Contract Risk Management: A Complete Guide to Identifying, Mitigating & Preventing Risks

Every contract your business signs carries a risk, missed obligations, hidden liabilities, non-compliance, or revenue leakage. In today’s fast-paced, regulation-heavy environment, unmanaged contract risk isn’t just a legal concern; it’s a serious business threat.

Minor oversights, such as vague indemnity clauses, quietly auto-renewed agreements, or overlooked regulatory requirements, can quickly escalate into lawsuits, financial losses, or reputational damage. And when your organization handles hundreds or thousands of contracts, even minor gaps compound rapidly.

This risk manifests in real dollars: research by Deloitte, citing the World Commerce & Contracting Association, reveals that poor contract management results in an average loss of 9.2% of the annual contract value, much of which occurs post-signature. For large enterprises, that number translates into millions in missed revenue and wasted resources.

Whether you’re in legal, procurement, finance, or operations, this blog will equip you with the insight and toolkit needed to safeguard your contracts and protect your business.

What is contract risk management?

Contract risk management is a proactive process that empowers you to identify, evaluate, and mitigate potential threats hidden within your business agreements.

These risks can emerge from vague language, non-compliance with laws, missed obligations, or poor vendor performance. They don’t just affect legal teams. They can lead to revenue loss due to legal disputes, damage your reputation in the market, and strain your relationships with partners and clients.

Effective contract risk management is a comprehensive strategy that goes beyond legal reviews. It’s about building the proper guardrails into every stage of the contract lifecycle, from drafting and negotiation to execution and post-signature performance.

Think of it as insurance for your contracts - innovative, scalable, and built to protect your business from the unexpected.

Types of Contract Risks

Every contract carries risk, but not all risks are created equal. From legal loopholes to reputational damage, contract risks can take many forms, and each type requires a different mitigation strategy. Let’s break them down:

Legal risks

Legal risks stem from non-compliance with regulations, ambiguous language, or the absence of critical legal clauses. These risks can expose your organization to lawsuits, regulatory penalties, or invalidated contracts.

Example:

A global logistics company signed vendor agreements without including data privacy clauses required under GDPR. As a result, when a breach occurred, the company faced non-compliance penalties running into millions and reputational fallout across Europe.

Common triggers:

- Non-compliance with local or international laws

- Poorly defined liability or indemnity terms

- Outdated templates require legal provisions

Financial risks

Financial risks arise when contract terms impact revenue, budgets, or payment timelines. These include errors in pricing, penalties for missed obligations, or contracts that inadvertently favor one party financially.

Example:

A SaaS company overlooked an automatic renewal clause in a software license agreement. The contract renewed at a higher rate without internal budget approvals, leading to unplanned expenses and strained vendor relations.

Common triggers:

- Incorrect payment terms or milestone dates

- Lack of price escalation clauses in long-term deals

- Overlooking penalties for SLA breaches

Operational risks

These are the day-to-day risks that affect your ability to execute the contract effectively. They often stem from vague responsibilities, poor scoping, or a lack of clarity around deliverables.

Example:

A construction firm entered a contract with a supplier without defining the timeline for material delivery. Delays led to project overruns and liquidated damages due to missed deadlines.

Common triggers:

- Unclear roles and responsibilities

- Inadequate performance metrics or timelines

- Scope creep due to undefined boundaries

Strategic risks

Strategic risks occur when contracts don’t align with long-term business goals or create lock-in scenarios that limit flexibility. These risks often go unnoticed until they begin to affect broader business decisions.

Example:

A retail chain signed a 10-year exclusivity deal with a packaging vendor. When newer, more sustainable vendors emerged, they couldn’t pivot due to the binding contract, hurting their ESG goals and brand image.

Common triggers:

- Overly long contract durations

- One-sided exclusivity or non-compete clauses

- Mismatched KPIs between the contract and company strategy

Reputational risks

These risks can damage your company’s public image and stakeholder trust. They typically arise from working with non-compliant vendors, contract breaches, or unethical clauses.

Example:

A fashion brand was found to be working with a supplier accused of labor violations. Though the brand was unaware, the absence of compliance audits in their contracts led to public backlash and a dip in customer loyalty.

