Contract Compliance Gaps in Private Investment Markets: How to Detect, Bridge, and Monitor Them

Private investment markets operate in a high-stakes, high-complexity environment where contracts are the backbone of financial, operational, and regulatory assurance. Limited Partnership Agreements (LPAs), side letters, investment management agreements, vendor contracts, and portfolio-company covenants collectively dictate how billions of dollars move across funds, investors, and counterparties. As the industry grows, the volume and complexity of these agreements increase proportionally.

Contract Compliance Gaps refer to any missed obligation, untracked commitment, outdated clause, conflicting requirement, or regulatory mismatch within executed agreements. These gaps often arise because critical details are buried across hundreds of pages, inconsistent amendments, multiple side letters, and changing regulatory frameworks. In an industry where LP trust and regulatory scrutiny are constantly rising, even small gaps can result in outsized financial, operational, and reputational damage.

Compliance Gaps Are Costly When Obligations Are Buried

With Aavenir ComplianceNext, you can extract every obligation, assign owners, monitor deadlines, and eliminate blind spots that threaten investor trust and regulatory confidence.

Common Contract Compliance Gaps in the Private Investment Market in North America

North America remains one of the most sophisticated and heavily regulated private investment ecosystems. The environment includes private equity, venture capital, private credit, real estate funds, infrastructure strategies, and fund-of-funds structures. Regulatory oversight is provided by agencies such as the SEC, IRS, FINRA, and various state regulators. This multi-layered system makes contract governance particularly difficult because every agreement contains interdependent obligations that must be tracked with precision.

Despite strong legal resources and compliance budgets, gaps still emerge. These gaps arise from rapid deal cycles, custom side-letter negotiations, inconsistent document storage, multiple amendments, and an operational disconnect between what is signed and what is actually implemented. SEC scrutiny continues to increase, especially under the Private Fund Adviser Rules, which demand accurate tracking of fees, expenses, disclosures, and investor-specific commitments.

Below are the most common contract compliance gaps faced by private investment firms in North America, along with deeper explanations of how each gap appears in real-world operations.

1. Fee and Expense Misalignment

Fee and expense allocation is one of the most sensitive and frequently cited areas of deficiency in the private fund industry. Even with well-written LPAs, the interpretation of fee bases and expense allocation rules often varies between legal, finance, and operations teams.

Firms commonly face gaps such as:

• Applying the wrong fee base, for example, committed capital instead of invested capital

• Incorrectly allocating broken deal expenses or shared expenses

• Missing the application of fee offsets, monitoring fee rebates, or expense caps

• Misinterpreting the effect of amendments or side letters on base fee calculations

The SEC’s Division of Examinations has reported that fee and expense issues account for nearly one quarter of all private fund deficiencies. These errors not only risk regulatory action but also damage GP to LP trust and invite costly remediation.

2. Side Letter MFN and Preferential Rights Failures

Side letters are essential in private markets because they accommodate the unique needs of large LPs such as sovereign wealth funds, pension funds, and endowments. However, the complexity and inconsistency of side letters make them among the highest-risk areas for compliance gaps.

Firms often miss:

• MFN rights that should be extended to eligible LPs

• Reporting customizations such as quarterly ESG reports or fee breakdowns

• Preferential liquidity terms

• Co-investment rights that must be offered based on predefined criteria

• Fee discounts that override the LPA for specific investors

These gaps usually occur because side letters are not harmonized, compliance teams lack access to consolidated terms, or obligations are buried across multiple documents. Missing a side letter obligation can lead to investor disputes and reputational damage that affects future fundraising.

3. ESG and Impact Reporting Gaps

ESG expectations in North America have risen significantly, particularly among institutional LPs. Large pension plans, university endowments, and impact investors often negotiate ESG commitments directly into LPAs and side letters.

