How do you process invoices? Your accounts payable department gathers these invoices on paper or via PDF, and it then takes the time to personally go over the information, check it, and authorize the payments. If you need to process a few invoices per month, this might work. But what if you have a lot of invoices, including supply bills, employee cost reports, and supplier payment requests?

Consider how long your Accounts Payable department would take to complete this laborious operation by hand. Errors, delays, and squandered time and energy are inevitable. It is undeniable that tried-and-true manual invoicing is still widely used in the company today, but it is also unavoidable that these antiquated techniques must be updated to embrace the new in a world that is changing at an ever-increasing rate. Trust us; automation offers promise in this area.

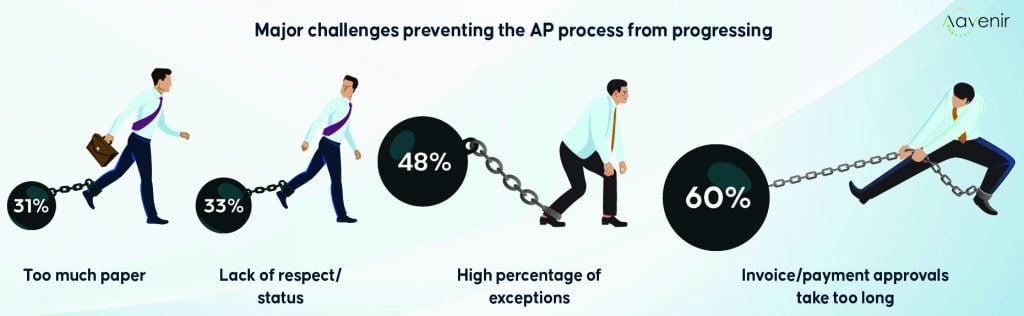

Source: Ardent Partners’ Accounts Payable Metrics that Matter in 2021

AI-enabled AP Automation Steps for Finance Team

Spend on Tech Tools to Increase Efficiency

By allowing current employees to be more productive, freeing them up to undertake more work that adds value, and reducing the need to hire additional people, investing in tech tools for the finance function can successfully combat rising compensation expenses.

Due to cloud-based software’s plug-and-play functionality and readily set-up API interfaces, finance tech products are now accessible to the general public.

Process Personalization

Improve invoice processing by adjusting the procedures to your company’s unique requirements. For instance, you can set up the application to collect data from all the sources if you receive bills via email, postal mail, or fax. Similarly, you can build an automated workflow if your approval process entails numerous steps. You now have the power and flexibility to scale as necessary.

Coordinating Priorities

The forecast for the economy forces CFOs to strike a balance between competing goals, such as overseeing regular financial reporting and processes, offering insight, and guiding strategy. The ability of finance professionals to generate commercial value will be constrained if accurate and timely management information is not provided. Fulfilling both tasks successfully is a tricky balancing act.

Manifesting Long-Term Growth

It is increasingly essential for CFOs to increase their income, be profitable, and avoid being put into a situation where they need to seek outside financing.

Due to economic instability, the Venture Capital (VC) market is less booming than it once was. For example, a renowned Silicon Valley VC firm, Sequoia, recently sent an email to its portfolio businesses telling them they may need to be prepared to “pull the trigger” on projects to save money and increase their runway. As a result, the UK’s number of new VC firms fell by two-thirds last year.

Instant ROI & Savings

According to Atradius, 87.6% of businesses in Western Europe and more than 90% in the US frequently receive late payments, with Great Britain having the highest percentage of past-due bills in the region at almost 50%.

If processing each invoice before the timeline, consider the amount of time you will save. How about the fewer resources you are now using for the job? Furthermore, you are no longer incurring late fees or penalties. As a result, automating your invoice processing department yields a rapid return on investment and, over time, results in significant savings. Additionally, gaining better cash flow visibility, quicker processing cycle times, and timely payments are all advantages of employing an automated solution.

Getting an Edge in the Marketplace

Even though upgrading to automation has many benefits, many businesses still use the same antiquated manual procedures. Embracing automation early in business gives you a competitive edge in several ways, including time savings and mistake reduction. However, while often required, change can be challenging for many people.

To establish a company’s reputation and propel it to new heights, keeping track of unpaid bills is essential. Because of this, a company needs to effectively and efficiently manage its AP. Employing an account payable automation solution is the better choice because managing accounts payable may be daunting and complex.