ServiceNow GRC Meets Aavenir Source-to-Pay: Implementing Real-time Vendor Risk and Compliance Management

Continuously monitor, detect, assess, mitigate, and remediate risks and compliances in third-party vendor ecosystems by harnessing the power of ServiceNow GRC integrated with Aavenir’s AI-powered Source-to-Pay (S2P) solutions built natively on unified ServiceNow Platform.

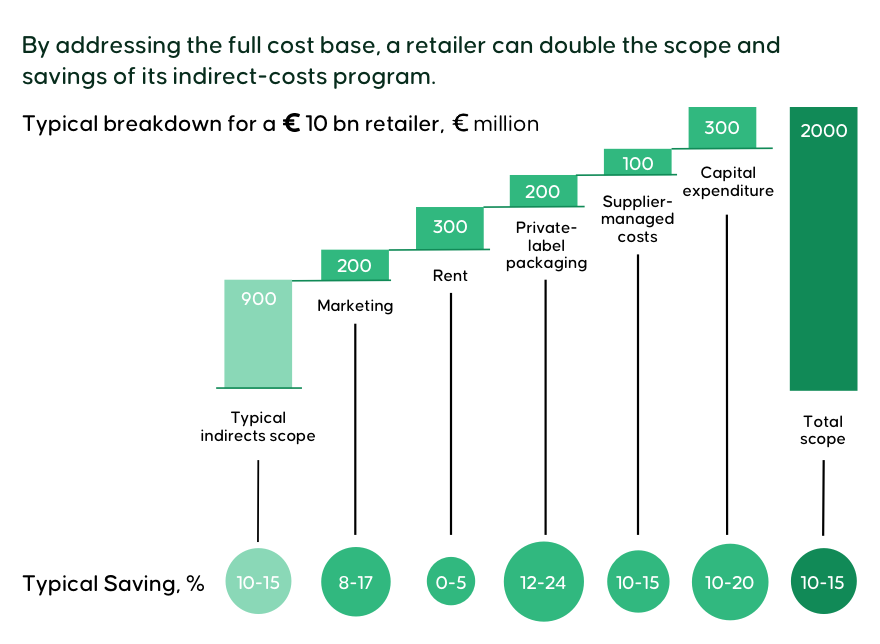

For most large enterprises today, 80-90% of their third-party supplier engagements are typically of large scale (multi-million-dollar engagements) and the term ranges from 3 to 5 years. Managing Risk and compliances for such vendors manually involves greater complexities and risks than ever before. Multiple enterprise teams need to collaborate internally and with suppliers across source-to-pay lifecycle stages, including selection, negotiation, purchasing, assessment, and evaluation, for collecting diverse pieces of information. It slows down source-to-pay processes or overburdens your sourcing and procurement teams. The reality is that, despite best intentions, critical items keep falling through the cracks—and most companies can’t even identify what is left unaddressed during vendor selection, contract negotiations, and vendor management.

Enterprises that implement integrated Governance, Risk, and Compliance approach across business functions including IT, finance, legal, procurements, and more, reduce supplier audit costs by 80%, find supplier risks by 22% faster, and boost the overall productivity of risk and compliance managers by 70%. From cutting costs to reducing risks, there are many benefits to implementing a unified GRC solution.