Compliance gaps appear when obligations are not operationalized. These gaps include:

• Missing annual ESG or sustainability reports

• Partial or inaccurate disclosure of climate metrics or DEI metrics

• Inconsistent tracking of impact KPIs at the portfolio level

• Failure to implement investor-requested exclusions or screening criteria

A PwC report found that 80 percent of North American institutional investors incorporate ESG factors into their decision-making. However, many GPs still struggle to centralize ESG obligations across different investors and documents, which results in inconsistent reporting and credibility issues.

4. State-Level Compliance and Regulatory Fragmentation

The United States follows a hybrid regulatory structure with federal and state authorities. This introduces additional layers of compliance that often appear directly in contracts or indirectly through referenced laws. When contracts rely on obligations linked to state-specific rules, the risk of missing them increases.

Common gaps include:

• Misinterpreting or overlooking state-specific tax withholding rules

• Failing to comply with state-level data privacy laws such as CCPA and CPRA

• Missing insurance and indemnity requirements that vary across states

• Vendor oversight obligations tied to state regulations

These gaps usually arise when obligations are distributed across regional operations, multiple portfolio companies, or fragmented legal teams.

5. Portfolio Company Operational Gaps

Contractual obligations frequently extend into the operational realities of portfolio companies. However, these obligations rarely reach the teams responsible for execution, creating a gap between legal agreements and day-to-day operations.

Portfolio company gaps often include:

• Failing to track or adhere to covenants related to borrowing, leverage, or insurance

• Missing deadlines for financial reporting or board reporting to the GP

• Overlooking employment, IP assignment, or confidentiality obligations during onboarding or offboarding

• Not documenting or verifying compliance with environmental, accessibility, or safety requirements that were included in the acquisition agreement

These issues arise because portfolio company leaders usually do not see the full contractual context, and GPs rely on informal communication rather than structured compliance workflows.

