history

- Obligation Tracking: Capturing ongoing commitments, renewal dates, and performance requirements

- Lessons Learned: Documenting insights for future contract reviews and process improvement

Best Practices for Effective Contract Review

Leading organizations have developed sophisticated approaches that dramatically improve contract review efficiency and effectiveness.

Standardize Clause Libraries and Fallback Terms

Creating comprehensive clause libraries accelerates review and ensures consistency:

- Preferred Language Repository: Developing standard clauses for common contract elements

- Risk-Based Alternatives: Creating fallback positions for different risk tolerance levels

- Industry-Specific Templates: Tailoring standard language for specific industries and contract types

- Regular Updates: Maintaining current libraries that reflect legal developments and business evolution

Implement Risk-Based Review Workflows

Not all contracts require the same level of scrutiny. Effective organizations implement tiered review processes:

- Low-Risk Fast Track: Streamlined review for standard, low-value agreements with established vendors

- Standard Review Process: Comprehensive review for typical commercial agreements within established parameters

- High-Risk Deep Dive: Intensive review for complex, high-value, or novel agreements requiring specialized expertise

- Emergency Protocols: Expedited procedures for time-sensitive agreements while maintaining appropriate controls

Define Clear Escalation Protocols

Establishing clear escalation procedures ensures appropriate decision-making authority:

- Value-Based Thresholds: Defining approval levels based on contract value and financial exposure

- Risk-Based Escalation: Routing high-risk terms to appropriate expertise levels regardless of contract value

- Timeline Requirements: Setting clear expectations for review turnaround times at each level

- Exception Handling: Creating procedures for urgent situations that require expedited approvals

Establish Contract Review KPIs

Measurement drives improvement. Key performance indicators should include:

- Cycle Time Metrics: Tracking review duration from intake to final approval

- Quality Indicators: Measuring redline frequency, post-signature issues, and rework requirements

- Resource Utilization: Monitoring reviewer workloads and bottleneck identification

- Business Impact: Assessing deal velocity, cost savings, and risk mitigation effectiveness

Bulk-Import Legacy Contract Data With AI

Aavenir uses smart automation to read, sort, and import legacy contracts—cutting time and errors during your CLM implementation.

How Aavenir’s CLM Solution Transforms Contract Review

Modern contract lifecycle management platforms like Aavenir revolutionize the contract review process by combining intelligent automation with human expertise to deliver unprecedented efficiency and accuracy.

Intelligent Contract Analysis

Aavenir’s AI-powered platform transforms contract review from a manual burden into an intelligent, guided process:

- Smart Clause Detection: Advanced AI identifies critical clauses, potential risks, and missing terms across diverse contract types

- Risk Scoring: Automated risk assessment provides objective, consistent evaluation of contract terms and conditions

- Compliance Monitoring: Built-in regulatory intelligence ensures contracts meet applicable legal and industry requirements

- Language Optimization: AI-driven suggestions improve contract clarity and enforceability while reducing ambiguity

Collaborative Review Workflows

Breaking down silos, Aavenir enables seamless collaboration across legal, procurement, and business teams:

- Real-Time Collaboration: Multiple stakeholders can review and comment simultaneously, eliminating version control issues

- Role-Based Access: Tailored interfaces provide relevant information and tools for each stakeholder type

- Automated Notifications: Smart alerts keep stakeholders informed of review progress and pending actions

- Audit Trail Maintenance: Comprehensive tracking of all review activities, decisions, and approvals for complete transparency

Integration with Source-to-Pay (S2P) Workflows

Aavenir seamlessly integrates contract review into broader procurement processes:

- Procurement System Integration: Direct connectivity with leading S2P platforms eliminates data silos and manual handoffs

- Supplier Lifecycle Management: Contract review insights inform supplier evaluation, selection, and ongoing management

- Purchase Order Alignment: Ensuring contract terms align with purchase orders and delivery requirements

- Performance Monitoring: Linking contract obligations to supplier performance metrics and scorecards

Advanced Analytics and Reporting

Transform contract data into actionable business intelligence:

- Portfolio Analysis: Comprehensive views of contract portfolios, terms distribution, and risk exposure

- Performance Metrics: Detailed tracking of review cycle times, approval rates, and quality indicators

- Predictive Insights: AI-driven forecasting of renewal requirements, risk events, and optimization opportunities

- Custom Dashboards: Tailored reporting for different stakeholder groups and management levels

Aavenir’s approach reflects the most impactful contract management trends of 2025, combining AI innovation with practical workflow optimization to address real enterprise challenges.

Future Trends in Contract Review

The contract review landscape continues evolving rapidly, driven by technological advancement and changing business requirements.