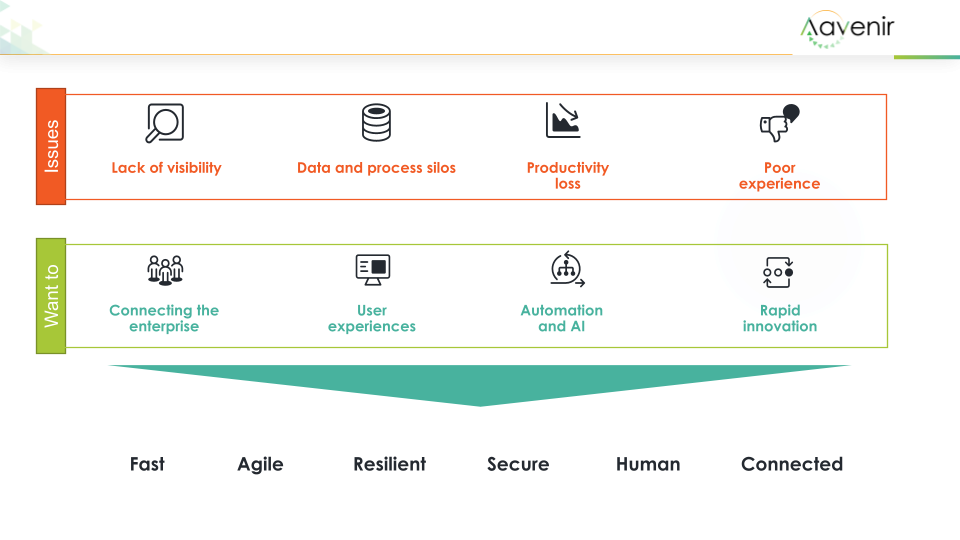

So, what’s wrong with current vendor risk and compliance management processes?

Manual: Managing risk and compliances manually for thousands of vendors has been time-consuming and error-prone, consisting of manual emails, spreadsheet updates, and repetitive data entry in siloed vendor management solutions. It slows down overall sourcing and procurement processes or overburdens your teams.

Siloed: Too many siloes can create difficulty in accessing vendor risk and compliance intelligence during vendor selection and contract negotiation. It makes it even more difficult to prioritize third-party risks through the vendor lifecycle or when requirements change.

Organizations use Governance, Risk, and Compliance (GRC) Management Solutions to improve risk visibility, prioritize GRC efforts, and deliver GRC insights to help firms act quickly and decisively. Most GRCs include a suite of applications such as Policy management, Regulatory compliance, Digital and technology risk management, Third party risk management, Audit management, Resilience and continuity management, and Privacy management.

ServiceNow GRC includes a Third-party Risk Management (TPRM) product, which helps organizations assess, monitor, and mitigate the underlying third-party risks and compliance requirements. Using ServiceNow GRC, organizations can generate/manage the third-party compliance checklists and risk score registers for regulatory, policy, and compliance reporting against preset ratios/parameters including, amongst others, financial stability, key staffing, business continuity, geographical risk, etc. For this analysis, GRC collates and analyses data from various 3rd party sources databases (D&B- Financial, Thomson Reuters - Regulatory Intelligence, Eco Vadis- ESG, Lexis Nexis- Supplier screening, Bit Sight-Cybersecurity) and ensures compliance against the organization’s unique checklists, risk registers, and existing policies.

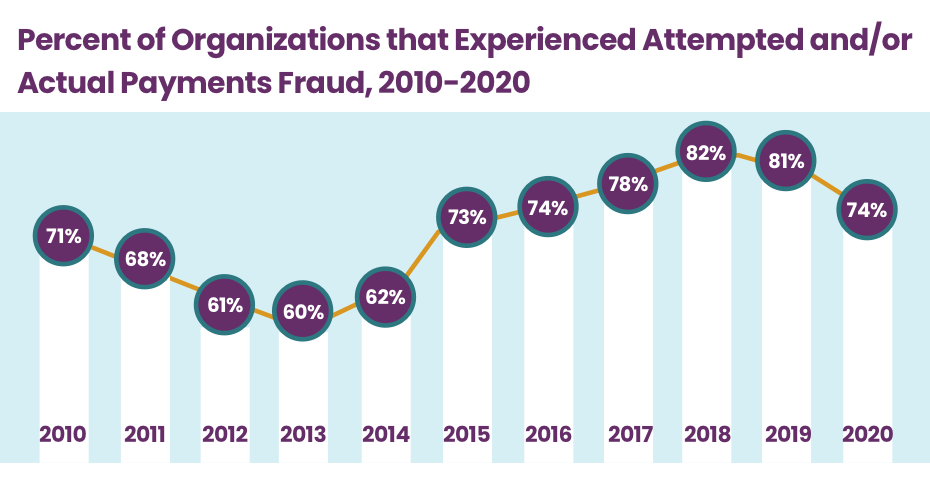

Retrospective (Not Real-time): The real gap is that GRC intelligence is not being accessed, managed, and continuously monitored in real-time from the transactional source-to-pay systems where the RFPs, contracts, and invoices are executed. For example, while procuring innovative or strategic services:

- Sourcing Managers need to look at unique risk, performance, and compliance requirements during the phase of supplier shortlisting, evaluation, and awarding.