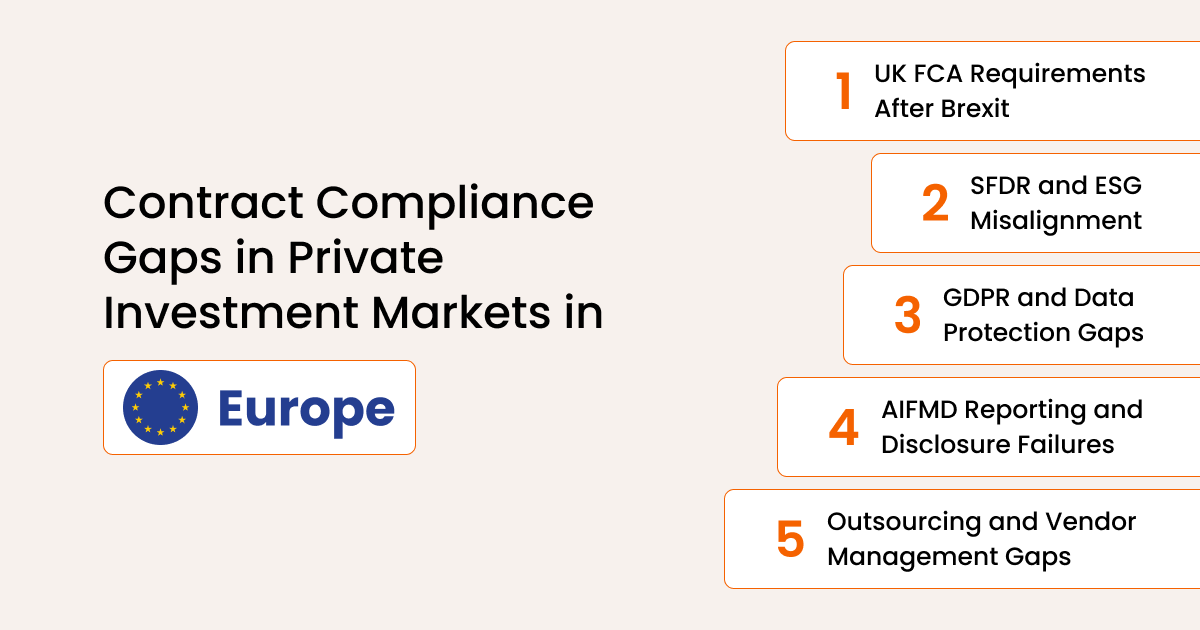

Common Contract Compliance Gaps in the Private Investment Market in Europe

Europe’s private investment ecosystem operates under some of the most detailed regulatory frameworks in the world. Regulatory regimes such as the Alternative Investment Fund Managers Directive (AIFMD), Sustainable Finance Disclosure Regulation (SFDR), the Markets in Financial Instruments Directive (MiFID II), the General Data Protection Regulation (GDPR), and the UK Financial Conduct Authority (FCA) rules create extensive contractual obligations that go well beyond traditional investor protections. While this rigorous regulatory environment aims to protect investors and market integrity, it also introduces complexity that makes contract compliance more challenging.

Private investment firms in Europe must manage contractual obligations not just across funds and jurisdictions but also within a shifting regulatory landscape. In addition, the impact of Brexit means that UK-specific compliance requirements must be recognized separately from EU regulations. Operating across multiple legal systems often leads to gaps when obligations are interpreted differently, stored in disparate systems, or communicated inconsistently across internal and external teams.

Below are the most common contract compliance gaps found in European private investment markets, along with detailed explanations of how they manifest and why they matter in practice.

1. AIFMD Reporting and Disclosure Failures

The AIFMD requires fund managers to provide detailed periodic reports to regulators and investors, including disclosures on risk profiles, leverage, liquidity, and delegated functions. Although the directive aims to improve transparency and investor protection, the number of specific reporting fields and the frequency of submissions make compliance demanding.

Firms often encounter gaps such as:

• Failing to track Annex IV reporting deadlines accurately

• Misunderstanding the scope of leverage reporting obligations

• Overlooking disclosures related to the delegation of portfolio or risk management functions

• Inconsistent reporting formats across EU member states

These gaps typically occur when the contract obligations are not harmonized with operational reporting systems. Without a clear mapping between contractual language and regulatory requirements, firms may submit incomplete or inaccurate information, leading to regulatory scrutiny and increased oversight.

2. SFDR and ESG Misalignment

Europe’s Sustainable Finance Disclosure Regulation has created some of the most comprehensive requirements for environmental, social, and governance disclosures. Many LPAs and side letters now include ESG commitments that must align with SFDR obligations, including disclosures on sustainability risks, adverse impacts, and designated articles such as Articles 8 and 9.

Common compliance gaps include:

• Missing Principal Adverse Impact indicators that must be disclosed at the fund level

• Incorrect or inconsistent classification between Article 8 and Article 9 products

• ESG commitments in side letters that are not reflected in public disclosures

• Incomplete impact or sustainability reporting at the portfolio company level

These gaps arise when ESG language in contracts is not translated into structured data requirements for reporting systems, or when internal teams are unclear about how contractual language maps to regulatory definitions.

3. GDPR and Data Protection Gaps

The General Data Protection Regulation imposes strict requirements on the processing, storage, transfer, and deletion of personal data. While many firms focus on GDPR compliance at the organizational level, contract-level obligations are often overlooked. Data protection clauses in investment agreements, vendor contracts, fund administration agreements, and side letters may contain specific requirements that must be operationalized.

Typical gaps include:

• Missing Article 28 Data Processing Agreements with vendors who process personal data

• Inaccurate or incomplete clauses for cross-border data transfers under Standard Contractual Clauses

• Untracked data retention and deletion schedules specified in investor agreements

• Lack of documentation for consent and lawful basis for data processing

These gaps can lead to significant legal risk, including enforcement actions by data protection authorities and reputational damage among European investors.

4. UK FCA Requirements After Brexit

With the United Kingdom no longer part of the European Union, private investment firms that operate in both markets must address UK-specific regulatory obligations separately from EU regimes. The UK’s Financial Conduct Authority has requirements that cover marketing, disclosures, custody arrangements, risk reporting, and governance.