Common triggers:

- Vendor misconduct or non-compliance

- Clauses that allow for unethical practices

- Failure to uphold SLAs related to customer experience

Common sources of contract risks

Contract risks often stem from structural inefficiencies in the creation, review, and management of contracts. Understanding these root causes is key to building a more resilient contract management process.

Poor version control

Without centralized version tracking, it becomes challenging to identify the most up-to-date contract. This can lead to confusion, missed edits, and errors in final execution.

Manual and inconsistent contract authoring

Relying on manual drafting methods and varied templates across teams results in inconsistent language, formatting, and legal terms. This increases the likelihood of non-compliance and slows down the review process.

Lack of a standard clause library

When contract creators don’t have access to a pre-approved clause library, they often insert language that hasn’t been legally vetted. This adds unnecessary negotiation time and exposes the organization to avoidable risk.

Siloed departments

When legal, finance, and sales operate in isolation, critical contract terms can be misaligned or missed entirely. Poor collaboration across departments often leads to operational and compliance issues.

Missed renewals and obligations

Many organizations lack systems to track contract obligations post-signature. This results in missed deadlines, unmonitored SLAs, and automatic renewals that may no longer serve the business’s interests.

Eliminating these common risk sources requires not just policy changes but more innovative tools and cross-functional collaboration.

The risk lifecycle in contract management

Effectively managing contract risk isn’t a one-time activity; it’s a continuous process that spans the entire contract lifecycle. From drafting to execution and beyond, risks can appear at multiple touchpoints. That’s why having a structured framework is essential. Here’s a breakdown of the four key stages in the contract risk lifecycle:

Risk identification

This is the foundation of contract risk management: spotting red flags before they become liabilities. Risk identification involves analyzing contracts for vague or non-standard language, incomplete clauses, outdated terms, and non-compliant provisions. It also includes evaluating vendor or third-party history, previous disputes, and compliance records. Using AI-enabled tools, organizations can scan large volumes of contracts to surface risks early, reducing manual review time and ensuring no critical details are missed.

Risk assessment

Once risks are identified, the next step is to assess their severity and likelihood. This is where risk scoring models come in. Contracts are evaluated based on multiple criteria such as deal value, business criticality, deviation from standard clauses, regulatory exposure, and vendor performance. Each contract is assigned a risk score, which helps prioritize which agreements require immediate attention or senior-level review. This strategic triage ensures resources are focused on high-impact risks without slowing down business operations.

Risk mitigation

Mitigation is about reducing risk exposure through smart planning and systemized controls. This involves using standardized templates and clause libraries, enforcing internal approval workflows, and applying negotiation playbooks to maintain contract consistency. During the authoring and negotiation phases, CLM platforms can guide users toward compliant language and alternative clauses when risks are flagged. Legal and business teams collaborate in real time, making it easier to resolve risks quickly while maintaining momentum on deals.

Risk monitoring

Risk doesn’t end once a contract is signed; it simply evolves. Post-signature, organizations must monitor contracts to ensure obligations are met, renewals are tracked, and compliance is maintained. AI-powered CLM systems offer dashboards, alerts, and reports that track ongoing performance, missed milestones, and emerging risks across the contract portfolio. Real-time visibility into these metrics helps legal, procurement, and compliance teams take corrective action before issues escalate.

By following this structured risk lifecycle: Identify → Assess → Mitigate → Monitor—organizations can shift from reactive firefighting to proactive contract governance. In the next section, we’ll explore best practices that help operationalize this approach.

Benefits of effective contract risk management

Implementing a structured and proactive approach to contract risk management doesn’t just protect your organization; it enhances overall performance. When contracts are governed with consistency, visibility, and accountability, the benefits ripple across departments. Here’s what effective contract risk management unlocks:

Minimized legal exposure

By identifying risky clauses, ensuring compliance, and routing contracts through proper approvals, organizations significantly reduce the chances of legal disputes, regulatory fines, or breach claims. This helps safeguard both brand reputation and legal standing.