- Legal needs to manage complex risk mitigation requirements during contract negotiations.

- Senior Management must ensure that all defined governance, risk, and compliance (GRC) checklists and policies are strictly adhered to throughout the entire source-to-pay process lifecycle.

Hence, what is needed is an integration of GRC solution with Source-to-Pay applications so that the intelligence from the GRC solution can be embedded in source-to-pay solutions to address the above two overlapping but separate aspects of third-party risk, compliance, and governance processes.

Is there a better way to solve the above challenges?

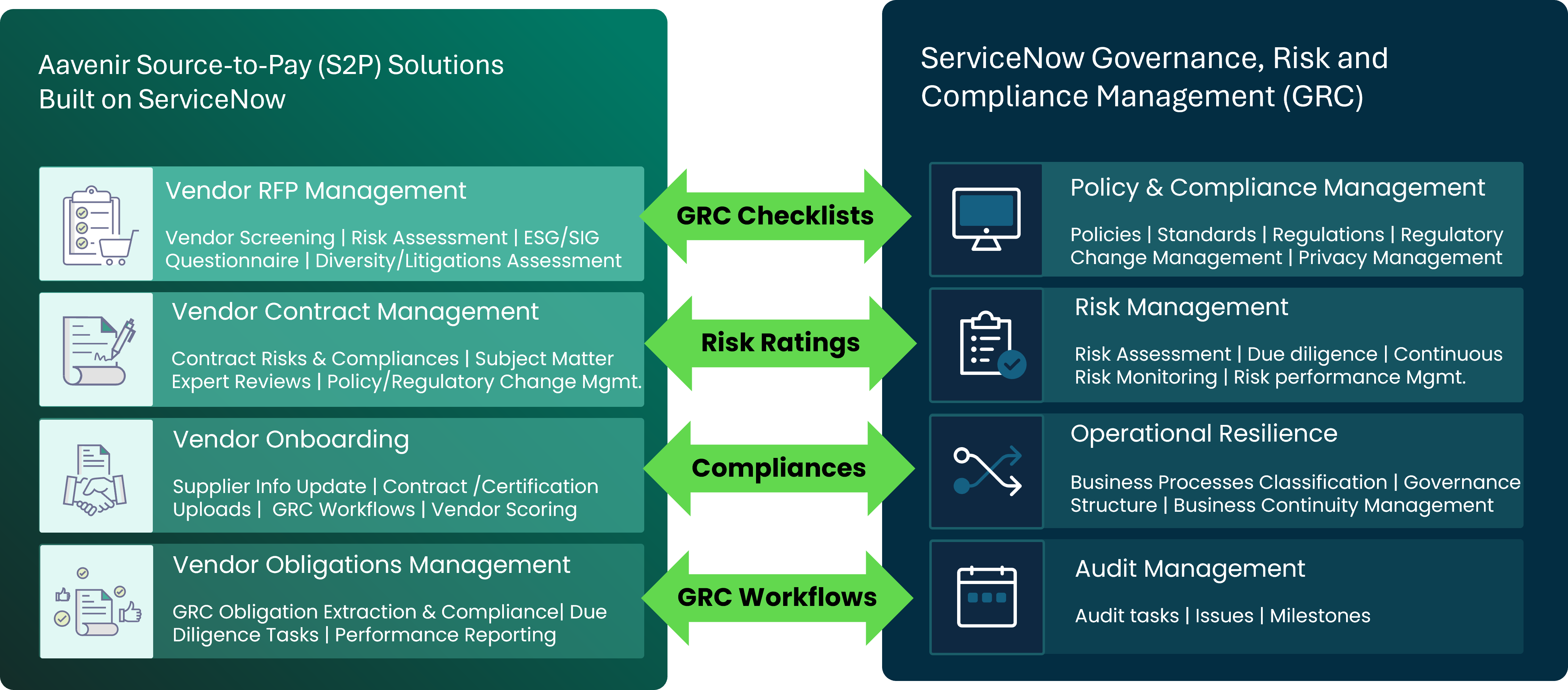

Innovative enterprises are unleashing the power of ServiceNow’s Governance, risk, and compliance management system that provides a unified view of supplier risk data, compliance checklists, supplier screening against blacklists, etc., and connecting ServiceNow GRC solution with Aavenir Source-to-Pay solutions used by procurement, sourcing, legal, Finance, IT and third parties.