Common compliance gaps include:

• Failing to update marketing and disclosure templates to reflect FCA requirements rather than EU directives

• Misalignment between UK ESG and risk reporting expectations and those in the EU

• Inconsistent application of client categorization and suitability assessments

• Custody and safekeeping obligations that are handled differently under FCA rules

These gaps often occur when firms rely on EU templates and compliance playbooks without adapting them for the UK context, leading to regulatory friction during assessments.

5. Outsourcing and Vendor Management Gaps

European regulatory frameworks, such as those outlined by the European Banking Authority (EBA) and European Securities and Markets Authority (ESMA), require firms to maintain robust oversight of outsourced services. Contractual obligations intended to enforce operational resilience, service level agreements, data security, and audit rights can be missed if not properly tracked.

Typical shortcomings include:

• Lack of documented due diligence and risk assessments for selected vendors

• Failure to monitor and escalate service level agreement issues in real time

• Incomplete contractual clauses that ensure the right to audit or review vendor practices

• No formal mapping between vendor performance data and contract obligations

Since third-party risk is a key focus of European regulators, these gaps can attract attention during routine compliance reviews.

Europe’s fragmented legal landscape and rigorous regulatory expectations mean that contract compliance cannot be treated as a one-off checklist item. It requires ongoing operational discipline, clear communications between legal and operational teams, and systematic tracking of obligations across funds, service providers, and portfolio companies.

Why These Gaps Matter

Contract compliance gaps are more than administrative errors. In private investment markets, they translate directly into operational, financial, and regulatory consequences. When obligations from LPAs, side letters, acquisition agreements, and regulatory requirements are not implemented accurately, the impact is felt across LP relationships, fund performance, and audit outcomes.

Impact of Non-Compliance

Contract compliance gaps in private investment markets have a direct and often disproportionate impact on a firm’s financial performance, investor confidence, and regulatory standing. Because obligations in LPAs, side letters, acquisition agreements, advisory contracts, and regulatory frameworks are interconnected, missing even a single requirement can trigger cascading consequences. Non-compliance does not remain a one-off administrative mistake. It creates structural weakness across governance, reporting, economics, and fund operations.

Below is an expanded breakdown of the most significant impacts, aligned more closely with the regulatory and operational realities of private investment firms.

Regulatory sanctions – SEC enforcement actions in the private funds space increased significantly over the past five years, and European regulators continue to intensify inspections under AIFMD, SFDR, and GDPR.

Financial leakage – Incorrect fee calculations, unclaimed fee offsets, penalty interest, and vendor overpayments can erode returns. These financial discrepancies often accumulate silently over multiple quarters, creating sizeable variances that must later be reconciled and reported, increasing both GP exposure and LP scrutiny.

LP dissatisfaction – Investors expect accuracy, transparency, and fairness, and even small compliance failures can weaken re-up potential and slow future fundraising cycles. LPs may respond by tightening side letter requirements, demanding enhanced reporting, or involving third-party diligence consultants, all of which increase operational workload and signal declining confidence in the GP’s controls.

Audit disruptions – Missing documents, inconsistent reporting, and unverified obligations often prolong audits and elevate the level of scrutiny applied to the firm. Extended audit cycles not only delay financial close processes but also increase the likelihood of findings that may require restatements, corrective actions, or additional follow-up from regulators.

Operational risk – Portfolio companies can unintentionally breach covenants or contractual requirements when obligations are not clearly communicated or monitored. Such breaches may trigger lender concerns, force renegotiation of terms, or require urgent intervention from the GP, creating avoidable operational instability and diverting management attention away from value creation.

Are compliance gaps putting your fund at risk?

Aavenir ComplianceNext helps private investment firms centralize obligations, detect risks early, and automate monitoring so nothing is missed across the fund lifecycle.

How to Bridge Contract Compliance Gaps

Once compliance gaps are identified, firms must implement structured methods to resolve them. Bridging the gap is both a process and a technology effort. It requires standardization, alignment across teams, clear ownership, and increasingly the use of AI systems that operationalize obligations at scale. Below is a refined breakdown of the most effective approaches.