Rise of AI and Predictive Analytics

Artificial intelligence is transforming contract review from reactive to proactive:

- Predictive Risk Modeling: AI outperformed trained lawyers by 10% in accuracy while completing contract reviews in just 26 seconds compared to 92 minutes for humans

- Pattern Recognition: Machine learning identifies subtle risks and opportunities that human reviewers might miss

- Outcome Prediction: AI models forecast likely negotiation outcomes and suggest optimal strategies

- Continuous Learning: Systems improve accuracy and efficiency through ongoing exposure to contract variations

Smart Clause Recommendation Engines

Next-generation platforms will provide intelligent guidance throughout the contract lifecycle:

- Context-Aware Suggestions: AI recommends specific clause modifications based on contract type, counterparty, and business objectives

- Negotiation Intelligence: Real-time guidance on negotiation strategies based on historical data and market intelligence

- Dynamic Templates: Self-updating contract templates that evolve based on successful negotiations and changing requirements

- Risk-Adjusted Recommendations: Suggestions tailored to organizational risk tolerance and strategic objectives

Integrated Compliance Tracking

Compliance management becomes embedded throughout the contract lifecycle:

- Regulatory Intelligence: Automated monitoring of changing regulations and their impact on existing contracts

- Obligation Management: Intelligent tracking of contract commitments, deadlines, and performance requirements

- Audit Automation: Streamlined compliance reporting and audit preparation through comprehensive documentation

- Exception Monitoring: Proactive identification of compliance gaps and recommended remediation actions

Cross-Functional CLM Workflows

Future platforms will support truly integrated business processes:

- End-to-End Integration: Seamless connectivity across legal, procurement, finance, and operational systems

- Business Process Automation: Intelligent workflows that adapt to changing business requirements and priorities

- Stakeholder Orchestration: Coordinated engagement of all relevant parties throughout the contract lifecycle

- Performance Optimization: Continuous improvement of processes based on data-driven insights and outcomes

Switch to Aavenir Contractflow for 5X Better Visibility

Experience smarter, faster, compliant contracting with Aavenir Contractflow. Implement in hours and get started with contract intelligence.

Final Thoughts: Make Contract Review a Competitive Advantage

Contract review doesn’t have to be a necessary evil that slows business velocity. Forward-thinking organizations are transforming their approach to contract review, turning it from a compliance checkbox into a strategic business capability that drives competitive advantage.

The key to success lies in the intersection of three critical elements: skilled people, optimized processes, and intelligent technology. 84% of contracting professionals are facing pressure to simplify agreements, while companies using AI have seen a 35% improvement in contract review accuracy. Organizations that invest in comprehensive contract review transformation realize benefits that extend far beyond legal compliance.

Effective contract review accelerates deal cycles, reduces risk exposure, improves vendor relationships, and provides valuable business intelligence that informs strategic decision-making. In an increasingly complex business environment, organizations that master contract review will enjoy sustainable competitive advantages through better risk management, stronger partnerships, and faster business execution.

The future belongs to organizations that view contract review not as a cost center, but as a profit center—a strategic capability that enables growth, mitigates risk, and creates value across the entire business ecosystem.

Frequently Asked Questions

What is the purpose of contract review?

Contract review serves multiple critical purposes: risk mitigation through identification of potential legal and financial exposures, compliance assurance by verifying adherence to applicable regulations and internal policies, strategic alignment by ensuring contract terms support business objectives, and relationship optimization by creating frameworks for successful partnerships. Effective contract review protects organizational interests while enabling informed decision-making and business growth.

How long should a contract review take?

Review duration varies significantly based on contract complexity, value, and risk level. Human contract review takes an average of 92 minutes, but this can range from 15 minutes for simple, low-risk agreements to several days for complex, high-value contracts. Organizations implementing AI-powered review tools report dramatic time reductions, with some reviews completed in minutes rather than hours while maintaining or improving accuracy.

What are the common risks in contract review?

Key risks include missed critical clauses such as liability limitations, indemnification terms, and termination rights; compliance gaps that result in regulatory violations; inadequate risk assessment leading to unfavorable terms; poor coordination between stakeholders causing communication gaps; and inconsistent review standards that create variable outcomes. These risks can result in financial losses, legal disputes, and damaged business relationships.

Can AI help in contract review?

Absolutely. AI is expected to cut manual labor in the contract review process by half while improving accuracy. AI assists through intelligent clause detection, automated risk scoring, compliance monitoring, and language optimization. However, AI works best in partnership with human expertise, providing efficient analysis and recommendations while humans provide judgment, negotiation strategy, and relationship management.

What’s the difference between contract review and contract approval?

Contract review is the analytical process of examining agreement terms, identifying risks, and recommending modifications, while contract approval is the formal authorization to execute the contract. Review focuses on analysis, risk assessment, and optimization, typically involving legal, procurement, and business stakeholders. Approval involves final decision-making and sign-off authority, usually requiring specific authorization levels based on contract value and risk. Review informs approval, but they serve distinct functions in the contract lifecycle.