Financial predictability

When contract risks are actively managed, businesses avoid unexpected costs, penalties, or revenue leakage. Accurate payment terms, proper milestone tracking, and controlled renewals ensure predictable cash flow and better financial forecasting.

Stronger vendor and client relationships

Clear responsibilities, well-defined SLAs, and consistent terms help build trust with vendors, partners, and clients. Risk-aware contracting reduces miscommunication and disputes, fostering longer, more strategic relationships.

Smoother audit trails and compliance

Automated tracking of contract changes, approvals, and obligations creates a transparent audit trail. This not only simplifies internal reviews but also ensures readiness for regulatory or third-party audits with minimal disruption.

Faster contract cycles

When risks are managed proactively, there's less back-and-forth during negotiation and fewer red flags during review. This accelerates contract turnaround times and helps businesses close deals, onboard vendors, or launch projects faster.

Together, these benefits strengthen your organization’s ability to grow with confidence, knowing that your contracts are not just signed, but strategically secured.

How to mitigate risk using an AI-powered CLM solution [step-by-step process]

Managing contract risk effectively requires more than just good intentions. It demands structured processes, real-time visibility, and smart automation. AI-powered Contract Lifecycle Management (CLM) solutions provide a scalable and proactive approach to mitigating risk throughout the contract lifecycle. Here’s how:

Step 1: Centralize contracts in a unified repository

The first step in reducing contract risk is gaining complete visibility. An AI-powered CLM consolidates all contracts, new as well as legacy, into a secure, centralized repository. This ensures that everyone has access to a single source of truth.

With advanced search filters and metadata tagging, users can easily retrieve contracts by party name, value, expiration date, or risk category. Centralization eliminates version confusion, prevents data silos across departments, and reduces the chances of critical terms being overlooked or lost in outdated folders or email threads.

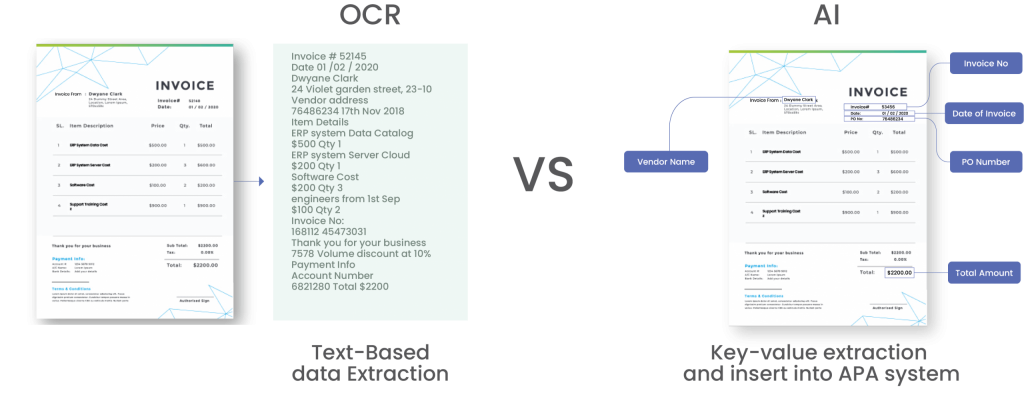

Step 2: Use AI to detect risky clauses automatically

Manual contract review is time-consuming and prone to errors, especially at scale. AI-powered CLM solutions can scan contracts in seconds and flag clauses that deviate from company policies or regulatory requirements. The system identifies risky language, missing indemnity or limitation of liability clauses, jurisdiction mismatches, and more. These intelligent insights enable legal teams to focus on high-risk areas early in the review process, saving time and reducing the likelihood of signing contracts with hidden liabilities or exposure to legal and compliance risks.

Step 3: Assign risk scores for better prioritization

Not all risks carry equal weight. AI-enabled CLM tools enable you to assign dynamic risk scores to each contract based on various factors, including contract value, counterparty risk, clause deviations, region-specific compliance, and past vendor history.

Risk scoring helps prioritize which contracts require more thorough legal scrutiny or executive-level approval. By quantifying contract risk, organizations can focus their resources on the most critical issues, reduce bottlenecks, and make informed decisions more quickly, without letting lower-risk contracts linger in unnecessary review cycles.