A. Standardize Templates and Clause Libraries

Contract variability is one of the biggest sources of compliance risk. Standardization reduces room for interpretation and ensures consistency across funds, deals, and jurisdictions.

• Maintain updated templates for LPAs, side letters, acquisition agreements, and vendor contracts that reflect current regulatory and investor expectations.

• Use a central clause library for key areas such as ESG disclosures, GDPR, AIFMD reporting, MFN rights, fees, waterfalls, and expense rules.

• Ensure every new contract is versioned properly and aligned with internal compliance and legal standards.

AI’s role: AI-driven clause comparison tools can automatically detect deviations from approved templates and highlight language that introduces additional compliance risk, strengthening first-line quality control.

B. Centralize Obligation Management

A major root cause of compliance gaps is the scattering of obligations across PDFs, emails, spreadsheets, and institutional memory. Centralization creates a single source of truth for obligations.

• Move all extracted obligations into a unified contract or compliance system.

• Assign owners, attach due dates, define dependencies, and track completion evidence.

• Represent obligations in structured formats so they can be searched, filtered, and monitored easily.

AI’s role: AI systems automatically extract obligations from LPAs, amendments, side letters, and vendor contracts, eliminating manual entry and ensuring nothing is missed during onboarding.

C. Automate Operational Workflows

Bridging gaps requires more than knowledge. It requires reliable workflows that convert obligations into timely actions.

Key automated workflows include:

• Regulatory filings and checkpoints linked to AIFMD, SFDR, GDPR, and SEC rules

• Fee and expense allocation reviews aligned with LPA terms

• Investor reporting cycles, such as custom ESG or fee breakdown reports

• Portfolio company covenants and reporting obligations

AI’s role: AI workflow engines can trigger tasks based on contractual conditions, update owners automatically, escalate overdue items, and predict which obligations are at risk of slippage.

D. Strengthen Portfolio Company Alignment

Portfolio companies can more easily meet their obligations when expectations are clearly communicated and supported by structured processes.

• Provide obligation summaries directly to CEOs, CFOs, controllers, and legal teams at portfolio companies.

• Implement dashboards that track KPIs, covenants, reporting deadlines, and ESG commitments.

• Conduct onboarding sessions where obligations from the acquisition agreement are mapped to operational teams.

AI’s role: AI-generated summaries help convert long agreements into concise, role-specific obligation lists that operational teams can actually follow.

E. Establish a Clear Escalation Path

Escalation is essential for preventing small oversights from becoming significant compliance failures.

• Define thresholds for escalation, such as overdue regulatory tasks, repeated fee miscalculations, or missed investor commitments.

• Route escalations to compliance, legal, and senior leadership based on severity.

• Maintain an audit-ready log of escalations, root-cause analysis, and corrective actions.

AI’s role: AI can flag anomalies or patterns of non-compliance, recommend escalation actions, and even classify issues by risk level, enabling smarter prioritization.

F. Use AI as the Operational Backbone for Bridging Gaps

AI does more than detect issues. It actively helps bridge them.

AI supports bridging by:

• Automatically re-checking documents whenever amendments or renewals are added

• Mapping new regulatory changes to existing obligations so updates are not missed

• Comparing obligations across all LPs to highlight conflicting or investor-specific requirements

• Creating structured compliance playbooks for each fund or portfolio company

This positions AI as a core enabler of consistent, repeatable, and audit-ready contract compliance.

Monitoring Contract Compliance and the Role of AI

Monitoring contract compliance is an ongoing responsibility that extends across the full lifecycle of the fund. Even after obligations are identified and processes are put in place, the risk of slippage remains high due to amendments, side letters, renewals, regulatory updates and evolving investor expectations. Effective monitoring requires a mix of real-time visibility, automated reminders, and continuous validation of obligations against changing conditions. AI enhances this process by ensuring that monitoring is not dependent on manual effort or periodic reviews.