In this article, we’ll talk about harnessing the power of ServiceNow GRC solution integration with Aavenir RFPflow- Vendor RFP Management, Aavenir Contractflow - Vendor Contract Management, Aavenir Onboardingflow - Vendor Onboarding Management, and Aavenir Obligationflow - Vendor Obligations Management for unified supplier risk and compliance intelligence management.

Enhanced Capabilities of ServiceNow GRC integration with Aavenir Source-to-Pay solutions.

Integrating ServiceNow GRC with Aavenir Source-to-Pay Solutions offers a comprehensive approach to managing third-party risks and ensuring compliance in real time. This integration streamlines the process of supplier screening, RFP creation, vendor onboarding, contract drafting and review, obligation management, and performance monitoring.

Here are the potential use cases of this powerful integration:

Vendor Risk and Compliance Assessment

- Shortlist Vendors Meeting Compliance Standards: Find vendors who satisfy the minimal risk ratings, regulatory criteria, diversity requirements (such as women- or veteran-owned businesses), compliance standards, and other requirements listed in ServiceNow GRC checklists and risk registers. Evaluate vendors against past experiences, ethical labor practices (such as forced or child labor issues, and more), or any active ongoing litigations.

- Build RFP Questionnaire for Vendor Risk and Compliance Assessment: Aavenir RFPflow can import comprehensive third-party risk and compliance evaluation questions from the ServiceNow GRC checklists. Include questions in the RFP to validate the latest Environmental, Social, and Governance (ESG) compliance, and assign weights to questions that promote responsible and ethical sourcing.

- Supplier Information Update: Aavenir RFPflow can collect vendor responses and automatically update the latest supplier information to ServiceNow GRC for integrated risk management and vendor portal use cases. Aavenir Onboardingflow can request vendors to upload risk and compliance management certifications for various industry regulators (such as the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), U.S. Department of Health and Human Services (HHS) and National Credit Union Association (NCUA) and more) and automatically upload certifications to ServiceNow GRC or Vendor Portal.

- Supplier Score Update: Aavenir can update supplier scores according to business rules defined in GRC, promoting fair and compliant supplier selection.

Contract Management

- GenAI-Powered Contract Authoring: AI-powered Aavenir Contractflow can generate contracts and clauses that meet GRC requirements, ensuring compliance from the start. Ensure contracts address significant operational, IT, and financial risk mitigation requirements throughout the vendor lifecycle, from contract initiation to negotiation to amendments.

- Enforce Organizational Policies: Using Aavenir Contractflow, contract managers can author/review contracts to enforce compliance with organizational-specific policies and procedures, such as data privacy, security, and vendor governance practices.

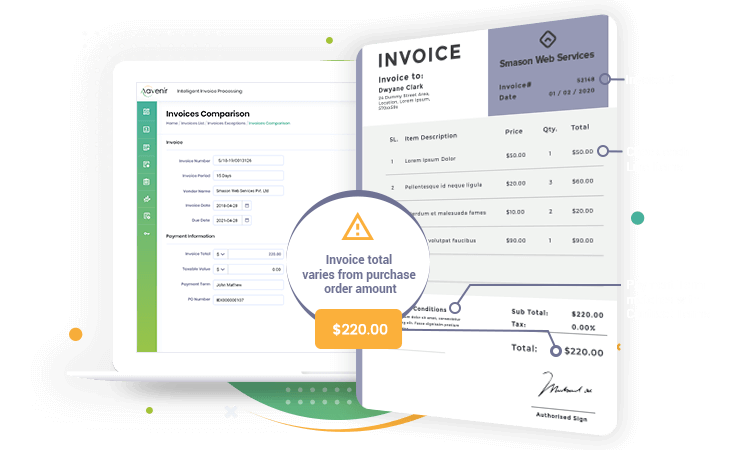

- Identify Risk Scores: Aavenir Contractflow can provide risk ratings/scores for each contract clause, terms, and obligations as per ServiceNow GRC to mitigate potential risks and compliance challenges.

- Ask GRC-related Questions to Contract: AI-powered Aavenir Avy AI Assistant allows contract managers and business teams to ask human-like questions to their contracts and get instant answers regarding any GRC information (for example: Are there specific data protection measures and protocols in place? | Does the contract include clauses ensuring environmental compliance?).