Step 4: Leverage pre-approved clause libraries and playbooks

Contract deviations are one of the most significant sources of risk and delay. By using a centralized clause library and pre-approved negotiation playbooks, business users can draft contracts using legally vetted language.

When risky or non-standard clauses are identified, the system automatically suggests approved fallback options. This not only speeds up redlining and negotiation but also ensures consistency across contracts. Legal teams spend less time correcting contract language, and business users gain the confidence to create contracts that align with company risk policies.

Step 5: Automate workflow routing based on risk level

An intelligent CLM solution enables dynamic workflow routing, meaning contracts are automatically escalated for additional review based on predefined risk thresholds. For instance, if a contract exceeds a certain deal value or contains non-standard clauses, it can be routed to senior legal counsel or compliance officers. This reduces the risk of high-stakes contracts being approved without adequate oversight.

Custom workflows ensure the right people review the right contracts at the right time, eliminating guesswork and ensuring proper governance across the contract lifecycle.

Step 6: Set alerts for renewals and obligations

Post-signature risks often arise when key contract dates or obligations are missed. AI-powered CLM platforms track milestones like contract expirations, auto-renewals, payment schedules, and compliance deliverables.

Automated alerts and reminders ensure that stakeholders never miss critical deadlines. This helps prevent unwanted renewals, SLA violations, or missed penalty clauses. Teams stay informed and accountable, reducing both operational and financial risk. Real-time visibility into obligations also ensures ongoing compliance and gives businesses time to renegotiate or terminate underperforming contracts proactively.

Step 7: Monitor risk trends with dashboards and reports

Finally, AI-powered CLM platforms offer powerful analytics dashboards that enable organizations to monitor risk exposure in real time. These tools aggregate data from across the contract portfolio, highlighting trends like common risk triggers, clause deviations, department-specific delays, and vendor performance issues.

With visual reports and KPIs, decision-makers gain the insights they need to improve processes, optimize terms, and enforce compliance continuously. Over time, this data-driven approach not only reduces risk but also enhances strategic contract planning and negotiation outcomes.

Want to see how Contract Lifecycle Management can actively reduce legal, financial, and operational risks? Check out 6 Ways CLM Helps Mitigate Business Risks to explore practical use cases and benefits.

Conclusion: turn contract risk into a competitive advantage

Risk in contracts is inevitable; however, that doesn’t mean it’s uncontrollable. With the right strategy, process, and technology, contract risk can be transformed from a liability into a source of strength and foresight.

By identifying risks early, standardizing your contract language, implementing approval workflows, and leveraging AI-powered insights, your organization can gain full control over compliance, cost, and performance across every stage of the contract lifecycle.

So, where do you begin?

Start with a contract risk audit:

Evaluate your current process:

- Are your contracts centralized and searchable?

- Do you have visibility into upcoming renewals and obligations?

- Are risky clauses slipping through the cracks?

Frequently Asked Questions (FAQs)

What is contract risk management, and why is it important?

Contract risk management is the process of identifying, assessing, mitigating, and monitoring risks throughout the contract lifecycle. It’s important because unmanaged risks, such as legal non-compliance, financial penalties, or missed obligations, can lead to revenue loss, operational disruptions, and reputational damage.

What are the most common risks in contract management?

The most common risks include legal risks (non-compliance, vague clauses), financial risks (budget overruns, missed payments), operational risks (scope creep, delivery failures), strategic risks (misaligned business goals), and reputational risks (vendor misconduct, public disputes).

How can AI-powered CLM solutions help reduce contract risks?

AI-powered CLM tools help by automating risk detection, flagging non-standard clauses, scoring contracts based on risk factors, and providing real-time alerts. They also streamline workflows, ensure compliance, and improve contract visibility, reducing manual errors and delays.

How do I know if my organization needs contract risk management?

If your organization deals with a high volume of contracts, operates in regulated industries, or struggles with missed deadlines, disputes, or audit issues, it likely needs a formal contract risk management process, supported by a modern CLM solution.