Below is a balanced breakdown of how monitoring should work, with AI integrated directly into each practice.

A. Ongoing Monitoring of Obligations

Monitoring requires visibility into all deadlines, covenants, reporting cycles, and investor-specific commitments.

• AI can automatically track due dates, flag upcoming deadlines, and highlight obligations at risk of delay based on historical patterns.

• AI systems can continuously cross-check obligations against new documents or portfolio updates to ensure nothing is missed.

• Automated alerts can notify teams when reporting cycles, such as Annex IV, SEC filings, ESG reports, or fee calculations, are approaching.

This reduces dependency on manual calendars and ensures obligations are monitored at all times.

B. Real-Time Detection of Changes and Amendments

Contracts evolve through amendments, renewals, side letters, and regulatory changes. Monitoring must capture these changes instantly.

• AI can re-read updated documents the moment they are uploaded and highlight new, modified, or conflicting obligations.

• AI-based comparison tools help detect deviations across versions of LPAs or side letters, ensuring the latest terms are always reflected.

• Firms can maintain a single source of truth that updates automatically as contractual or regulatory conditions change.

This prevents outdated terms from slipping into operations.

C. Portfolio-Level Monitoring

Portfolio companies often carry obligations related to covenants, insurance, ESG metrics, safety requirements, and reporting duties.

• AI can track portfolio company data and map it against obligations in acquisition agreements, ensuring compliance with leverage limits, insurance thresholds, or KPI commitments.

• Early warnings can be triggered if reporting is late, a covenant is nearing breach, or an insurance policy is due for renewal.

• Central dashboards powered by AI help GPs view compliance status across all assets in one place.

This minimizes operational surprises and reduces governance risk.

D. Monitoring Fee and Expense Accuracy

Fee and expense compliance is one of the highest areas of regulatory scrutiny and requires ongoing verification.

• AI can validate management fee calculations against LPA rules, ensuring the correct fee base is applied across periods.

• Systems can automatically detect anomalies, such as incorrect expense allocations or missing offsets, long before audits surface them.

• AI-driven reconciliation checks help maintain accuracy across committed capital changes, co-investments, side letter obligations, and amendments.

This improves accuracy and strengthens trust during audits and investor reviews.

E. Monitoring Investor-Specific Commitments

Many LPs negotiate unique rights in side letters, and firms must ensure these commitments are honored consistently.

• AI can map investor-specific obligations such as reporting preferences, ESG requirements, fee discounts, or co-investment rights, and monitor whether these are being fulfilled.

• Systems can detect conflicts between investor terms, helping avoid inadvertent preferential treatment.

• AI-based reminders ensure custom obligations are completed on time, even if they differ across LPs.

This helps maintain fairness and transparency across the investor base.

F. Responsive Monitoring Aligned With Regulatory Updates

Regulatory expectations evolve constantly, especially in Europe under AIFMD, SFDR, and GDPR, and in North America under SEC rules.

• AI can monitor regulatory updates and automatically match new requirements to existing contractual obligations.

• Firms can see immediately which funds or contracts may need updates or new disclosures.

• AI-driven insights help prepare for regulatory examinations by showing the firm’s readiness status in real time.

This ensures monitoring is not static and evolves with the regulatory environment.

Conclusion

Contract compliance in private investment markets is no longer a task that can be handled through manual oversight or fragmented spreadsheets. The volume of obligations, the growing complexity of LPAs and side letters, the pace of regulatory change, and the operational interdependencies across funds and portfolio companies mean that even well-resourced firms struggle to maintain complete visibility and control. Compliance gaps are not isolated errors. They are signals of structural weakness that can lead to financial leakage, regulatory exposure, operational disruption, and erosion of LP trust.

Firms that invest in detecting, bridging, and continuously monitoring these gaps build stronger governance frameworks and more resilient fund operations. They reduce risk, streamline audits, improve transparency, and demonstrate maturity to investors and regulators. Most importantly, they ensure that the commitments made on paper are faithfully executed throughout the life of the fund.