- Identify Missing and Risky Clauses: Aavenir Contractflow can automatically find missing GRC-related clauses, flag contracts/clauses/terms that pose compliance risks, and pass these insights to risk managers to keep the GRC risk register updated and enable timely remediation actions.

- Signed Contract Uploads: Aavenir Contractflow can upload all signed contracts to ServiceNow GRC or vendor portal to make it accessible by business teams for compliance checks.

Obligation Management

- Automatic GRC Obligation(s) Capture: Aavenir Obligationflow automatically discovers key obligations related to risk and compliance management from the contract, such as SLAs, ESG requirements, payment schedules, deliverables, regulatory requirements, and more.

- Track Obligation Fulfillment and update ServiceNow GRC: Aavenir Obligationflow creates contractual obligations fulfillment tasks, assigns workflows to relevant business teams, and updates GRC checklists to track compliance in real-time.

- Performance Reporting: Aavenir Obligationflow Dashboard continuously measures, tracks, and reports supplier’s compliance performance against contractual terms, SLAs, and non-SLA obligations and can update information in ServiceNow GRC for real-time vendor performance reporting.

- Automated Notifications: Avenir Obligationflow and ServiceNow GRC users can receive automated notifications and reminders for upcoming deadlines and obligations, reducing the risk of non-compliance.

- Real-Time Compliance Reporting: Generate real-time reports of a supplier’s compliance with your organization’s GRC policies and regulations.

- Monitor Performance Deviations: Aavenir can monitor deviations from contractually agreed-upon performance standards and trigger ServiceNow GRC workflows for risk assessments and remediation actions automatically.

Benefits of integrating ServiceNow GRC with Aavenir Source-to-Pay solutions:

By integrating ServiceNow GRC with Aavenir Source-to-Pay Solutions, organizations can effectively manage third-party risks and ensure compliance in real-time, enhancing supplier governance and compliance and mitigating potential risks throughout the supplier lifecycle.

- 40% improvement in productivity for GRC staff handling vendor assessments

- 30% reduction in vendor tiering time

- 63% reduction in vendor contract management time

- 40% reduction in penalty payments from failed audit findings

- 80% improvement in productivity for GRC staff responsible for vendor risk reporting

- 22% decrease in overall workload (efficiency gain) for vendor risk management

All figures calculated below are based on metrics collected from ServiceNow customers as part of Forrester Total Economic Impact™ (TEI) studies as well as customer surveys and interviews, as a commissioned validation on behalf of ServiceNow. The integration of Aavenir source-to-pay solutions will further elevate the business value of ServiceNow integrated risk products, enabling more opportunities to manage vendor risk and build resilience in real time.

Source: Forrester Total Economic Impact™ (TEI) of ServiceNow — Validated Financial Model Data, a commissioned study conducted by Forrester Consulting, February 2022.

Start Your Path to Success

Connecting Aavenir source-to-pay solutions with ServiceNow GRC solutions offers organizations an integrated approach to mitigating risks, ensuring compliance, and optimizing business outcomes throughout the source-to-pay lifecycle.

- Enhanced Risk Management: Real-time monitoring and assessment of vendor risks, enabling proactive mitigation strategies.

- Streamlined Compliance: Automated compliance checks ensure adherence to regulatory and organizational standards throughout the supplier’s lifecycle.

- Improved Supplier Selection: Comprehensive supplier evaluations incorporating risk and compliance criteria for better-informed decision-making.

- Efficient Contract Management: AI-powered contract generation and clause management streamline the creation and review of compliant contracts.

- Centralized Information: Unified platform for managing all supplier information, contracts, and compliance documents, enhancing accessibility and oversight.

- Operational Efficiency: Automation of routine tasks such as obligation tracking, and performance monitoring reduces manual effort and errors.

- Real-Time Reporting: Instant access to compliance and performance reports, facilitating timely and informed decisions.

- Cost Savings: Reduces costs associated with non-compliance penalties and inefficient manual processes.

- Enhanced Governance: Strengthens governance practices by ensuring consistent application of risk and compliance policies across all vendors.

Want to learn more about how Aavenir and ServiceNow GRC work better together?