In today’s environment, contract compliance cannot rely on periodic reviews or manual checks. It requires a unified system that brings together obligations, workflows, monitoring, and intelligence into a single operational layer. This is where AI-powered contract management software makes a defining difference.

How Aavenir ComplianceNext Helps Private Investment Firms Stay Ahead

Aavenir ComplianceNext is designed specifically to help private investment firms transform contract compliance from a reactive chore into a proactive, automated, and audit-ready discipline. Built on deep domain expertise and advanced AI capabilities, ComplianceNext enables firms to maintain complete control over obligations across funds, investors, portfolio companies, and vendors.

Here is how Aavenir ComplianceNext helps close the compliance gap:

1. Complete Obligation Extraction and Visibility

ComplianceNext automatically extracts obligations from LPAs, side letters, acquisition agreements, vendor contracts, and regulatory documents, transforming them into structured, searchable, and actionable data.

• No obligation is missed.

• All commitments, including investor-specific ones, are visible in one place.

2. Automated Workflow Execution and Team Alignment

The platform turns obligations into tasks with Owners, Due Dates, Dependencies, and Alerts, ensuring that compliance does not rely on memory or manual tracking.

• Regulatory filings, reporting cycles, covenants, and investor commitments are executed on time.

• Portfolio companies receive obligation summaries directly relevant to their roles.

3. Continuous Monitoring With AI-driven Insights

ComplianceNext continuously monitors deadlines, fee calculations, amendments, side letters, and portfolio data, identifying risks before they escalate.

• Real-time alerts and dashboards help prevent slippage.

• AI flags anomalies, overdue items, and conflicts across investor terms.

4. Audit-ready Evidence and Governance Strengthening

The platform automatically captures proof of completion, communication trails, and compliance logs, making audits smoother and reducing the risk of findings.

• Audit teams, LPs, and regulators see a clear trail of compliance activities.

• Firms demonstrate operational maturity instantly.

5. Scalable Across Funds and Jurisdictions

Whether managing multiple funds, cross-border structures, UK and EU regulatory obligations, or dozens of portfolio companies, ComplianceNext centralizes compliance operations into a single, consistent workflow.

• Designed for global fund structures.

• Easily scales across new vintages, strategies, or regulatory environments.

Want to eliminate compliance blind spots and ensure every contractual obligation is met?

Our team can walk you through how leading private investment firms are automating compliance, reducing operational risk, and staying ahead of regulatory expectations.

Frequents Asked Questions (FAQs)

1. What are contract compliance gaps in private investment markets?

Contract compliance gaps refer to missed obligations, untracked commitments, outdated clauses, conflicting requirements, or regulatory mismatches within executed agreements. These gaps often occur because critical details are buried across multiple documents, amendments, side letters, and evolving regulatory frameworks.

2. Why do contract compliance gaps matter for private funds?

Contract compliance gaps have direct operational, financial, and regulatory consequences. They can lead to regulatory sanctions, financial leakage from incorrect fee allocations, damage to investor trust, audit disruptions, and operational risks when portfolio company obligations are not met.

3. What are common types of contract compliance gaps in North America?

In North America, common gaps include fee and expense misalignment, side letter MFN and preferential rights failures, ESG and impact reporting inconsistencies, state-level regulatory fragmentation, and operational gaps at the portfolio company level.

4. How are contract compliance gaps different in Europe compared with North America?

European private investment markets face contract compliance gaps tied to detailed regulatory regimes such as AIFMD, SFDR, GDPR, and UK FCA rules. Common issues include AIFMD reporting, ESG misalignment, data protection gaps, UK-specific regulatory requirements after Brexit, and vendor oversight requirements under EBA/ESMA.

5. How can technology help detect, bridge, and monitor contract compliance gaps?

Technology, especially AI-enabled contract intelligence platforms, can automatically extract obligations from contracts, map them to regulatory and investor requirements, compare them to standard templates, automate workflows, and continuously monitor them. This reduces manual effort, improves accuracy, and enhances audit readiness.